XRP Futures ETF Launching May 19: Could It Outshine BTC and ETH’s Historic Debut?

Jakarta, Pintu News – Amid delays in the United States SEC’s decision on the XRP spot ETF, a futures-based ETF is scheduled to launch on May 19, 2025.

Recently, derivatives marketplace CME Group announced plans to launch a futures contract-based ETF based on the Ripple token. While this is not the expected spot ETF, investors are holding out hope for this launch to increase liquidity and possibly influence the SEC’s decision later on.

Can this launch also outperform the debut of ETH and BTC futures ETFs? Let’s discuss.

CME XRP Futures ETF Launch Confirmed

CME Group’s XRP futures contract-based ETF is set to begin trading on May 19, and will use the CME CF XRP-Dollar Reference Rate as its benchmark.

Read also 3 Crypto DeFi that Investors Are Watching Right Now

Interestingly, this ETF will be available in two contract sizes: one micro version containing 2,500 XRP, and another larger version containing 50,000 XRP.

Giovanni Vicioso, Global Head of Crypto Products at CME Group, acknowledged that demand for Ripple tokens continues to rise, both from institutional and retail investors. He also emphasized the importance of creating regulated derivative instruments as a tool for risk management.

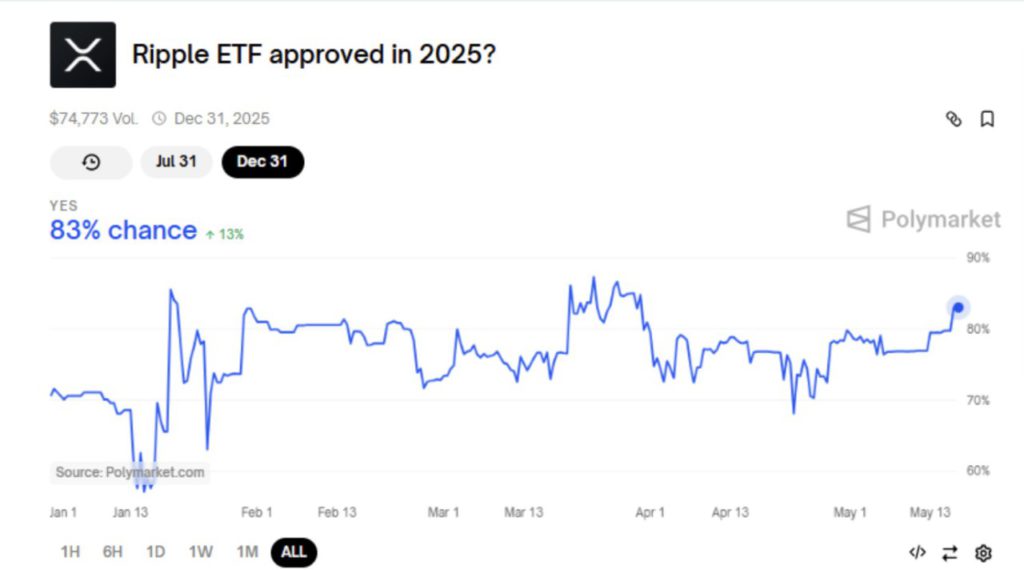

Amidst the launch of this Ripple futures product, the odds of the spot ETF being approved by the SEC have also increased, with the figure reaching 83% on Polymarket’s prediction platform at the time of writing. This is notable because the Solana ETF decision has been delayed.

Next, an important decision to look forward to is regarding Franklin Templeton’s product-based spot Ripple ETF, which is scheduled to be decided on June 17.

Can XRP Futures ETF Outperform ETH and BTC Debut?

The launch of the XRP Futures ETF by CME Group is a major event for the crypto world. Crypto analyst, Cypress Demanincor, called it a significant opportunity that could attract huge liquidity flows into the market.

The ETF will join CME’s other regulated crypto products such as the Bitcoin , Ethereum and Solana futures ETFs. In the first quarter, these products recorded 141% growth on an annualized basis, with average daily trading volume reaching 198,000 contracts or about $11.3 billion in notional value.

Nearly 43,000 Solana futures contracts were traded, and the XRP Futures ETF is expected to score similar or even better results.

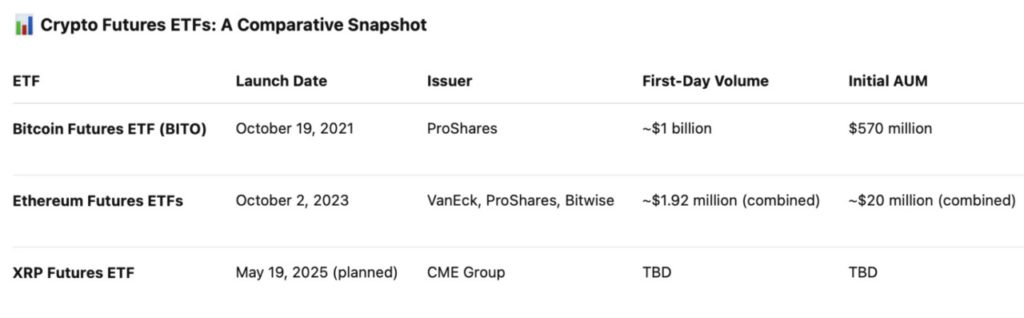

However, while there is a lot of enthusiasm for the launch of the Ripple futures ETF, the chances of it surpassing the debut performance of the ETH and BTC ETFs are considered slim.

Read also: Filecoin & Lockheed Martin Send Data from Space with Decentralized Storage Technology!

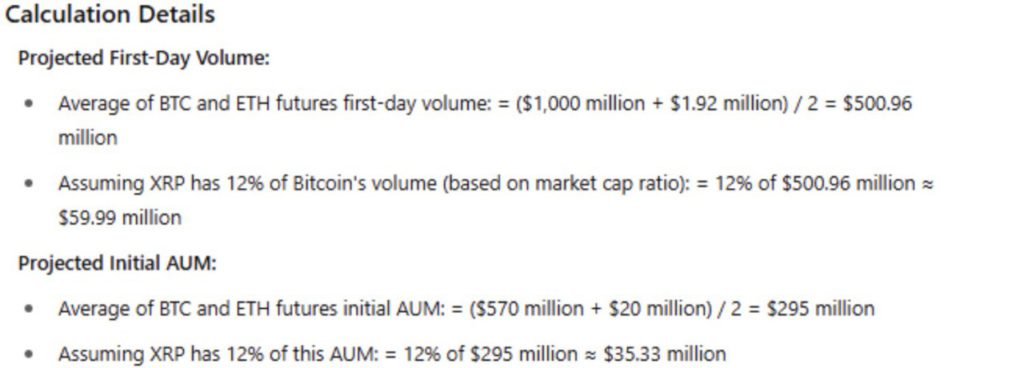

In comparison, ProShares’ Bitcoin Futures ETF (BITO) posted $1 billion in first-day trading volume and achieved $570 million in initial AUM. Meanwhile, three Ethereum Futures ETFs collectively recorded $1.92 million in first-day volume and nearly $20 million in initial AUM.

When compared to the market capitalization and trading volume of ETH and BTC, and taking into account XRP’s position in the market, AI models such as ChatGPT predict that the trading volume of the XRP Futures ETF on day one could reach around $60 million, with AUM estimated at $35 million.

While this is still speculation, a statistical approach suggests that the performance of the XRP Futures ETF is likely to be more limited than the Bitcoin and Ethereum futures ETFs.

In addition, the performance of products such as Teucrium 2x Long Daily XRP ETF (XXRP) and others also show a similar trend.

The main reason for this limited performance potential is that most investors are looking forward to the launch of an XRP spot ETF rather than a futures ETF.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. XRP Futures ETF Goes Live on May 19, Will It Beat ETH and BTC Debut? Accessed on May 19, 2025

- Crypto Briefing. CME to Launch XRP Futures. Accessed on May 19, 2025