Is Shiba Inu About to Soar? Bull Flag Pattern and Burn Rate Surge Spark Major Rebound Hopes!

Jakarta, Pintu News – Shiba Inu saw a decline today, May 13, as the overall crypto market lost some of its gains due to a surge in liquidation of long positions.

Even so, this drop in SHIB’s price appears to be temporary, as the bull flag pattern and significant increase in SHIB’s burn rate suggest that this meme coin may be preparing for a rebound.

As of May 13, 2025, the SHIB price is at $0.0000152, down more than 10% in the last 20 hours after falling from a daily high of $0.0000175.

Bull Flag Signal Signals Potential Rebound in Shiba Inu Prices

Shiba Inu’s daily price chart shows that this top meme coin has the potential for a big rebound after forming a bull flag pattern.

Read also: Is Cardano About to Explode? Charles Hoskinson Teases Major New Integration After Midnight Upgrade!

However, to confirm a bullish trend reversal, SHIB needs to break the downward sloping resistance line. If this happens, the price of SHIB is expected to jump up to 48% towards $0.000024.

The Awesome Oscillator (AO) histogram indicator shows a steadily increasing bar since surpassing the zero line, which signals that the bullish momentum is getting stronger. This indicates that despite the lingering volatility, SHIB has the potential to score further gains and reach the 261.8% Fibonacci level at $0.000029.

However, traders need to be aware of the RSI (Relative Strength Index) indicator which has now started to move down and form a lower high, and has the potential to cross the signal line downwards.

If this crossover occurs and the RSI drops below the 50 level, then bearish momentum could increase, triggering predictions of a Shiba Inu price drop to $0.0000126.

SHIB Combustion Rate Explodes 6,500%

Data from Shibburn showed that the SHIB burn rate jumped dramatically, reinforcing the bullish outlook that Shiba Inu prices could potentially rebound.

In the last 24 hours (13/5), more than 28 million SHIB tokens have been removed from circulation, reflecting an increase of 6,500% compared to the previous day.

This spike in SHIB burn rate comes as network activity on Shibarium and ShibaSwap’s DEX platform increases. According to data from DeFiLlama, trading volumes on ShibaSwap increased by 26% over the past month.

At the same time, the total value locked (TVL) in Shibarium has crossed the $3.38 million mark – a positive signal that could support Shiba Inu’s price movement going forward.

Potential Short Liquidation May Support Uptrend

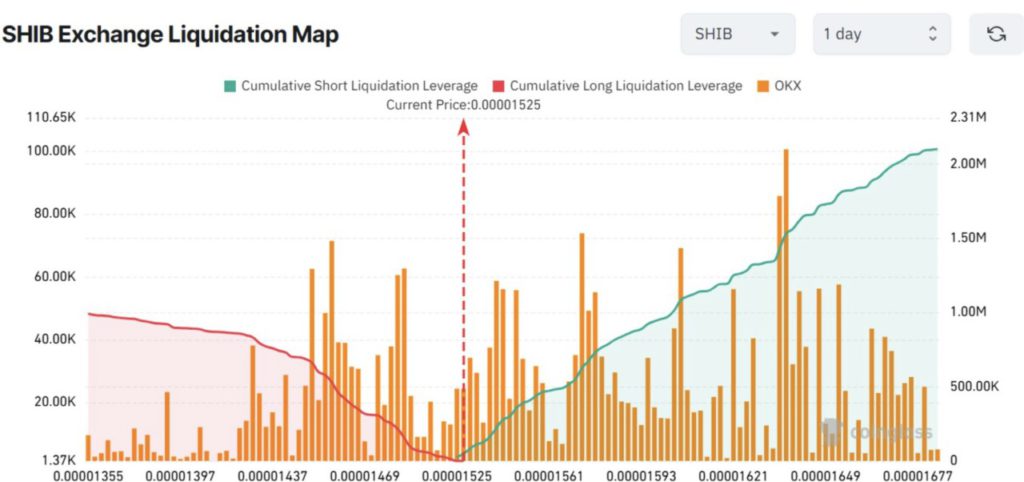

Data from Coinglass further reinforces the rebound potential of Shiba Inu prices. The liquidation map shows that a large number of short positions will be liquidated if the SHIB price jumps to the $0.0000163 level.

Read also: These 3 Explosive Altcoins Could Shatter All-Time Highs This May

If SHIB manages to rebound according to the bull flag pattern and reaches that level, more than $1.53 million of short positions will be liquidated.

High network activity and the potential for large short liquidations could be the main catalysts that push Shiba Inu to outperform other new meme coins that often lack utility.

Therefore, as long as network activity remains high, the price of Shiba Inu has room to rebound and target the $0.000024 level in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Shiba Inu Price Sheds 10% But Bull Flag & Soaring Burn Rate Signal Rebound. Accessed on May 14, 2025