Quant (QNT) Reached a 3-Month Peak, But There Are Bearish Signals to Watch Out For!

Jakarta, Pintu News – Quant recently recorded a significant gain of 10.65% to reach a three-month high. Despite this, market sentiment is still not fully bullish. In the past 24 hours, Quant (QNT) managed to bounce off a local low of $93 and reached $108, before dropping slightly to $106 at press time.

Spot and Futures Market Analysis

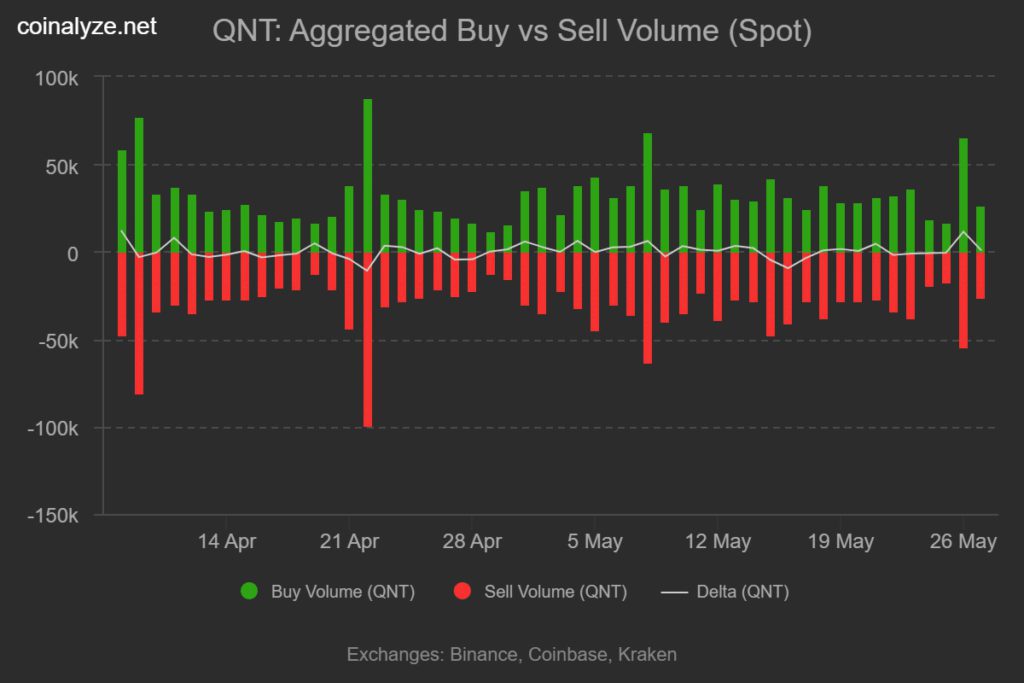

Quant trading volume (QNT) jumped dramatically by 606%, totaling $71 million. Specifically on the spot market, there was a 346.9% increase in volume to $40.2 million, indicating increased activity from both buyers and sellers. Buyers raised 27,000 QNT tokens, while sellers offloaded 26,000 QNT tokens, signaling high market engagement.

On the other hand, activity in the Futures market also saw a significant spike. Open Interest for Quant (QNT) rose 41% to $22 million, according to data from CoinGlass. This increase shows that investors are actively taking strategic positions, both long and short. However, most investors seem to be opting for short positions, given that the Funding Rate (FR) of Quant (QNT) fell sharply into negative territory.

Also Read: Whale’s Big Sale of SAND, Will Prices Plummet as Early as June 2025?

Bearish Signal amid Rising Prices

Despite the increase in price and volume, bearish sentiment was evident among futures traders. The Funding Rate hitting a monthly low showed strong bearish sentiment among futures traders. In addition, selling volume in the futures market was still higher than buying volume, with 6,000 sell orders compared to 3,000 buy orders, indicating that futures market participants were not very optimistic despite rising prices.

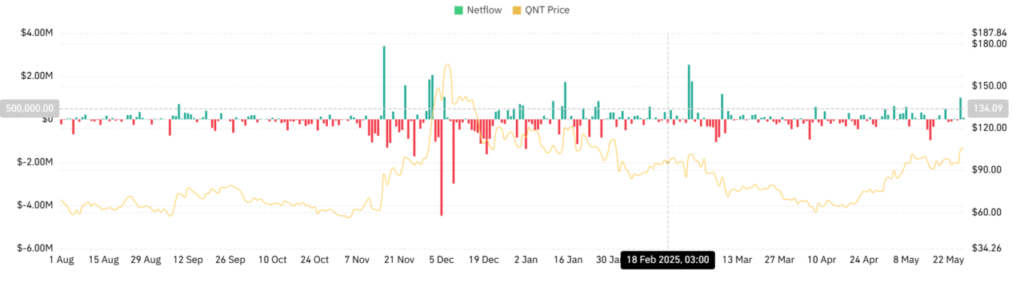

In the spot market, a similar trend was seen with inflows into the exchange outpacing outflows. Despite the price increase, sellers have offloaded $1.1 million worth of Quant, signaling significant profit-taking by investors who had previously incurred losses since February. This price increase, along with bearish sentiment, raises questions about the future direction of Quant (QNT).

Quant Price Outlook and Predictions

According to AMBCrypto’s analysis, Quant (QNT) is experiencing strong upward momentum, but market sentiment has not yet turned bullish. The MACD and RSI indicators showed bullish crossovers confirming the strong upward momentum. The RSI crossover indicates increased buyer pressure, with buyers controlling the market, while the MACD crossover corroborates this demand, signaling that the uptrend is likely to continue.

If speculators continue to buy, Quant (QNT) could rally up to $113. However, truly convinced buyers have yet to step in, and the overall market sentiment is still cautious. Meanwhile, increased selling activity on exchanges suggests that holders are taking profits. If this trend continues, the uptrend may be short-lived, and QNT could return to $98.

Conclusion

The significant rise in Quant (QNT) prices has not been followed by a bullish change in market sentiment. Although there are technical indications depicting further upside potential, bearish factors such as the dominance of short positions in the futures market and profit-taking in the spot market may limit further upside potential. Investors are advised to monitor market indicators closely before making investment decisions.

Also Read: BNB Nearing $700 Again – Time to Buy or Wait?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Quant (QNT) hits 3-month high but traders watch out for this bearish sign. Accessed on May 28, 2025

- Featured Image: Capital.com