Ethereum Stalls at $2.500 — But Surging ETH ETF Inflows Could Spark the Next Breakout!

Jakarta, Pintu News – Ethereum ETF investment flows have surged again as ETH prices showed strong momentum with a 9% increase on May 14 yesterday.

In addition, institutional involvement in Ethereum has also increased, with Abraxas Capital buying over $500 million worth of ETH in the space of one week, hinting at the potential for huge gains ahead.

Market analysts project that the price will at least rise another 20% to reach $3,200, and potentially even push it to $4,000. Then, how will Ethereum’s price move today?

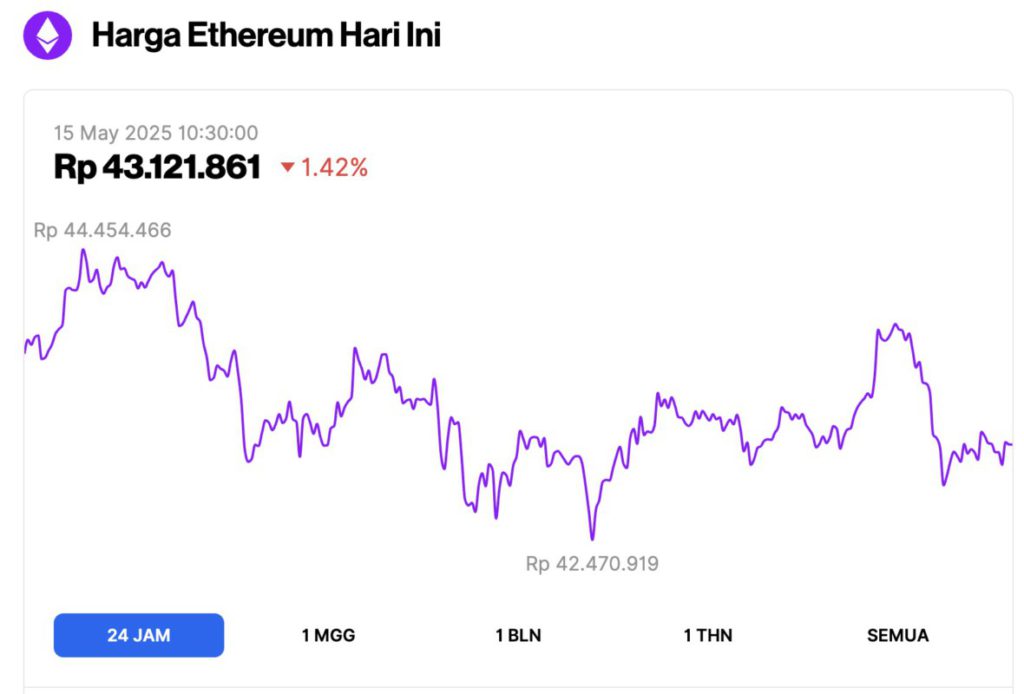

Ethereum Price Drops 1.42% in 24 Hours

As of May 15, 2025, Ethereum (ETH) is trading at approximately $2,590, or around IDR 43,121,861, marking a 1.42% decline over the past 24 hours. Within that timeframe, ETH reached a high of IDR 44,454,466 and dipped to a low of IDR 42,470,919.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $312.62 billion, with daily trading volume falling 29% to $25.44 billion in the last 24 hours.

Read also: 3 Crypto Predicted to Steal the Show in the Next Bull Run Cycle

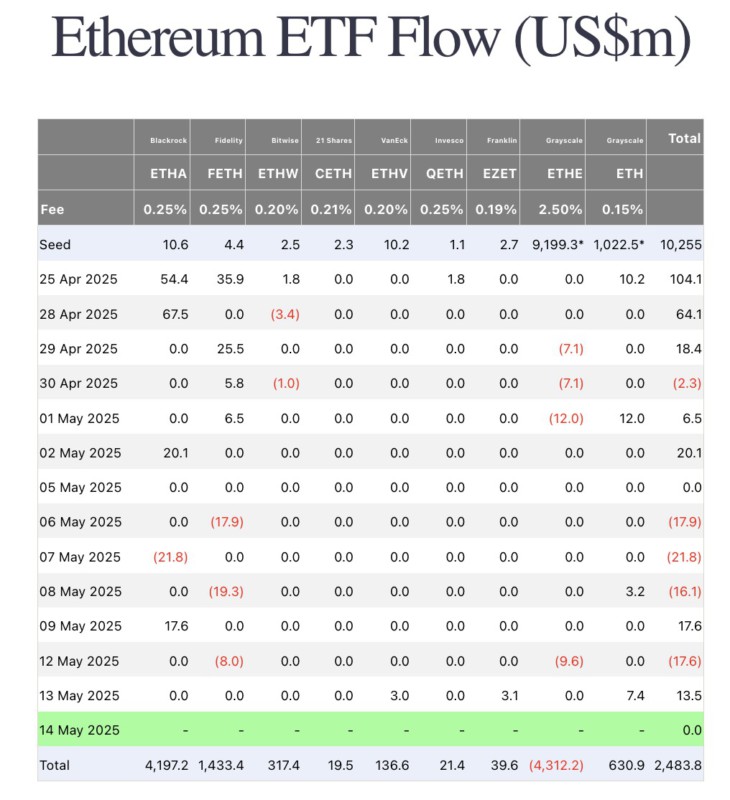

Ethereum ETF Inflows Strengthen Again

Fund flows into the spot Ether ETF have increased again, with inflows totaling $13.5 million on Tuesday, according to data from Farside Investors.

Among the ETFs, Grayscale mini-Ether ETF recorded the largest inflow of $7.4 million, followed by VanEck’s ETHV at $3.0 million, and Franklin’s EZET at $3.1 million.

Last week, asset manager BlackRock filed an amendment for its spot Ethereum ETF, proposing an in-kind creation and redemption mechanism. The move follows a meeting with the SEC Crypto Task Force and reflects growing institutional interest in Ethereum.

If approved, this amendment will allow authorized participants to directly exchange Ethereum (ETH) for ETF units, as well as vice versa, thereby easing the flow of capital between ETH and its ETF.

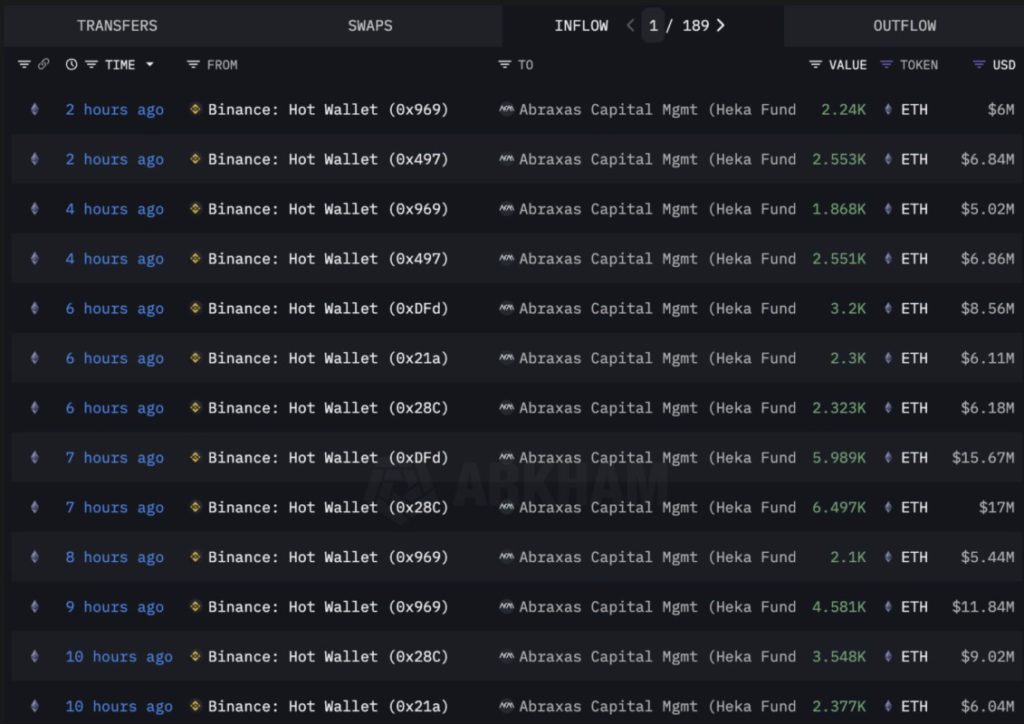

Institutional Fund Flows to Ethereum Grow Stronger

Furthermore, in the past week, institutional fund flows into Ethereum increased sharply, led by Abraxas Capital.

According to on-chain data from Arkham Intelligence, the company borrowed USDT yesterday to increase its ETH holdings when the price was still around $2,460. Since then, the price of ETH has risen 10% to around $2,700.

Throughout this week, Abraxas Capital has accumulated 242,652 ETH worth approximately $561 million, signaling the return of strong bullish sentiment in the Ethereum market.

Where will ETH Price Go Next?

Ethereum price continued its relentless rally, rising 9.5% on May 14 and breaking the $2,700 level. Moreover, according to data from Coinglass, open interest in ETH futures jumped 14% to $32.61 billion.

Read more: Cardano Ready to Surge? Charles Hoskinson Leaks New Integration Post Midnight Upgrade!

Rekt Capital crypto analysts note that Ethereum has fully closed the daily CME gap around the $2,530 and $2,630 levels, which are marked in the green.

If the Ethereum ETF inflows continue and the price manages to close daily above this area, then this zone has the potential to become a new dynamic support. According to Rekt Capital, this could be the foundation for further uptrend continuation.

Still based on his analysis, if ETH manages to break the next gap in the range of $2,900-$3,033, then the price could accelerate towards $3,200. With ETH accumulation still strong, some analysts even predict the next price target to be at $3,600.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum ETF Inflows Bounce Back As ETH Eyes $3200 Next. Accessed on May 15, 2025