Bitcoin and Ethereum are leaving exchanges at a rapid pace, is this a sign of a supply crisis?

Jakarta, Pintu News – The reduction in the number of Bitcoin and Ethereum on exchanges has hit rock bottom, signaling a major shift in the dynamics of the crypto market.

Drastic Reduction in Supply on the Exchange

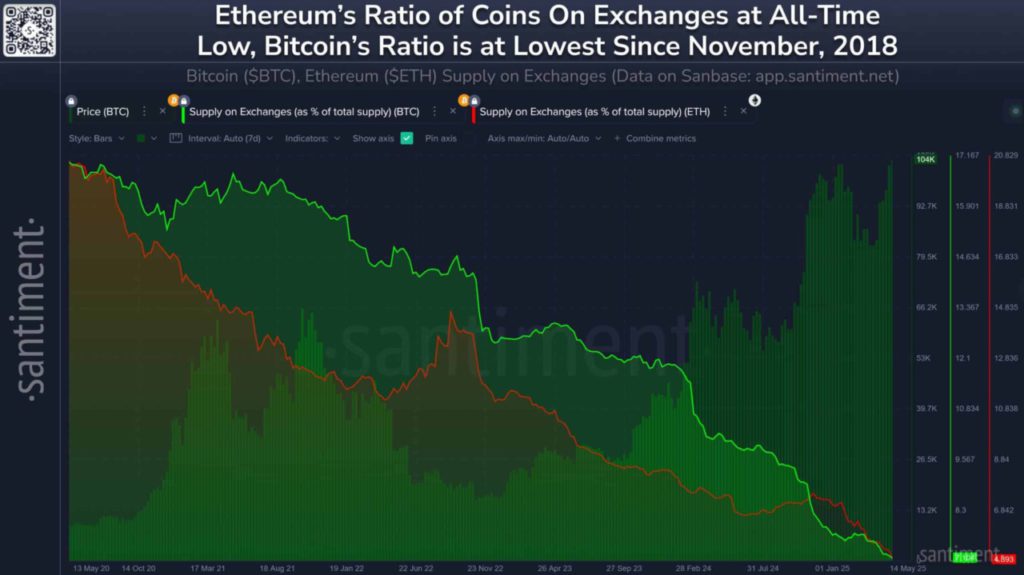

Bitcoin (BTC) inventory on exchanges is now just 7.1%, the lowest figure since November 2018, while Ethereum (ETH) fell below 4.9% for the first time in more than ten years. The withdrawal of more than 1.7 million BTC and 15.3 million ETH from crypto exchange exchanges (CEXs) over the past five years shows an increasing trend towards self-storage and long-term holding.

This could be an early indication of a potential supply crunch if demand increases suddenly. With diminishing numbers on the exchanges, this may limit seller liquidity, which historically can precede large price increases. However, there is an argument that this decline may be more due to funds moving to cold storage for safety reasons, rather than accumulation.

Also Read: PEPE Coin (PEPE) Shows Bullish Signal, What’s the Secret?

Supply Crisis Debate

A supply crisis occurs when the number of tokens available on exchanges decreases while demand increases, creating upward pressure on prices. With Bitcoin (BTC) and Ethereum (ETH) balances at their lowest points in years, the stage seems to be set. However, not everyone is convinced by this scenario.

Some analysts argue that large owners, or “whales”, may simply be moving their funds to safer storage, rather than actually accumulating more. On the other hand, doubts still hang over retail investors and there could be a drop in interest after the launch of ETFs. If market sentiment changes, capital currently on the sidelines could return to the exchanges, reversing the current trend quickly.

Bitcoin: From Alternative to Mainstream

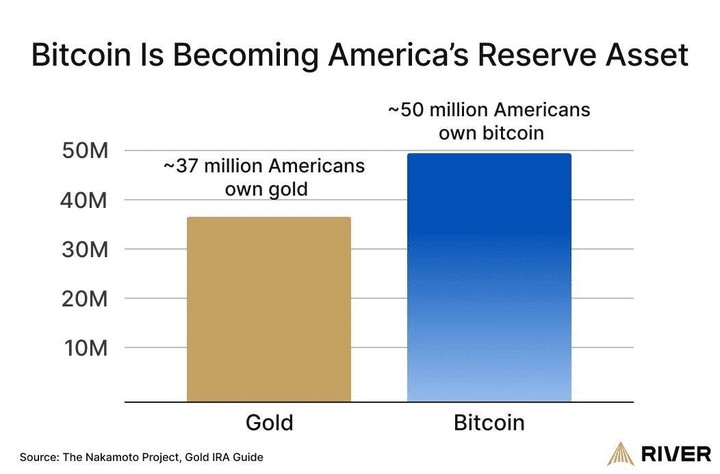

Around 50 million Americans now own Bitcoin (BTC), a number that exceeds gold holdings, according to data from River and The Nakamoto Project. This signals a significant shift in priorities. Bitcoin (BTC) is no longer a fringe asset, but a growing backup alternative.

The sharp decline in the supply of Bitcoin (BTC) on exchanges may have more to do with a redefinition of long-term value in the digital age than just speculation. It shows a paradigm shift in the way people view and use Bitcoin (BTC) as an asset.

Conclusion: What Will Happen Next?

With the supply of Bitcoin (BTC) and Ethereum (ETH) dwindling on exchanges, the market may be on the verge of a major change. Whether this will trigger a price spike or simply be a shift in storage strategies by large investors remains to be seen. However, one thing is for sure, the dynamics of the crypto market are changing, and this could have long-term implications for all stakeholders in the industry.

Also Read: Will Pi Token (PI) Surge Beyond $0.9? Check out the Analysis!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Crypto supply shock: Bitcoin and Ethereum leave exchanges at record pace. Accessed on May 22, 2025

- Featured Image: Securities.io