Bitcoin (BTC) Price Volatility Surging Soon? Check out the Causes!

Jakarta, Pintu News – Amidst the current uncertainty in the crypto market, Bitcoin price is showing signs of experiencing a new wave of volatility. Recent analysis of on-chain data shows that there are patterns that may indicate significant price movements in the next few weeks. Over the weekend, Bitcoin (BTC) moved slowly, hovering in the $92,000 to $95,000 range, but recent data provides clues as to what might happen next.

Open Interest Indicator: Bitcoin (BTC) Price Movement Prediction

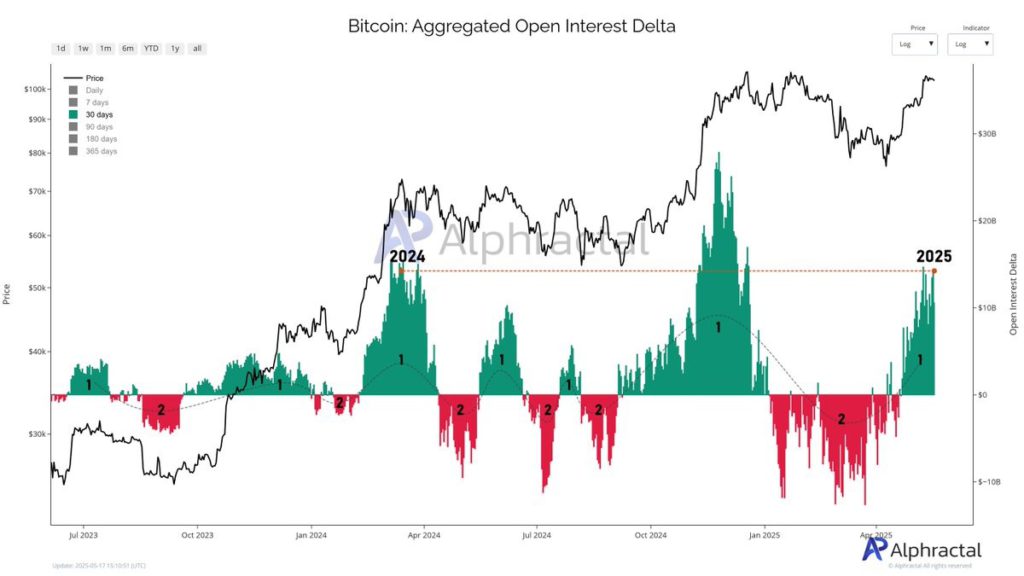

Alphractal, a blockchain analytics firm, recently revealed their findings regarding the open interest cycle and its relationship with Bitcoin (BTC) price. Open interest is a metric that measures the total money flowing into Bitcoin (BTC) derivatives in a given period. Meanwhile, the Open Interest Delta indicator estimates the change in open interest over a given time.

According to Alphractal, the 30-day Open Interest Delta has reached the same level at which Bitcoin (BTC) price rose to its previous peak of around $73,737 in 2024. This pattern suggests that the Bitcoin (BTC) market may be at the beginning of a change in cyclical behavior. The firm noted an alternating pattern of increases and decreases in the Open Interest Delta, indicating a clear cyclical behavior in the market.

Also Read: Bitcoin Approaches Golden Cross: Bullish Signal Amid US Debt Concerns

180 Day Open Interest Delta Insights

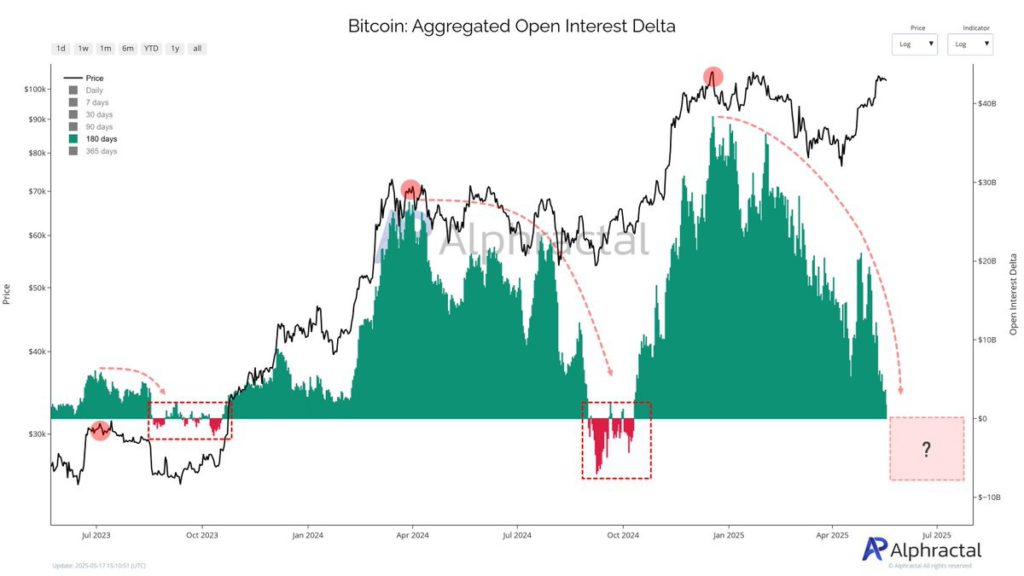

Furthermore, Alphractal highlighted that the 180-day Open Interest Delta provides more interesting insights regarding Bitcoin’s (BTC) price trajectory in the coming weeks. A negative 180-day Open Interest Delta metric is usually associated with a market bottom or accumulation trend. This suggests that there could be a significant increase in Bitcoin (BTC) price volatility soon.

The chart presented shows that the 180-day Open Interest Delta is just above negative territory, which indicates a potential increase in volatility. However, it should be noted that crossing below the zero threshold could also signal the beginning of a new consolidation phase. Alphractal concludes that investor behavior may exhibit fractal patterns in their risk appetite.

Current Bitcoin (BTC) Price

Bitcoin (BTC) price is currently hovering around $103,367, indicating a 0.4% drop in the last 24 hours. Despite the small drop, analysis of on-chain data suggests that there could be major changes coming in the near future. Investors and market watchers should pay attention to these indicators to anticipate the next price movement.

Bitcoin (BTC) price behavior in the coming weeks may be heavily influenced by the dynamics of the Open Interest Delta. If previous patterns repeat, we may see significant price movements, both up and down, which could provide opportunities for traders and investors.

Conclusion

This latest analysis provides market participants with important insights into potential upcoming Bitcoin (BTC) price volatility. By understanding the dynamics of the Open Interest Delta, investors can be better prepared for possible sharp price fluctuations and capitalize on opportunities that arise.

Also Read: XRP Strengthens After V-Shaped Recovery, Next Price Target IDR56,000?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Price Could Be Preparing for Fresh Wave of Volatility. Accessed on May 19, 2025

- Featured Image: Generated by AI