Will the “Sell the News” Phenomenon Drag Down the Altcoin Market Again?

Jakarta, Pintu News – The crypto market often shows a quick reaction to positive news, but what happens afterward often surprises many. The “sell the news” phenomenon seems to be a common pattern, where sharp price increases are often followed by equally rapid declines.

Check out the full analysis below!

Crypto Market Turmoil: Between Euphoria and Reality

In the first week of May 2025, the crypto market was surprised by a series of positive news that pushed the price of Bitcoin beyond $103,000 and Ethereum to a new peak above $2,250.

However, the market excitement was short-lived, as in less than 48 hours, a market correction took place and wiped out most of the gains that had been made. The crypto Fear and Greed Index jumped from 48 to 70 in three days, but then slumped again along with the price drop in the market.

The highly news-reactive nature of the crypto market makes the “sell the news” phenomenon particularly relevant. Investors and speculators often react to expectations rather than reality, causing extreme price fluctuations.

Also read: Bitcoin (BTC) heading towards $110,000? Here’s the latest analysis after US inflation data!

Learning from History: When Good News Doesn’t Always Mean Profits

Market history has shown that good news does not always result in long-term gains. For example, the launch of the Bitcoin Futures ETF by ProShares in October 2021 briefly pushed the price of Bitcoin (BTC) up by almost 40%, but just a few days after trading began, the price of Bitcoin (BTC) experienced a massive correction.

A similar phenomenon happened to Ethereum (ETH) when the SEC approved the Spot Ethereum ETF in March 2024, where the price of Ethereum (ETH) actually fell 12% in the week after the announcement.

This pattern suggests that the market has often “digested” the news before the reality of the market has actually set in. This often leads to unsustainable price increases followed by sharp declines.

Also read: 3 Altcoins that have the potential to explode after the US PPI Inflation Data is Released!

Market Sentiment Analysis: Expectations vs Reality

The phenomenon of “sell the news” often occurs not because the news itself is bad, but because the market has anticipated the news well in advance.

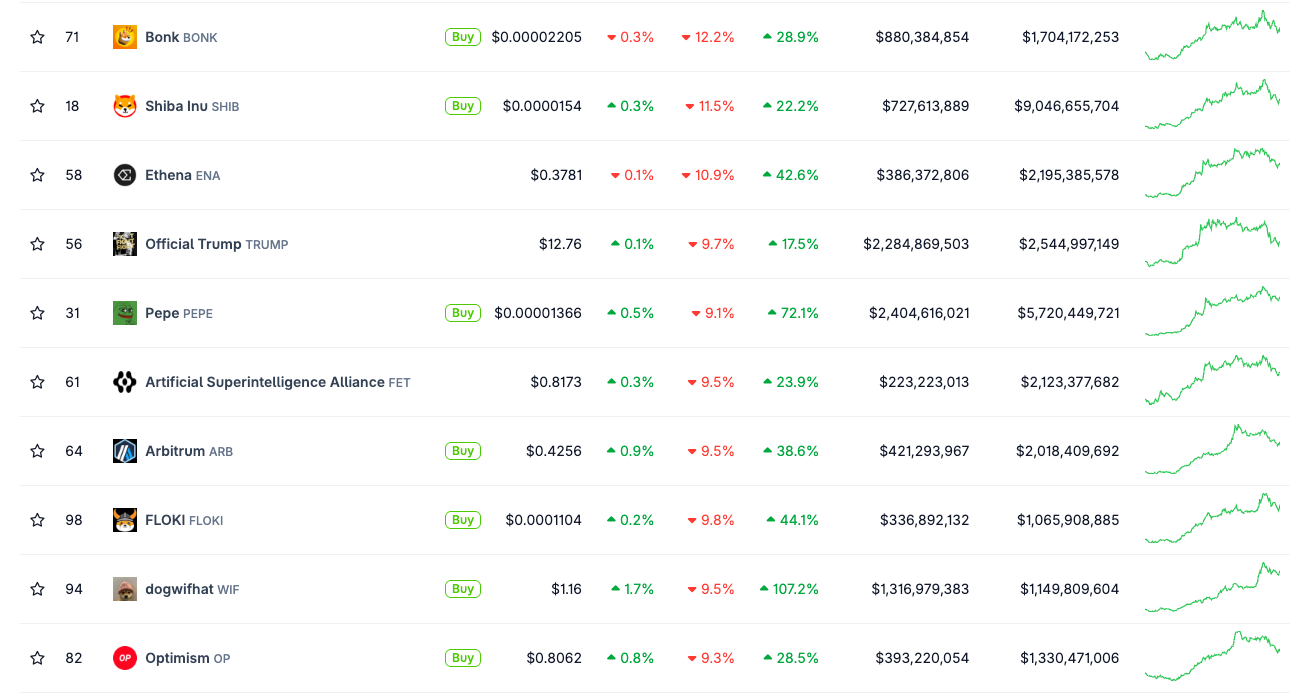

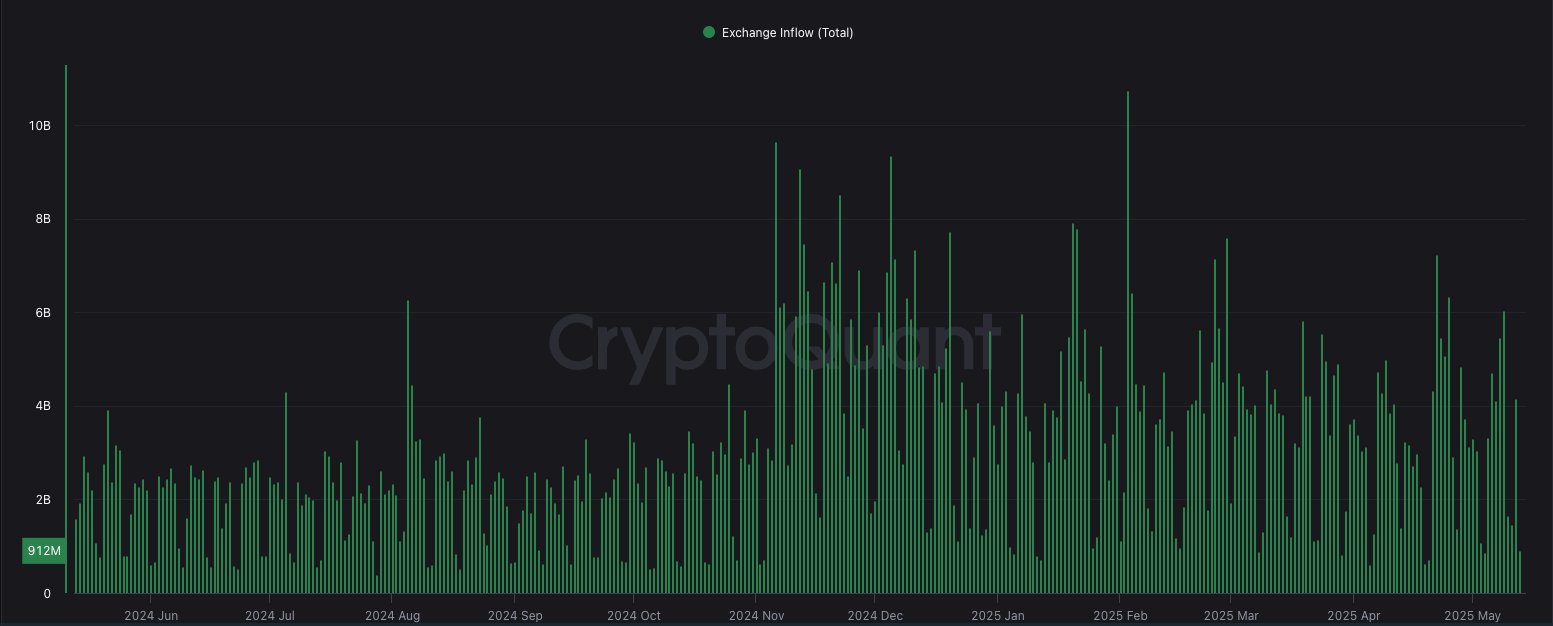

Analysis from CryptoQuant shows that stablecoin inflows to exchanges increased by 27% between April 28 and May 10, 2025, signaling that many investors are preparing to take advantage of the news.

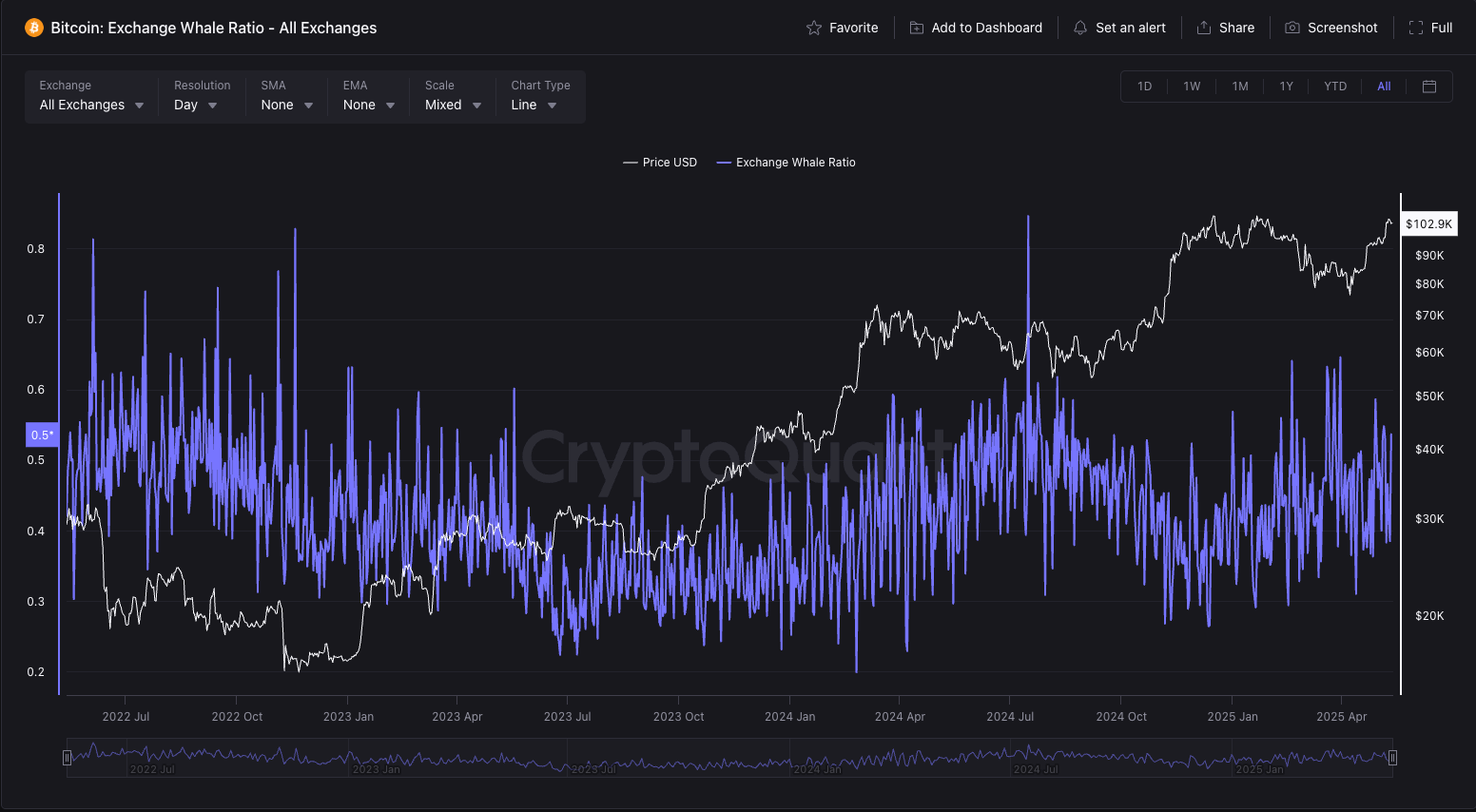

However, the number of Bitcoin (BTC) whale wallets has remained stable, suggesting that the inflow is mostly coming from short-term speculators. Technical indicators are also giving warning signals.

The daily RSI for Bitcoin (BTC) and Ethereum (ETH) exceeded 70 on May 9, indicating overbought conditions. Meanwhile, trading volumes started to decline despite the price continuing to increase, a classic setup for a potential market reversal.

Conclusion

The “sell the news” phenomenon is part and parcel of the market cycle, especially during unsustainable rallies or when information spreads too quickly. However, this doesn’t mean every piece of good news should be viewed with skepticism.

The key to making the right investment decisions lies in analyzing the substance of the news and the capital flows that follow.

Investors need to assess the intrinsic value of information, monitor capital flows, and set exit strategies in advance to avoid emotional reactions that could lead to losses.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NFT Evening. Sell the News Isn’t Just a Phrase, Will It Hit Altcoins Again. Accessed on May 18, 2025

- Featured Image: Generated by AI