Bitcoin ETF Buys 7,869 BTC: Is a Wave of Price Rise Coming Soon?

Jakarta, Pintu News – Increased buying by Bitcoin ETFs indicates the potential for strong bullish momentum in the cryptocurrency market. With large transactions taking place recently, many are wondering if this is the start of a broader upward trend in prices.

Bitcoin ETFs: Biggest Inflows of the Year

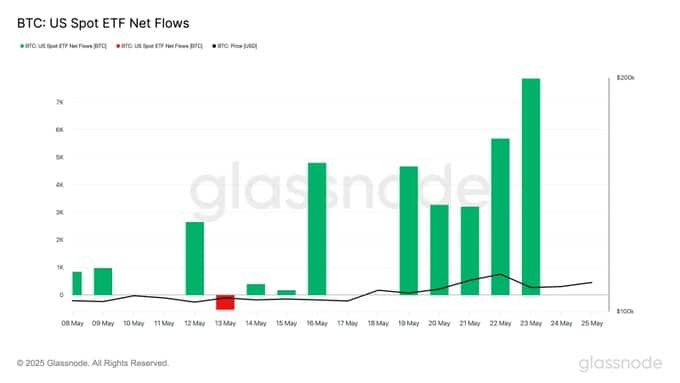

Last Friday, the Spot Bitcoin ETF in the United States recorded one of the largest daily inflows this year with the addition of 7,869 BTC to its portfolio. This was the largest daily inflow since April 29. This increase not only shows the growing interest but also the increasing confidence of institutional investors in Bitcoin (BTC).

This positive trend is also supported by the 7-day simple moving average (SMA) of ETF inflows showing an increase, indicating that this is not just a one-time occurrence but part of a continuing trend. The growing confidence among large investors could be a catalyst for more inflows going forward.

Also Read: Whale’s Big Sale of SAND, Will Prices Plummet as Early as June 2025?

Trader Positioning Indicates Optimism

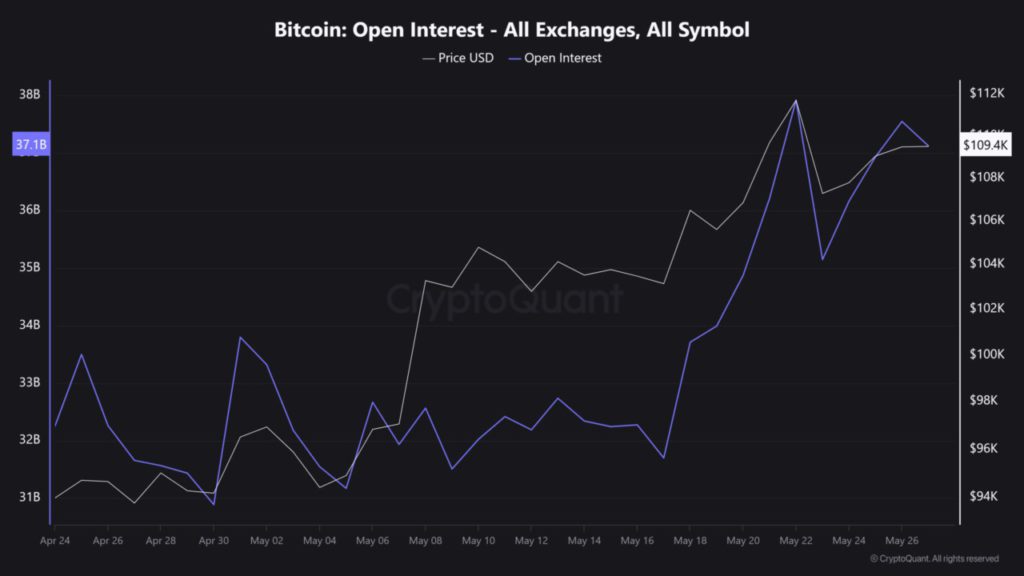

Adding to the bullish narrative, Open Interest across exchanges also showed a significant increase. According to data from CryptoQuant, Open Interest increased from around $31 billion at the end of April to over $37 billion on May 26. This increase shows that capital flows are not only passive but also actively supporting market direction bets.

The increase in Bitcoin (BTC) price along with the Open Interest shows that investors are not just waiting on the sidelines but are also active in taking positions that could push price volatility upwards. This could be an early indication of the potential for higher prices in the near future.

Technical Momentum Approaches Overbought Zone

Bitcoin (BTC) is trading around $109,616 at press time, consolidating after a sharp upward move. The daily RSI (Relative Strength Index) indicator stands at 67.48, which is just below the overbought threshold of 70. This indicates strong bullish momentum without significant signs of market exhaustion.

Bitcoin’s (BTC) price movement is showing a healthy pattern with the formation of higher highs and higher lows, and the last candle showed a tight range-a pattern that may indicate trend continuation. If ETF inflows continue, this technical structure could provide a boost for BTC to try to break a new record above $112,000 in the short term.

Conclusion

With all these indicators, the Bitcoin (BTC) market seems to be gearing up for the next bullish phase. Investors and traders are advised to keep an eye on these indicators as they could provide early signals for significant price movements in the future.

Also Read: BNB Nearing $700 Again – Time to Buy or Wait?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin ETFs just bought 7,869 BTC, bullish momentum incoming. Accessed on May 28, 2025

- Featured Image: Generated by AI