Bitcoin (BTC) Breaks $100K: What are the Hidden Risks Lurking?

Jakarta, Pintu News – The Bitcoin market has recently witnessed a significant price surge, with the exchange rate surpassing $100,000. This phenomenon was triggered by a wave of new buyers entering the market. However, there are hidden risks that many investors may not be aware of.

Key Drivers of Bitcoin (BTC) Price Increase

According to data from Glassnode, the recent rise in Bitcoin (BTC) price is due to increased demand from new investors. The First-Time Buyer RSI indicator for Bitcoin (BTC) has stayed at 100 throughout this week, indicating that new investors continue to enter the market.

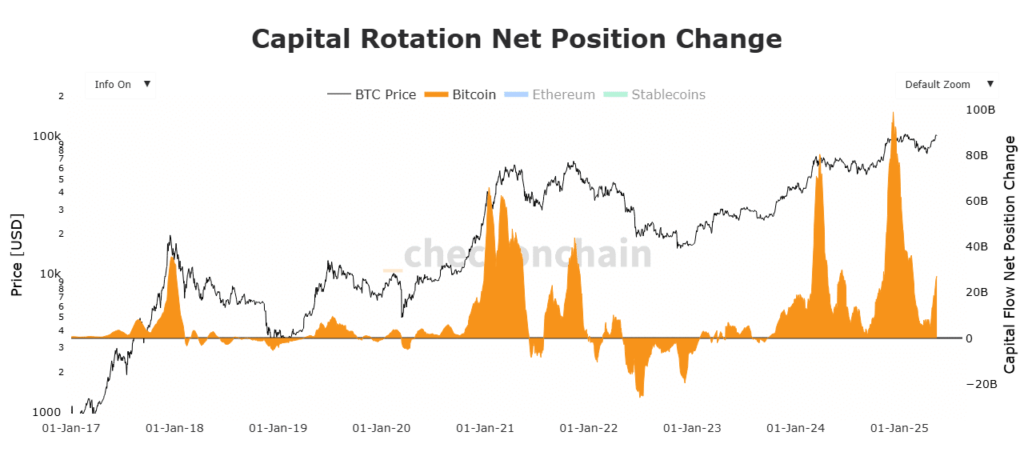

In the past 20 days, around $6 billion has been injected into the market through new Tether issuances. This signals that Bitcoin (BTC) is increasingly in demand by first-time buyers. Over the past 30 days, the change in capital rotation position increased from $6 billion to $26 billion. This large surge in capital reflects the growing demand for Bitcoin (BTC) from a variety of circles, including large investors, retailers, and institutions.

Also Read: Potential for XRP, Kaspa, and Solana in the Next Altcoin Cycle According to Analysts!

Bitcoin (BTC) Attracts New Investors

The rise in the number of new buyers shows that Bitcoin (BTC) is increasingly attractive to those who have not previously been involved in the crypto market. The presence of these new investors is important for continued growth as it signals an increasing adoption rate.

However, there is a difference in sentiment between the new buyers and the momentum buyers which could affect the continuation of the price rally. Although the new buyers are entering the market aggressively, the momentum buyers are still hesitant, with their RSI only at 11.

Momentum Buyers: Key to Sustainable Rally

Momentum buyers are historically key to a sustained rally. Without their presence, price increases are often difficult to accelerate higher, with prices tending to stagnate or even decline if only supported by new buyers. If the sentiment among momentum buyers could change, then Bitcoin (BTC) could potentially break the $100,000 resistance and reach new highs.

Conclusion

Although the Bitcoin (BTC) market is currently dominated by a wave of new buyers, the sustainability of the price rally still depends on the changing sentiment of momentum buyers. Investors and analysts should pay attention to the dynamics between these two groups of buyers to predict the next direction of the market.

Also Read: New York Mayor Appoints Crypto Advisor After Corruption Case Dropped

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. First-time Bitcoin buyers drive BTC beyond $100k, but this hidden risk remains. Accessed on May 14, 2025

- Featured Image: Cryptoslate