Ethereum’s supply on exchanges reaches its lowest point, will the price increase continue?

Jakarta, Pintu News – Ethereum on-chain data shows that Ethereum inventories on exchanges have reached historic lows, signaling a decrease in selling pressure and an increase in long-term holding positions.

With this, the price of ETH has surged 7% today, breaking the $2,550 level, with the market capitalization surpassing $300 billion. The overall market sentiment for Ethereum (ETH) has become extremely bullish, with a 58% rise over the last month.

Ethereum Inventory on Exchanges Lowest in 10 Years

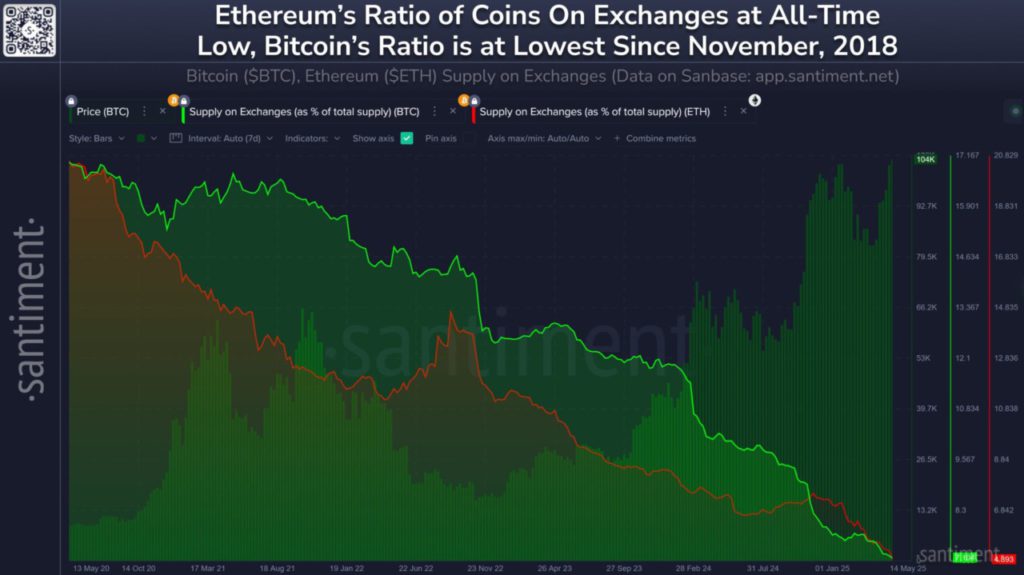

Blockchain analytics firm Santiment has shared an important statistic, noting that currently less than 4.9% of the total Ethereum (ETH) supply is held on exchanges. This is the lowest percentage of Ethereum (ETH) on exchanges since its inception over a decade ago.

Furthermore, Santiment also stated that over the past decade, the supply of Ethereum (ETH) held on exchanges has decreased by 15.3 million ETH. This indicates a growing preference among investors for long-term storage and decentralized storage options.

Also Read: XRP Futures Launches on CME: A New Beginning for Crypto Investing!

Lack of Ethereum on Exchanges Signals What?

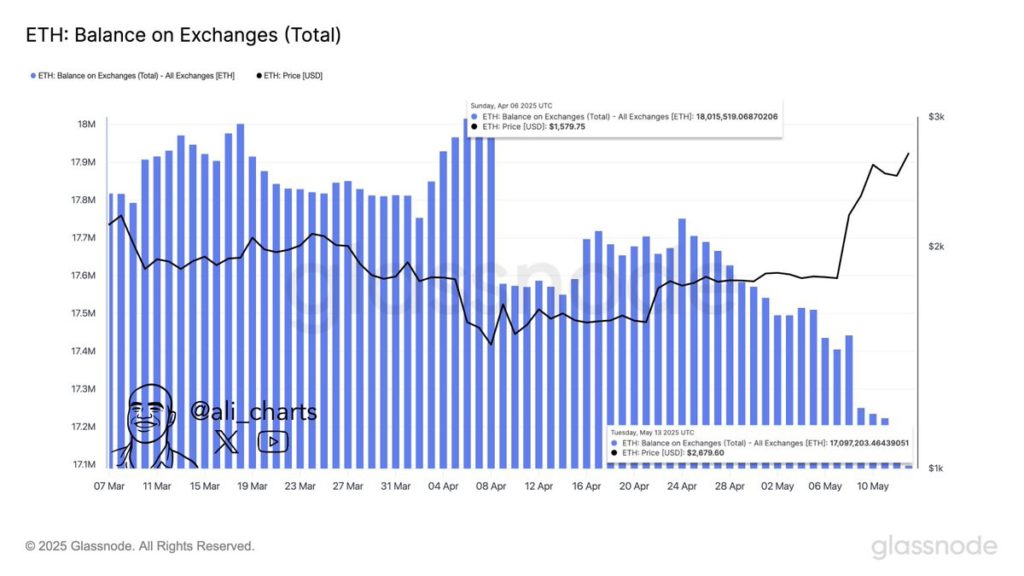

During the 60% rise in the last month, the supply of Ethereum (ETH) on exchanges has been dwindling rapidly. According to data from Glassnode, crypto analyst Ali Martinez explained that nearly 1 million ETH has been withdrawn from exchanges over the last month. A decrease in Ethereum (ETH) held on exchanges often indicates a decrease in potential selling pressure.

This will also ensure greater Ethereum (ETH) price stability and long-term bullish sentiment. Renowned market veterans like Arthur Hayes believe that Ethereum will lead the altcoin season this summer.

Will Ethereum’s Rally Continue?

After dipping below $2,400, Ethereum (ETH) price has shown great strength again, rising 8.83% in the last 24 hours, and is currently trading at $2,573 with a market capitalization of $310 billion. According to Coinglass data, Ethereum futures open interest has risen 7% to over $31.24 billion, confirming the strong bullish sentiment among traders.

On the other hand, 24-hour liquidations have surged to $91.6 million, of which $59.6 million were short liquidations. Popular analyst Crypto Patel also highlighted the formation of a “Golden-Cross” pattern on the 12-hour chart of Ethereum (ETH). A Golden Cross forms when the short-term moving average crosses above the long-term moving average.

As a result, Ethereum (ETH) price targets projected by analysts are currently between $3,800 and $5,000 or higher. If Ethereum (ETH) price holds above the crucial resistance of $2,500, the bulls could continue the Ethereum price rally to $3,000 and higher in the short term.

Conclusion

With numerous positive indicators and growing interest from investors, the prospects for Ethereum (ETH) look very promising. A significant increase in price and a decrease in supply on exchanges are signals that Ethereum may continue to experience strong growth in the near future.

Also Read: SEC and Crypto Regulation: Between Stability and Innovation

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Ethereum Exchange Supply Hits Lowest in History, ETH Rally to Continue. Accessed on May 20, 2025

- Featured Image: Generated by AI