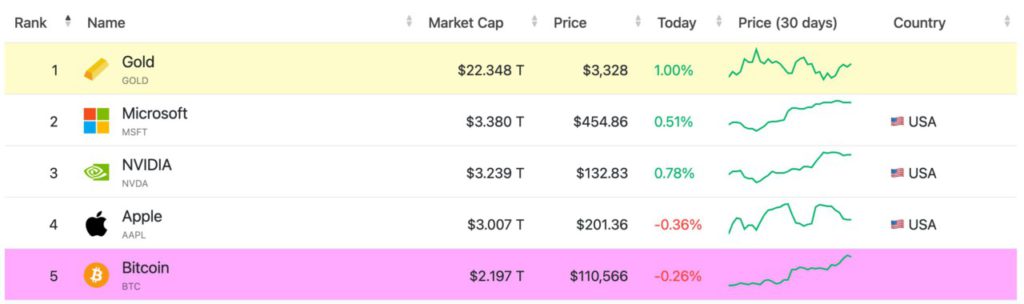

Bitcoin (BTC) surpasses Amazon and Google, becoming the fifth top global asset

Jakarta, Pintu News – On May 21, Bitcoin reached a milestone by recording a new record high near the $110,000 mark. This surge was driven by significant buying pressure, which increased Bitcoin’s (BTC) market capitalization to over $2.1 trillion. Today, this market-leading cryptocurrency has placed itself among the world’s most valuable assets, coming in fifth in market capitalization and surpassing major companies such as Amazon and Google.

Bitcoin (BTC) and its Position in the Global Market

With this new milestone, Bitcoin (BTC) not only set a price record but also increased its position in the list of global assets. According to the Companies Market Cap page, Bitcoin (BTC)’s market capitalization now stands at around $2.182 trillion. Currently, Bitcoin (BTC) only lags behind tech giants like Apple, NVIDIA, and Microsoft, as well as the traditional safe-haven asset, gold, which has a capitalization of over $22 trillion.

This rise marks a new era for Bitcoin (BTC) as a globally recognized investment asset. This position represents a significant shift in the market’s perception of cryptocurrencies, which are increasingly accepted as a legitimate and valuable form of asset.

Also Read: PEPE Coin (PEPE) Shows Bullish Signal, What’s the Secret?

Bitcoin’s (BTC) Potential to Surpass Gold

With its ever-increasing market capitalization, many analysts and investors have begun to question whether Bitcoin (BTC) could one day surpass gold. Gracy Chen Chen, Managing Director of Bitget, in a roundtable discussion reported by Rob Nelson of The Street in February, highlighted the transformative nature of the cryptocurrency market.

The growth and acceptance of Bitcoin (BTC) as a global asset shows its untapped potential. While there is still macro uncertainty and the threat of further volatility, the long-term prospects of Bitcoin (BTC) as an asset that can compete with gold seem increasingly realistic.

Bitcoin (BTC) Price Projections Going Forward

Antoni Trenchev, co-founder of digital asset trading platform Nexo, commented on the current market landscape with optimism. According to him, after surpassing the January price peak and achieving a 50 percent gain from the April low, Bitcoin (BTC) is entering new territory with the support of institutional momentum and a favorable regulatory environment in the US.

Trenchev also emphasized that the market is still in the fourth year of the Bitcoin (BTC) price cycle, which is traditionally seen as a critical period after the event of cutting miner rewards in half. Under these conditions, the price target of $150,000 by 2025 is still very much achievable.

Conclusion

With all the achievements and potential demonstrated by Bitcoin (BTC), the cryptocurrency is not just a digital means of payment, but has become a recognized and valued investment asset worldwide. The significant price increase and position among the top global assets marks a new era for Bitcoin (BTC) and perhaps for the entire cryptocurrency ecosystem.

Also Read: Will Pi Token (PI) Surge Beyond $0.9? Check out the Analysis!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin All-Time High Propels It Past Amazon, Google to 5th Place Among Global Assets. Accessed on May 22, 2025

- Featured Image: Generated by AI