Ethereum (ETH) Towards $3,000: Decisive Factors to Watch Out For

Jakarta, Pintu News – Ethereum seems to be preparing to hit the $3,000 price in the near future. Although traditional investors are starting to pull back, current market conditions are showing some encouraging signals. Recent analysis of various data sources shows that there are several factors that could determine the fate of Ethereum (ETH) in the future.

Traditional Investors Retreat: A Positive Signal?

According to data from LookOnChain, funds invested in Ethereum (ETH) through spot ETFs saw a net withdrawal of $10.83 million in the last 24 hours. This suggests that traditional investors prefer to secure profits after the recent price increase.

While this may be seen as a negative sign, this withdrawal also reduces selling pressure in the market. This withdrawal by traditional investors may give more space to market participants who are more focused on the technology and long-term prospects of Ethereum (ETH). With less selling pressure, the potential for a price increase becomes more open. This suggests that the market may be in an accumulation phase that could push prices higher.

Also Read: Bitcoin (BTC) Potential to Break New Record Highs in May

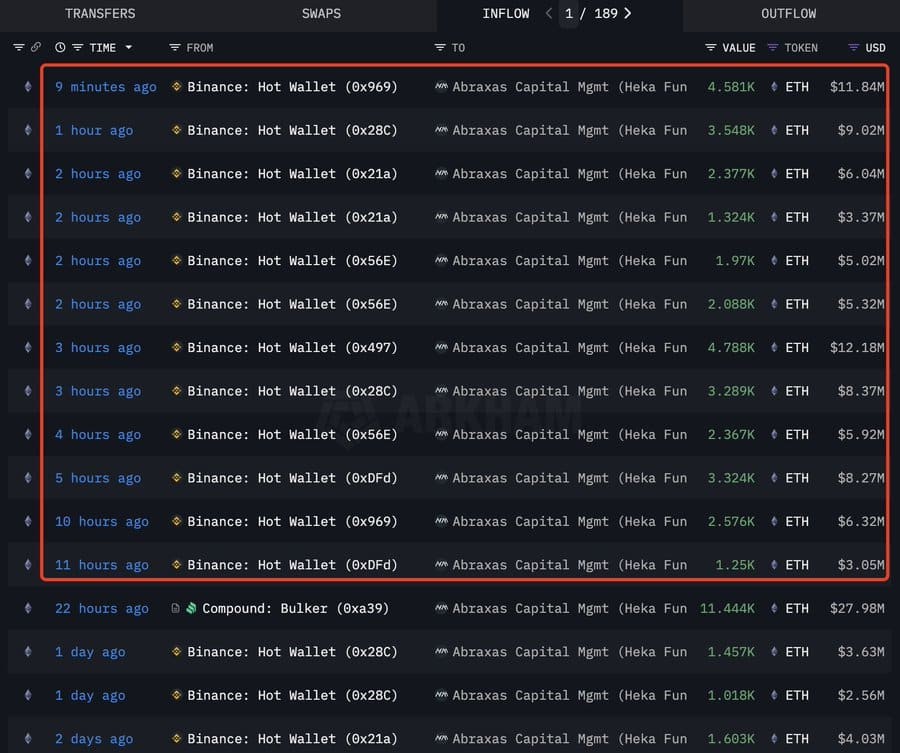

Market Indicators Show Strong Demand

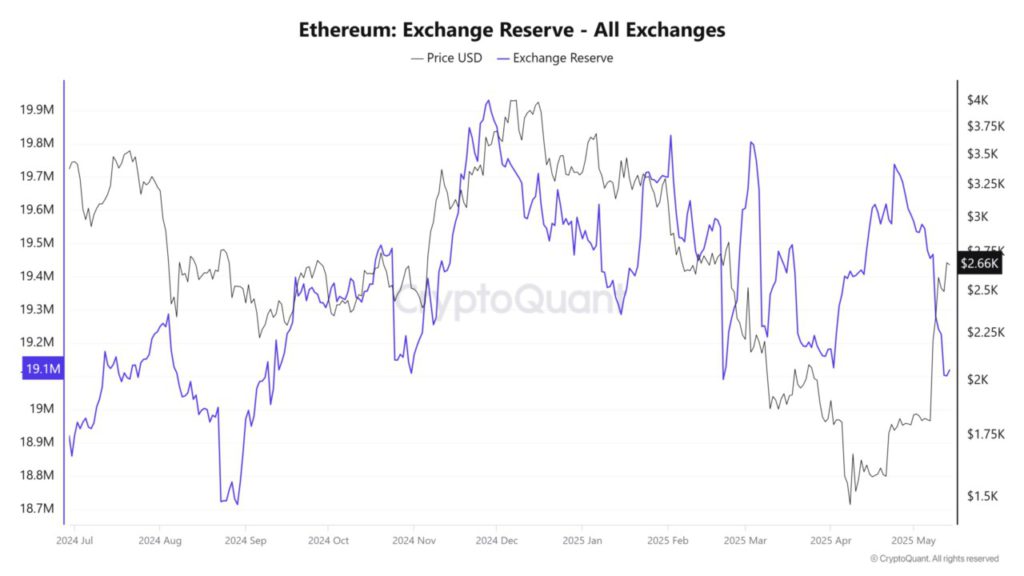

Exchange reserve data shows that the amount of Ethereum (ETH) held on exchanges has dropped to 19.1 million, signaling reduced selling pressure. This suggests that there is strong demand from traders who continue to collect Ethereum (ETH) from exchanges, which in turn creates increased supply pressure.

In addition, the Fund Market Premium, which reflects institutional flows as seen in the Grayscale product, still shows a negative number of -0.3. This indicates that there is still room for growth, especially if institutional players get involved again. This combination of high demand and limited supply could be the catalyst that pushes Ethereum (ETH) price up further.

Ethereum’s (ETH) Chance to Reach $3,000

With various market indicators showing favorable conditions, Ethereum (ETH) has a strong chance of breaking the $3,000 price in the near future. Renewed participation from institutional, traditional investors, and spot traders will be decisive.

If the current trend continues, where demand remains strong and supply continues to dwindle, there is nothing preventing Ethereum (ETH) from reaching and even surpassing that price target. These dynamic market conditions offer opportunities for investors who understand the direction and momentum.

Conclusion

Taking into account the various factors currently affecting the Ethereum (ETH) market, there is good reason to be optimistic about reaching the $3,000 price. Although there are some uncertainties, existing indicators suggest that Ethereum (ETH) is on the right track for further growth.

Also Read: Ukraine Considers Bitcoin as a National Strategic Reserve

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum eyes $3000: How these factors could decide ETH’s fate. Accessed on May 15, 2025

- Featured Image: Decrypt