Ethena (ENA) Uptrend: Will it Break the $0.60 Boundary?

Jakarta, Pintu News – Ethena , one of the relatively new cryptocurrency assets, has shown consistent strengthening signals in recent days. Sharp price increases, increased activity on the network, and large movements from both institutional and retail market participants have attracted market attention. In this context, the question arises whether ENA is able to break the psychological barrier of $0.60 (equivalent to IDR 9,895) in the near future.

Address Growth and Large Scale Transactions

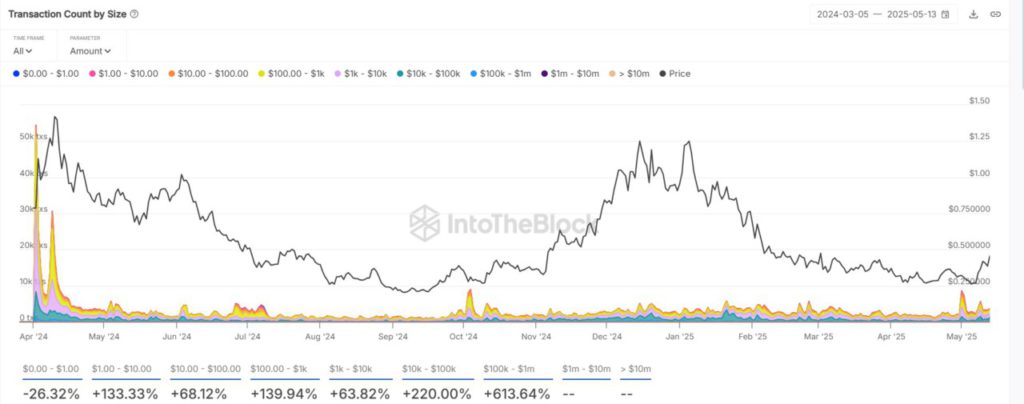

Ethena’s on-chain performance recorded a significant surge in the number of new addresses and large-value transactions. In the past week, new addresses increased by 56.43% and active addresses rose by 37.12%. In addition, transactions in the range of $10,000-$100,000 (IDR164.92 million – IDR1.649 billion) jumped by 220%, while transactions in the range of $100,000-$1 million (IDR1.649 billion – IDR16.49 billion) rose dramatically by 613.64%.

This data indicates increased involvement from large and institutional investors. In general, the growth in addresses and large transactions indicates a growing market interest in this crypto asset. If this trend continues, then the potential for price increases could get stronger in the near future.

Also Read: Bitcoin (BTC) Potential to Break New Record Highs in May

Accumulation Signal: High Outflows from Exchanges

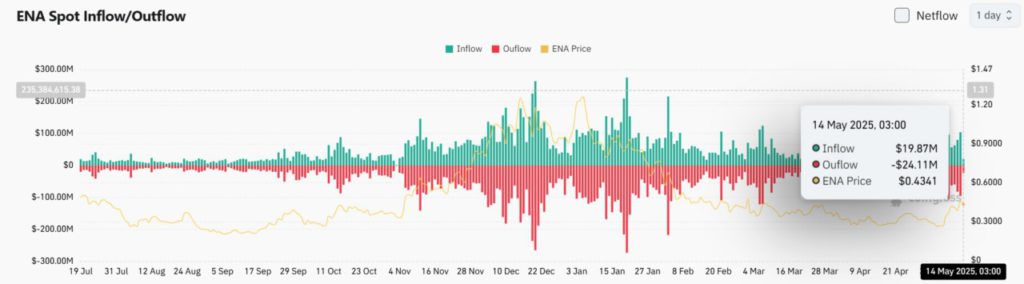

Data from the exchanges showed a strong accumulation behavior towards ENA. Total outflows from exchanges reached $24.11 million, while inflows were only $19.87 million. This means that more ENA tokens are leaving the exchange for personal wallets or self-storage.

This phenomenon is often associated with a reduction in selling pressure on centralized exchanges, as investors tend to hold assets for the long term. Large net outflows during periods of price strength are generally a signal that the price rally may continue, and indicate investor confidence in the long-term prospects of ENA.

Leverage Correction: Long Liquidation as Market Reset

The derivatives market showed that there was a long squeeze, where highly leveraged long positions were massively liquidated. Long liquidations totaled $504,440 (IDR 8.31 billion), far above short liquidations of only $75,450 (IDR 1.24 billion). This indicates that many speculators suffered losses as the price approached resistance levels.

However, this leverage reset could pave the way for a healthier and more stable price structure. With less speculative exposure, room for further upside could be created if buyers come back into the market. This makes the correction an opportunity to build a more solid technical foundation.

Short-Term Activity Increases: Momentum Remains Strong

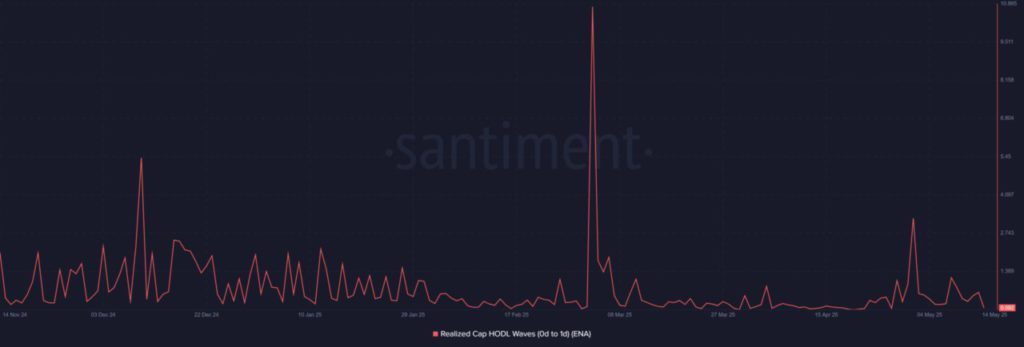

Data from Santiment showed an increase in short-term trader activity, reflected by the Realized Cap HODL Waves (0-1 day) metric rising to 0.0915. This shows that many market participants are making transactions in a short period of time, signaling a surge in volume and liquidity.

While short-term activity can add volatility, it can also strengthen short-term momentum. With market attention refocused on ENA, there is great potential for this cryptocurrency to break through key resistance levels and enter a broader uptrend phase.

Conclusion

Ethena (ENA) is showing a strong combination of network growth, institutional transactions, reduced supply on exchanges, and leverage cleansing. If the price manages to break and hold above $0.60 (IDR 9,895), it could be a valid signal of an overall trend reversal. In the meantime, the market remains cautiously optimistic, awaiting further confirmation.

Also Read: Ukraine Considers Bitcoin as a National Strategic Reserve

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMBCrypto. Will Ethena [ENA] crack the $0.60 ceiling next? 3 signs say yes. Accessed May 16, 2025.

- Featured Image: Cryptonomist