Bitcoin Holds at $102.000 — Whale Moves and Open Interest Surge Signal New All-Time High Incoming?

Jakarta, Pintu News – As inflation in the United States dropped to 2.3% in April, Bitcoin began to show gains. As of May 14, BTC was trading at $103,827, recording an increase of almost 1.5%.

Now, Bitcoin is eyeing new highs, supported by recent whale activity that hints at further upside potential. So, how will Bitcoin price move today?

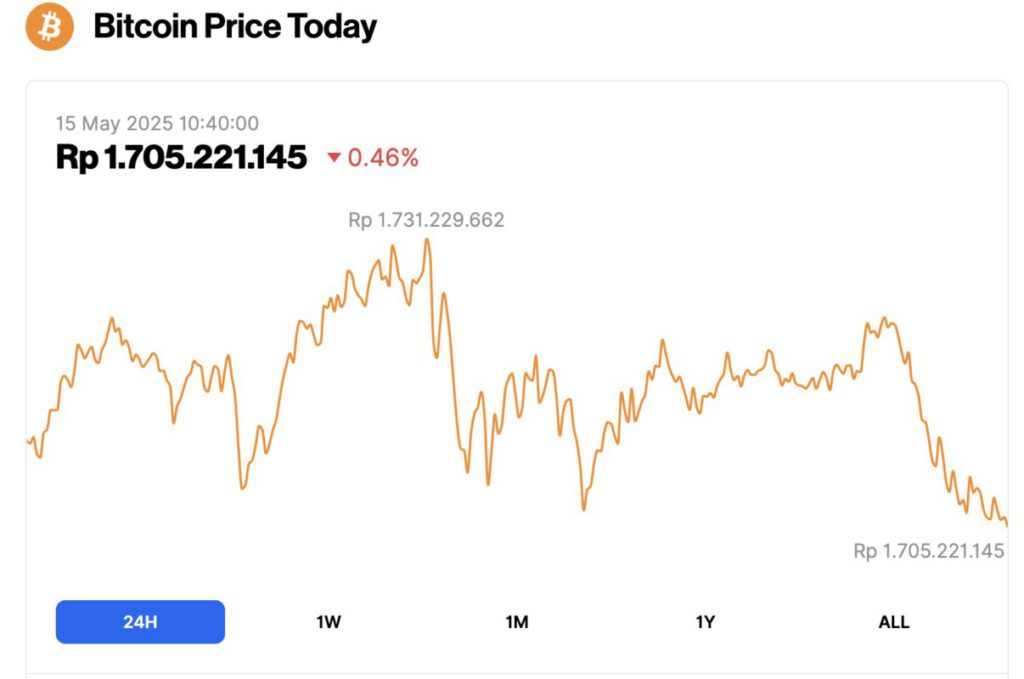

Bitcoin Price Drops 0.46% in 24 Hours

On May 15, 2025, Bitcoin was trading at $102,877, equivalent to IDR 1,705,221,145, marking a 0.46% decline over the past 24 hours. During this time, BTC reached a daily high of IDR 1,731,229,662 and a low matching its current price at IDR 1,705,221,145.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.04 trillion, with trading volume in the last 24 hours also down 11% to $44.69 billion.

Read also: Ethereum Stalls at $2.500 — But Surging ETH ETF Inflows Could Spark the Next Breakout!

Bitcoin Price Analysis

On the daily chart (14/5), Bitcoin showed a rebound from the 50% Fibonacci level around $75,500. This bounce pushed the price up by almost 36% in the last 36 days.

This bullish trend triggered a breakout from the falling wedge pattern and managed to surpass the 78.6% Fibonacci level at around $92,000, as well as break the psychologically important $100,000 barrier. Currently, Bitcoin is facing strong resistance at the upper supply area around $104,000.

However, at this crucial point, the technical indicators started to show a weakening of momentum. The RSI reversed in the overbought zone and threatened to drop below its 14-day average. Moreover, the MACD and its signal line are also approaching a potential bearish crossover, which could indicate a short-term top forming.

If BTC fails to break through the current resistance, it is likely to retest the $97,000 level, with further support around $92,000, which is the 78.6% Fibonacci area.

On the other hand, if the breakout manages to cross the $104,000 resistance, it could open up opportunities for a further rally towards the Fibonacci 1,272 extension level around $127,800.

Decreased Inflow from Whale

According to a recent tweet from CryptoQuant analyst DarkFost, there is a divergence between whale and retail investor activity on Binance. Since early April, Bitcoin’s bullish momentum has continued to strengthen.

However, inflows from whales to exchanges declined, while inflows from retail investors increased sharply from $12 billion to $15 billion. The decline in whale inflows to exchanges could be interpreted as a sign of confidence that the market still has the potential to go higher.

Read also: These 3 Explosive Altcoins Could Shatter All-Time Highs This May

Moreover, additional data shows that whales have even accumulated more than 83,000 BTC since last month, reinforcing the positive sentiment towards future price movements.

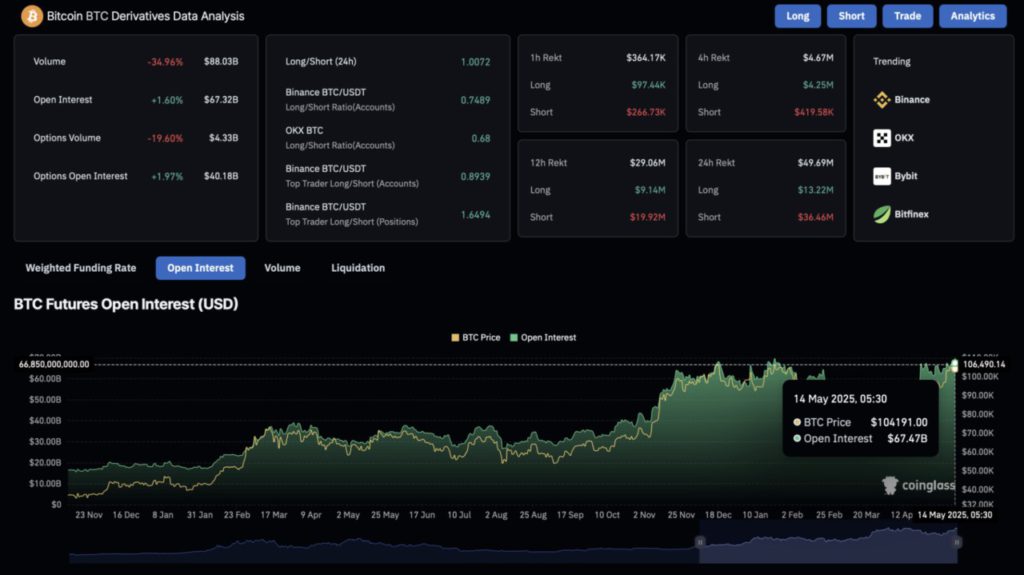

Bullish Sentiment Drives Bitcoin Futures Market

As fund flows from retail investors increase, optimism in the Bitcoin futures market is reaching new heights. Open interest is now approaching the $70 billion mark, with the current total standing at $67.47 billion.

Additionally, over $36 million worth of short positions have been liquidated in the past 24 hours, signaling the strong dominance of bullish sentiment.

Currently, the open interest-weighted funding rate stands at 0.0075%, reflecting the positive sentiment in the derivatives market. Bitcoin futures traders remain highly optimistic about the continuation of the uptrend and the chances of reaching new all-time highs.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. Bitcoin at $104K: Whale Activity and Surging Open Interest Hint at New All-Time High. Accessed on May 15, 2025