Bitcoin (BTC) surges past $104,000, driven by institutional investors

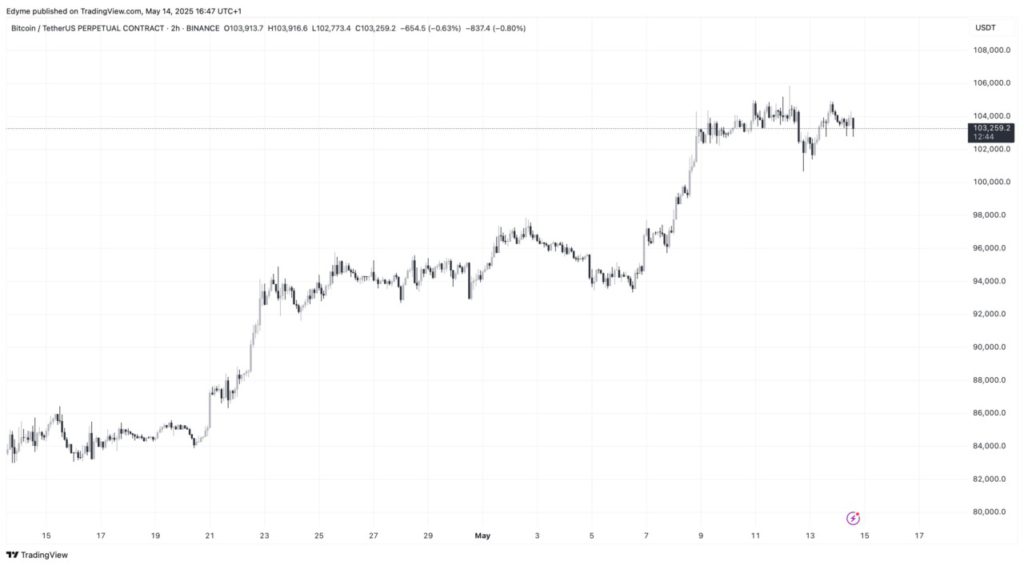

Jakarta, Pintu News – Bitcoin is showing steady gains once again, with the exchange rate now surpassing $103,000. Despite a 0.4% decline in the last 24 hours, the asset has risen more than 20% in the last month. This rise confirms the bullish sentiment in the global market, but recent data suggests a shift in the source of momentum driving this rise.

Global Investors’ Role Increases

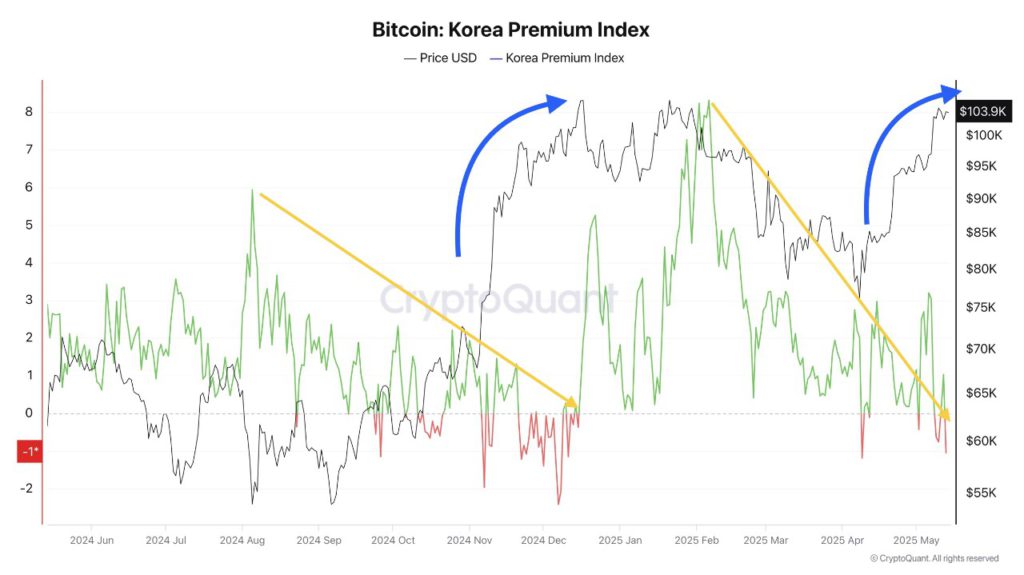

The latest analysis from CryptoQuant by Avocado Onchain shows a downward trend in the so-called “Korea Premium,” which measures the difference in Bitcoin (BTC) price on Korean exchanges compared to international platforms. Despite the increasing market price of Bitcoin (BTC), the Korea Premium continues to show a downward trend.

This signals that the ongoing rally is driven more by institutional flows and investor sentiment in markets outside Korea, rather than the historically active Korean retail segment. In previous cycles, especially in 2017 and 2021, exchanges in South Korea often traded Bitcoin (BTC) at a premium due to a surge in local demand, sometimes up to 20% higher than international prices. These periods are usually regarded as signals of retail-driven euphoria.

Also Read: Bitcoin (BTC) Potential to Break New Record Highs in May

Changing Market Dynamics

Avocado explains that this change in market dynamics reflects a new phase of capital distribution in the crypto space. With spot Bitcoin (BTC) ETFs operational in the US, as well as growing interest from corporations and even sovereign wealth entities, a greater proportion of trading activity is now driven by institutional strategies rather than retail speculation.

This is reflected in the fading Korea Premium, which has not seen a surge despite Bitcoin (BTC) breaking through key resistance levels in recent months. Even in the event of a rebound, any Korea Premium close to 10%-which was once considered moderate-should now be interpreted as high.

New Role of Institutional Activities

According to Avocado, the absence of an excessive domestic premium suggests that Asian retail no longer sets the tempo in the Bitcoin (BTC) market. Instead, global institutional actors, equipped with new vehicles such as ETFs and custodial platforms, seem to be the main drivers of demand.

This change is significant as it could signal more sustainable and less volatile growth for Bitcoin (BTC), in contrast to previous boom-and-bust cycles driven by retail enthusiasm.

Avocado’s observations point to the maturation of the crypto market, where retail sentiment is lagging and institutional interest is increasing, so Bitcoin’s (BTC) price trajectory may now be more responsive to global macroeconomic events, policy shifts, and capital allocation trends from large asset managers.

Conclusion

These evolving dynamics may also change the way traders interpret volume and volatility spikes, especially as retail signals like Korea Premium lose some of their predictive power. With these shifts, the Bitcoin (BTC) market is showing signs of greater maturity, promising a more stable and predictable future.

Also Read: Ukraine Considers Bitcoin as a National Strategic Reserve

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Tops $104K as Global Market Momentum Outpaces Korean Demand. Accessed on May 15, 2025

- Featured Image: Generated by AI