5 Crypto “Made in USA” That Could Skyrocket by the End of May 2025 — Don’t Miss Out!

Jakarta, Pintu News – Made in USA crypto is gaining traction towards the last week of May, with AVA, Solana , Pi Network (PI), Uniswap , and Worldcoin taking center stage.

AVA jumped nearly 10% as interest in AI increased, while SOL saw increased accumulation from institutional investors despite ETF delays.

PI climbed back above $0.80 with momentum continuing to grow despite concerns about its ecosystem.

Meanwhile, UNI faces legal pressure from Bancor, and WLD remains in the spotlight after experiencing regulatory challenges and expansion efforts into the United States.

AVA

AVA is the native token of Holoworld, an artificial intelligence -powered storytelling platform designed for creators, brands, and developers.

The ecosystem allows users to create immersive experiences using customizable AI avatars, realistic animations, and voice-based interactions. Holoworld claims to have over 1 million users and tens of millions of interactions.

The AVA token was initially launched through PumpFun, a launchpad on the Solana network, and currently has a market capitalization of around $65 million. In the last 24 hours, AVA is up almost 10% as interest in AI-themed tokens grows.

Technical indicators show a positive trend, with the AVA EMA line indicating the possibility of a golden cross forming in the near future.

If this momentum holds, the token price has the potential to rise to challenge the resistance level at $0.069, and if successfully broken, could open up opportunities to rise to $0.0919 and even up to $0.15.

However, if the bullish momentum fades and the support level at $0.060 fails to hold, the price of AVA could drop back to $0.0519, and if the downtrend gets stronger, the potential drop could reach $0.047 or even $0.0417.

Solana (SOL)

Solana saw increased accumulation from institutional investors throughout May 2025. Whales have been staking large amounts of SOL, with some even investing millions of dollars in Solana-based assets.

Currently, more than 65% of SOL supply is on-stake. App revenue in the first quarter reached $1.2 billion, the highest figure in the past year, indicating strong ecosystem growth.

Although the altcoin market is relatively calm, analysts compare Solana’s structure to Ethereum in early 2021. On-chain inflows and developer activity are on the rise.

On the other hand, the SEC postponed a decision regarding Solana’s five ETF proposals, shifting the timeline to mid-2025. Nevertheless, SOL prices rose 2.7%, showing resilience.

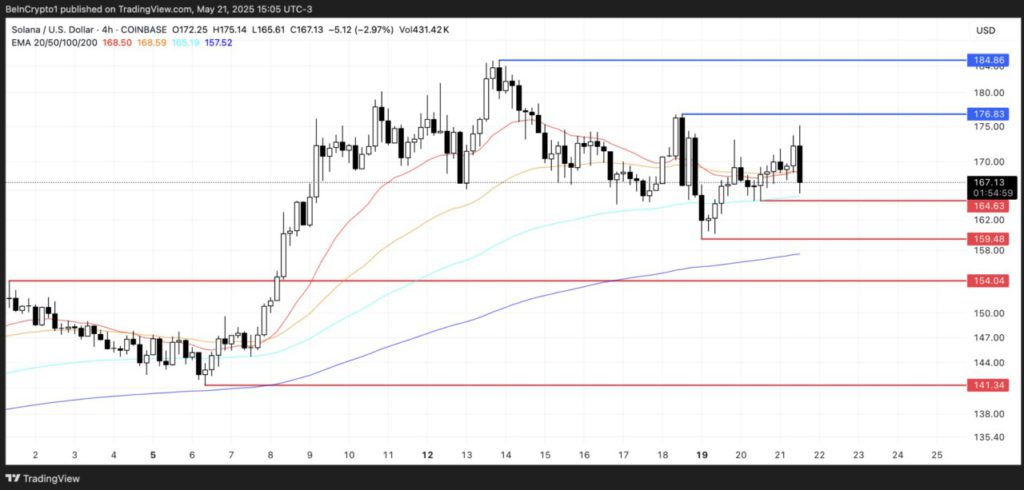

Technically, SOL is holding at the $164 support level. If this level is strong, the price could potentially test resistance at $176.83 and $184.86. However, if $164 fails, the next supports are at $159.48, $154, and $141.

Pi Network (PI)

Pi Network has faced some major obstacles since its mainnet launch in February 2025, although it is fast becoming one of the most talked about “Made in USA” coins.

Obstacles include not being listed on Binance or Coinbase, poor price performance, and unrealized ecosystem promises. Although 86% of the community voted for listing on Binance, there is still no official listing.

Read also: Pi Network Price Dives 3% Today: Vietnam Takes Control of Nodes, Raising Alarms Over Centralization!

However, PI is showing signs of short-term strength. In the last 24 hours, the price rose by almost 10%, breaking the $0.80 level. PI’s market capitalization is back near $6 billion, and the EMA line shows the possibility of a golden cross forming in the near future.

If this momentum continues, PI could test resistance at $0.96. If it breaks through, the upside potential could reach $1.30 and $1.67.

Conversely, if the uptrend weakens, PI prices could drop back to $0.66. If that level fails to hold, the next support is at $0.57 and lower.

Uniswap (UNI)

Bancor filed a patent infringement lawsuit against Uniswap, alleging that the leading DEX is using its patented automated market maker (AMM) technology without permission.

Bancor claims to have developed and patented the constant product AMM model since 2017, which was later adopted by Uniswap for its own protocol. The lawsuit was filed in New York and demands compensation from Uniswap Labs and the Uniswap Foundation, making UNI one of the most interesting “Made in USA” coins to watch next week.

Currently, UNI is trading near the important support level of $5.94.

If this level fails to hold, the price could drop to $5,649 and even down to $5,43. On the other hand, if momentum recovers, UNI could again test the resistance at $6,329. If successfully broken, the next resistance is at $6.52 and $7.36.

Worldcoin (WLD)

AI-related tokens are attempting to make a broader recovery in recent weeks, and Worldcoin (WLD) has remained in the spotlight during this period. The project is facing regulatory challenges while undergoing a major expansion, so it continues to attract attention.

Read also: Bitcoin Prints New All-Time High of $111,880 on Pizza Day – Here’s What’s Next!

Legal issues arose in Kenya, where the high court ruled that Worldcoin violated privacy laws and ordered the deletion of biometric data collected from users.

Around the same time, Indonesia suspended its operations due to regulatory and certification concerns. Despite these obstacles, Worldcoin recently launched in six major US cities and plans to distribute 7,500 biometric verification devices across the country.

In the past 24 hours, WLD gained 6.8%, showing signs of a short-term recovery. Its EMA line indicates a possible golden cross which would be a positive technical signal.

If this momentum holds, WLD could rise towards $1.19, and if that resistance is broken, the upside potential continues to $1.36. But if it fails to sustain above $1.11, the price could drop to $1.05, and may drop below $1 if bearish pressure increases.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 5 Made in USA Coins to Watch for the Last Week of May. Accessed on May 22, 2025