XRP Eyes $3 Surge — Could It Dethrone USDT as the World’s #3 Crypto?

Jakarta, Pintu News – XRP has experienced an impressive surge in recent times, successfully unseating Tether and becoming the third largest crypto in the world.

With a market capitalization of $154 billion, the value of XRP is now equivalent to half the valuation of Ethereum .

However, despite the positive market sentiment, XRP’s uptrend is not yet supported by solid enough strength, and the altcoin is currently approaching overbought conditions.

If the momentum strengthens again, it is possible that XRP will again show aggressive price movements as it did in 2024.

XRP Market Signals Yet to Show Full Strength

XRP’s relative strength index (RSI) currently stands at 69.23, slightly below the critical threshold of 70.0 which signals an overbought condition.

Read also: Ethereum Stalls at $2.500 — But Surging ETH ETF Inflows Could Spark the Next Breakout!

Historically, when an asset enters an overbought zone, there is usually a price reversal as momentum begins to weaken. However, in November 2024, XRP deviated from this general pattern and continued its bullish trend despite entering the overbought region.

The current situation opens up the possibility that XRP could repeat a similar pattern, provided that the market momentum continues to grow. At that time, the price did not correct, but rather skyrocketed higher despite being in overbought conditions.

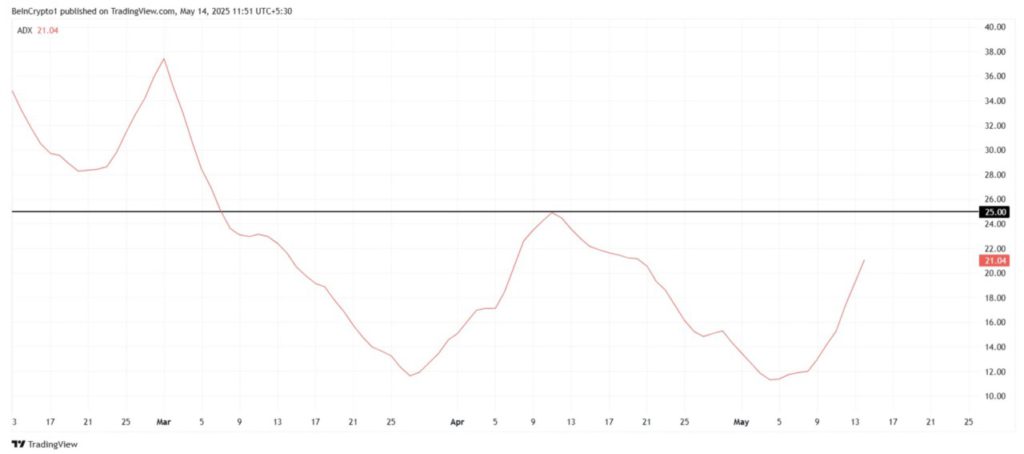

For XRP to repeat the positive performance of 2024, the current uptrend needs to be supported by stronger forces. Currently, XRP’s Average Directional Index (ADX) is slightly below the 25.0 threshold-an important level used to confirm the strength of an uptrend.

If the ADX value surpasses this limit, it will be a signal that the bullish momentum is getting solid and could potentially sustain the current rally.

In the previous case in November 2024, similar conditions occurred where the ADX showed an increase in trend strength. This helped XRP to break through the resistance level and continue its price increase, even under overbought conditions.

Therefore, ADX could be a key indicator to determine if XRP is able to repeat its previous success.

XRP likely to break $3

Currently, XRP is trading at $2.58, having recorded a 21% gain in the past week.

The altcoin managed to break the $2.56 resistance level, but has not managed to confirm the level as strong support. If this level can be maintained, the XRP uptrend has the potential to continue.

Read also: Chinese Giant GDC Gears Up with $300 Million to Load Up on TRUMP Token and Bitcoin!

With the $3.00 target now approaching, XRP is looking to cross the next resistance at $2.95. If it manages to break this level, a push towards $3.00 is highly likely, repeating the pattern of strong price movements previously recorded.

However, if the strength of the uptrend is not solid enough, XRP could slip back into overbought conditions, which risks triggering a price reversal.

In the event of a correction, XRP could potentially drop below $2.56, and in the worst case scenario could touch the $2.27 area. This drop would invalidate the current bullish scenario, and could signal the end of the rally.

Therefore, the market’s ability to maintain strength in the near term will be the determining factor for the next direction of the XRP price.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Price Sets Eyes on Rally. Accessed on May 15, 2025

*Featured Image: CoinMarketCap