Tether’s Dominance Strengthens as Stablecoin Market Capitalization Reaches $243 Billion

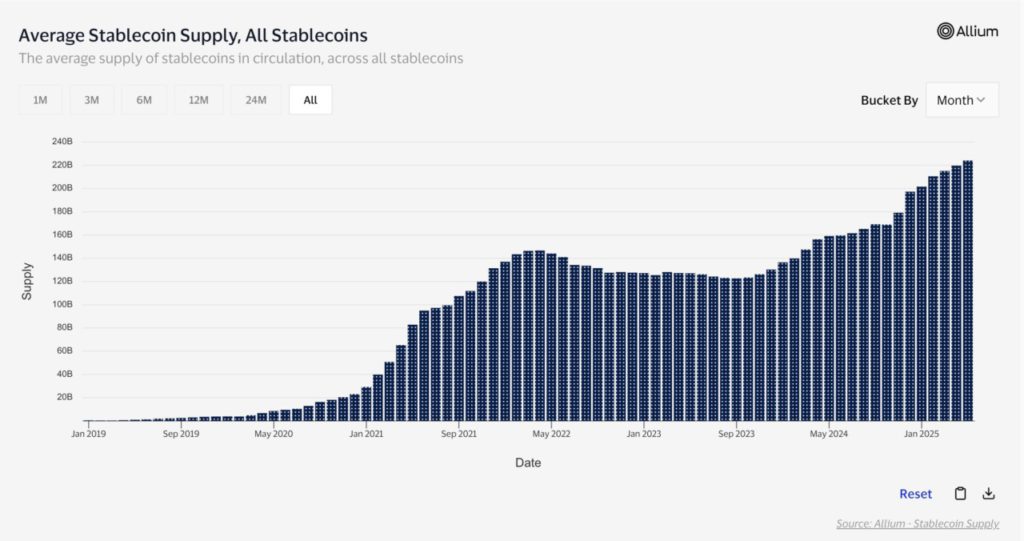

Jakarta, Pintu News – The stablecoin market continues to show significant growth, with the total market capitalization reaching a new record of $243.8 billion. This increase reflects more than $38 billion in assets added since the beginning of the year. Tether dominates the market with a market capitalization of over $151 billion, or 62% of the total stablecoin market.

Check out the full information below!

Stablecoins and the Dominance of Tether (USDT)

Tether (USDT) continues to strengthen its position as the stablecoin market leader with a market capitalization of over $151 billion. This shows a strong dominance in the market with a percentage of 62% of the total stablecoin market capitalization.

This growth is supported by the trust and wide adoption of various users around the world. Tether’s (USDT) closest competitor is USD Coin , which has $60.4 billion in assets. It is followed by Ethena USDe (USDe) with almost $5 billion in assets.

A new presence in the market, USD1 launched by President Donald Trump’s World Liberty Financial, has also attracted attention with over $2.1 billion in assets.

Read also: Coinbase Hacked, Sequoia Capital Partner’s Important Data Spread?

Stablecoin Usage and Transactions

Data from Visa shows an increase in the use of stablecoins in everyday transactions. In the past 12 months, more than 192.2 million unique sender addresses have made transactions using stablecoins, while 242.7 million recipient addresses were recorded. The number of unique active addresses has increased to 250 million.

The total number of transactions reached 5.8 billion with a transaction volume of $33.6 trillion. Stablecoins offer lower fees than traditional methods, such as wire transfers or payment systems like PayPal that charge 2.99% plus a variable fee for a $1,000 transaction. Faster transaction speeds are also one of the main advantages of stablecoins.

Read also: Jerome Powell Criticized by Trump, Will Interest Rates Be Cut?

Stablecoin Future Projections

According to a recent report from Citi, it is expected that stablecoins will continue to gain a larger market share in the coming years. Citi estimates that the market value of stablecoins will reach more than $1.6 trillion by 2030.

Meanwhile, Standard Chartered projects that the value will reach $2 trillion by 2028.

This growth is driven by increased trust from users as well as wider integration with traditional financial systems. Stablecoins offer an efficient and economical solution, making them an attractive option for many users and investors around the world.

Conclusion

With rapid growth and increasing adoption, stablecoins are likely to continue to play an important role in the evolution of the global financial system. The advantages in transaction costs and speed make stablecoins a promising alternative to traditional payment methods.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Stablecoin Market Cap Hits $243B, Annual Transactions. Accessed on May 19, 2025

- Featured Image: Unchained Crypto