Bitcoin (BTC) Beats 1 Kg Gold Price, MEXC and JPMorgan: “The Era of Digital Gold Has Begun?”

Jakarta, Pintu News – Bitcoin has reached another important milestone after surpassing the price of 1 kilogram of pure gold bullion. This achievement confirms Bitcoin’s position as “digital gold” and symbolizes its power as a store of value in the modern financial era.

This was conveyed directly by MEXC Chief Operating Officer, Tracy Jin, in a statement released to CryptoTimes. According to him, Bitcoin is no longer just a speculative asset in the crypto world, but has now become an important part of global investment portfolio strategies.

Bitcoin Vs Gold: Who is the Superior Store of Value?

Tracy Jin said that Bitcoin is now a vital store of value and deserves to be considered on par with gold.

Although gold is still ahead in annual performance with a 23% gain, while Bitcoin is up 12%, Bitcoin’s price achievement of surpassing gold is an important symbol of the shift in global investor sentiment. Bitcoin has advantages such as a fixed supply, full transparency, and programmable digital infrastructure.

With all these advantages, Bitcoin is considered a hedge against the risk of fiat and ever-bloating government debt.

Jin emphasized that Bitcoin now not only shapes the crypto ecosystem, but also plays a major role in institutional financial strategies. The interest of major investors and states like New Hampshire and Arizona further solidifies Bitcoin’s position as a strategic asset of the future.

Read also: 5 Most Swapped Memecoins on Uniswap Wallet This Week

BTC momentum is strong, but risks still lurk

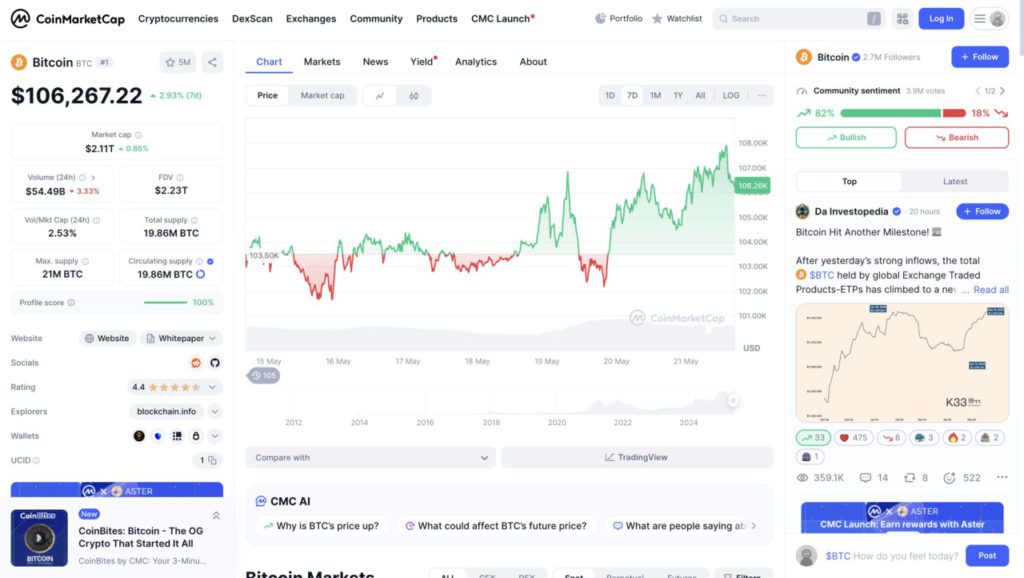

Bitcoin has shown a positive trend for six weeks in a row, with last week’s closing price close to IDR1.73 billion ($106,500).

Jin said that the Rp1.73 billion ($105,800) area is an important resistance zone, and if successfully broken, the price could jump to Rp1.79 billion ($109,000), potentially even reaching Rp2.14 billion ($130,000) in the third quarter. The long-term target is even predicted to break Rp2.46 billion ($150,000) by the end of the year.

However, Jin also cautioned that volatility remains a major factor to watch. After the US credit rating downgrade on May 19, BTC prices briefly fell 4.5%, reflecting the market’s sensitivity to macroeconomic news.

Important support areas are in the range of Rp1.59 billion-Rp1.62 billion ($97,000-$98,500), and if these levels are broken, a deeper correction to Rp1.49 billion ($91,000) could occur before the uptrend resumes.

JPMorgan: Bitcoin Starts to Slide Gold’s Dominance

In a recent report, JPMorgan analysts supported the view that Bitcoin is starting to take market share from gold. According to them, corporate interest and regulatory support from the US are the main drivers of this surge.

Between mid-February and April, gold had a lead over Bitcoin, but in the last three weeks, the trend reversed with BTC taking the lead.

JPMorgan expects this trend to continue, especially with the big plans of companies like Strategy (formerly MicroStrategy) which plans to invest IDR 1.38 quadrillion ($84 billion) into Bitcoin until 2027.

Currently, the company has invested almost a third of the target. Support from states and government institutions also provides a strong foundation for Bitcoin to expand its dominance as a hedging asset.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Times. Bitcoin Is Beating Gold as a Store of Value: MEXC. Accessed May 21, 2025.

- Featured Image: Bitcoin News