Ethereum (ETH) plummets, XRP threatened, and Shiba Inu fails to surge? Here’s what analysts are saying!

Jakarta, Pintu News – The crypto market is in turmoil again with Ethereum losing its position above $3,000, Ripple on the verge of a critical drop, and Shiba Inu failing to maintain its surge. This uncertainty raises big questions about the next direction for these digital currencies.

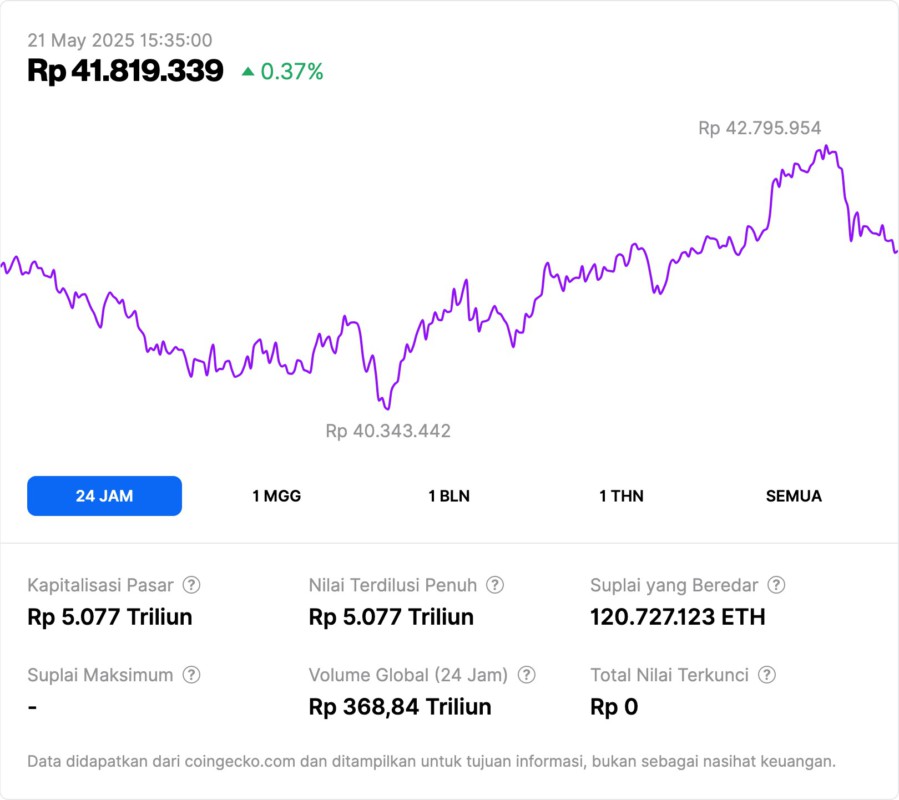

Ethereum (ETH) Loses Momentum

Ethereum (ETH) experienced a significant drop after failing to maintain its position above $3,000. Losing support at the 200 EMA located at $2,438 added to the bearish pressure on this asset. A daily close below this critical level turns it from support to resistance, signaling difficult times likely in the next few days.

If the next strong support in the range of $2,200 to $2,170 does not hold, Ethereum (ETH) might retest the $2,000 level. Trading volumes not showing an increase in bullish buying adds to the concerns.

The lack of market confidence is evident from the lack of buying volume that can match the selling pressure. This suggests that the market may not only be experiencing a healthy correction, but is starting to enter a weakening phase. The bullish structure that failed to sustain after breaking the 200 EMA suggests that the previous rise may not be as strong as expected.

Also Read: XRP Futures Launches on CME: A New Beginning for Crypto Investing!

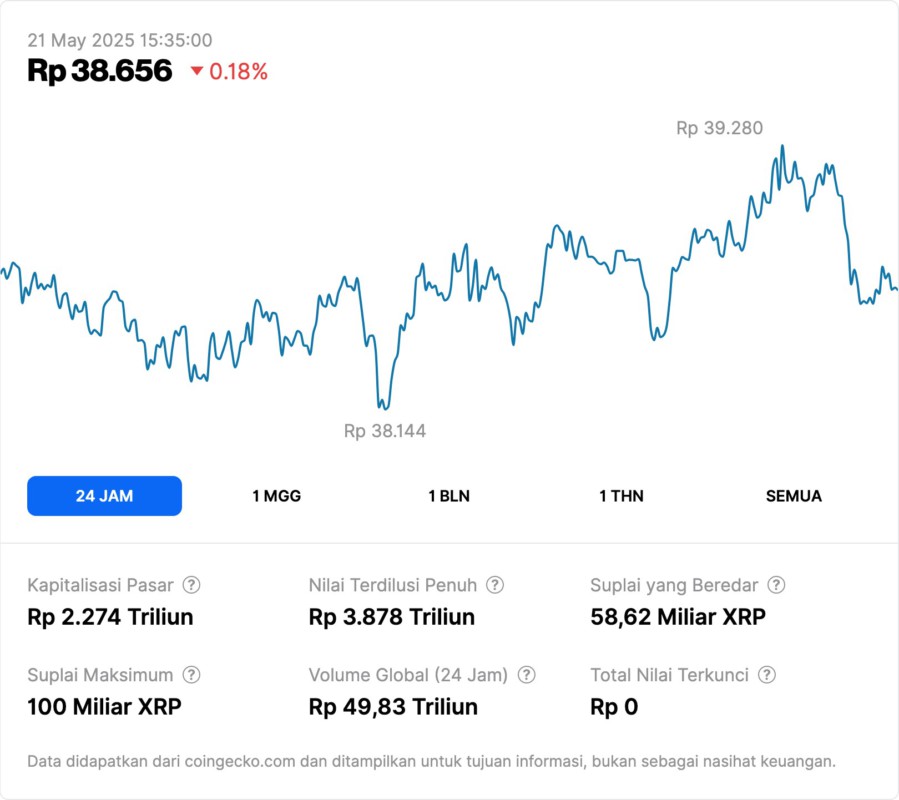

Ripple (XRP) at a Critical Crossroads

Ripple (XRP) is currently at a critical juncture with prices starting to approach the 26 EMA, an important dynamic support level. If this level is broken, with the current price at $2.31, Ripple (XRP) may see a further decline with targets in the range of $2.18 to $2.04.

The bullish momentum that once propelled the price towards $2.80 now seems to have dissipated, with volumes continuing to decline indicating reduced buyer interest. Without any major inflows or a revival in sentiment, it is difficult for Ripple (XRP) to maintain its current value.

Many market participants who were previously targeting the $3.00 psychological resistance level are now seeing their hopes dashed. Consolidation within a narrower range and each increasingly weaker bounce suggests that Ripple (XRP) may be entering a deeper correction.

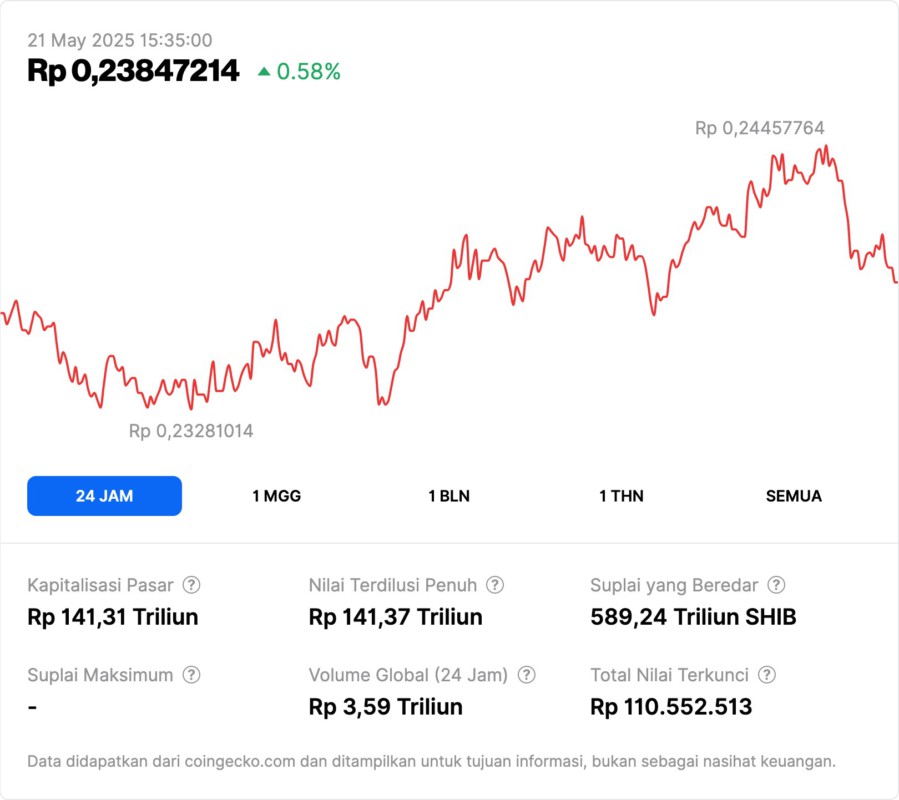

Shiba Inu (SHIB) Failed to Maintain its Rise

Shiba Inu (SHIB) came under selling pressure after a breakout attempt above the 100 EMA failed to sustain. Hopes for a long-term rally were raised when the asset broke the important moving average in early May. However, the bullish momentum quickly died down and SHIB returned to the previously claimed support level.

This failure shows the market’s lack of confidence in Shiba Inu (SHIB). Although volume increased during the upside attempt, there was no significant follow-on buying. The token returned to the $0.000014 level due to mounting selling pressure. The 200 EMA which was slightly above the breakout zone failed to show strong rejection, making it a major obstacle for Shiba Inu (SHIB) to overcome in the absence of strong fundamental or speculative catalysts.

Conclusion

The recent instability in the crypto market shows how dynamic this investment environment can be. Investors and traders should remain vigilant against rapid and unexpected changes. With Ethereum (ETH), Ripple (XRP), and Shiba Inu (SHIB) all showing signs of weakness, it is important to monitor market developments closely and make informed decisions based on current data.

Also Read: SEC and Crypto Regulation: Between Stability and Innovation

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Ethereum (ETH) Lost 3,000, XRP to Lose 2%, Shiba Inu (SHIB) Breakthrough Failed. Accessed on May 20, 2025

- Featured Image: Generated by AI