Is Bitcoin Headed for a $200,000 Explosion? 5 Shocking Reasons Experts Say YES!

Jakarta, Pintu News – Bitcoin recently hit an all-time record high. However, based on several on-chain indicators, this is not yet the peak of the current bull cycle.

Referring to the four on-chain indicators provided by Lookonchain, BTC is expected to hit the $200,000 mark in this cycle.

$200,000 Could Be BTC’s Peak of the Season

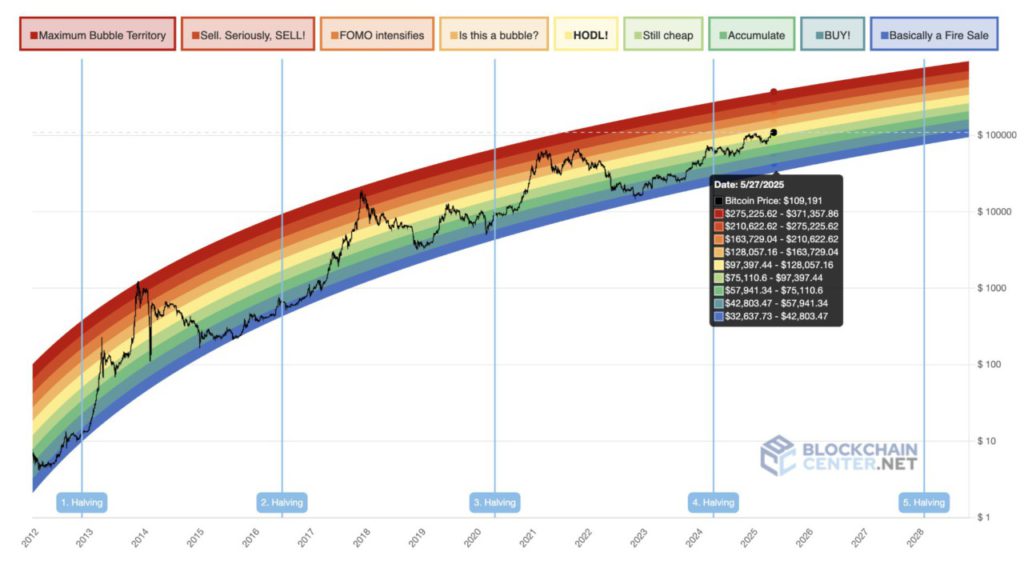

First, the $200,000 target was estimated using the 2023 version of the Rainbow Chart. This long-term valuation tool uses a logarithmic growth curve to predict the future price direction of BTC.

Read also: 3 Altcoins that Whales Bought Before the Crypto Bull Run!

If this prediction is accurate, then Bitcoin is only halfway through this cycle.

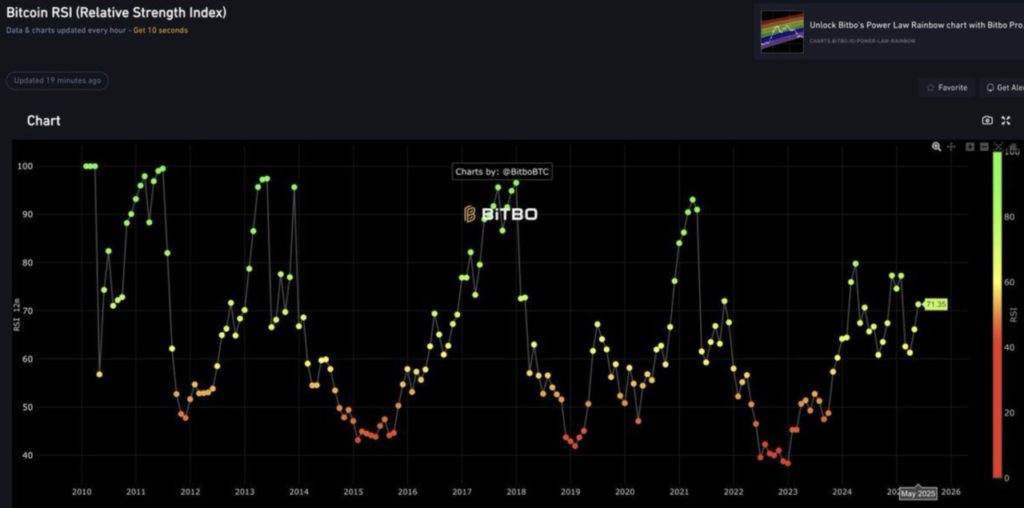

Secondly, Bitcoin’s Relative Strength Index (RSI) stands at 71.35. BTC is considered to be in an overbought state if this indicator is above 70, which means the price is likely to drop in the near future.

Conversely, if it is below 30, BTC is considered oversold and has the potential to rise.

Bitcoin is in a Slightly Overought Zone

With current levels, Bitcoin is in the “slightly overbought” zone but still has room to grow when compared to previous peaks. BTC usually peaks when the RSI crosses the 90 threshold.

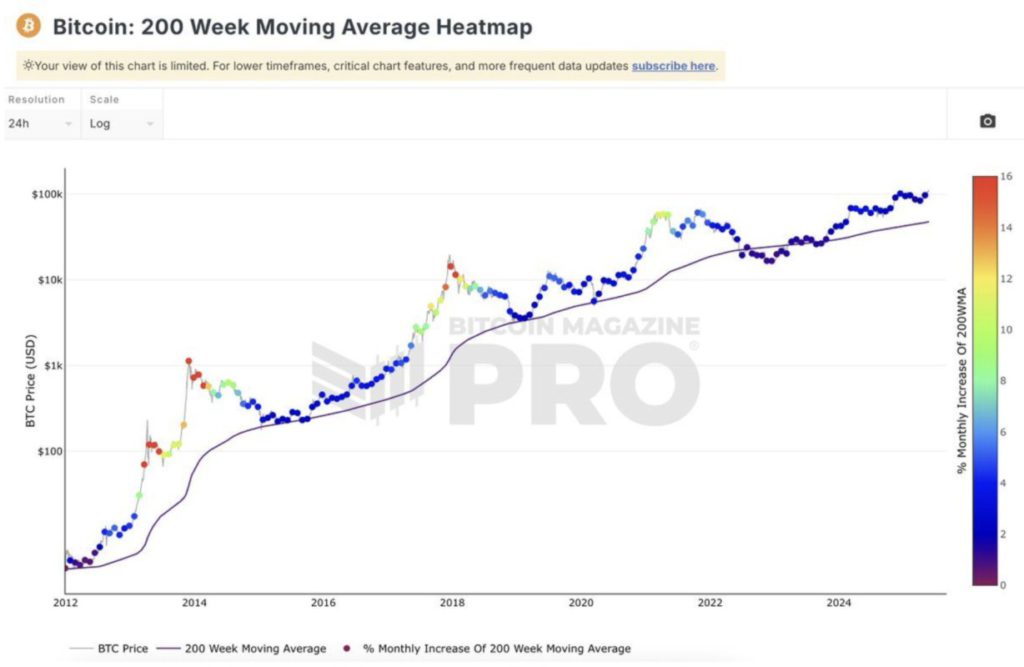

Third, the Heatmap of the 200-week Moving Average (MA) shows a blue zone. This indicates that the price has not yet peaked, making it a good moment to hold or buy BTC.

Finally, the 2-Year MA Multiplier indicator shows that the price is currently between the red and green lines. Since the price has not touched the red line, it shows that the market has not yet peaked.

Bitcoin Still Has Growth Potential

In addition to the previously mentioned technical indicators, some other on-chain data also supports the view that Bitcoin still has room to grow.

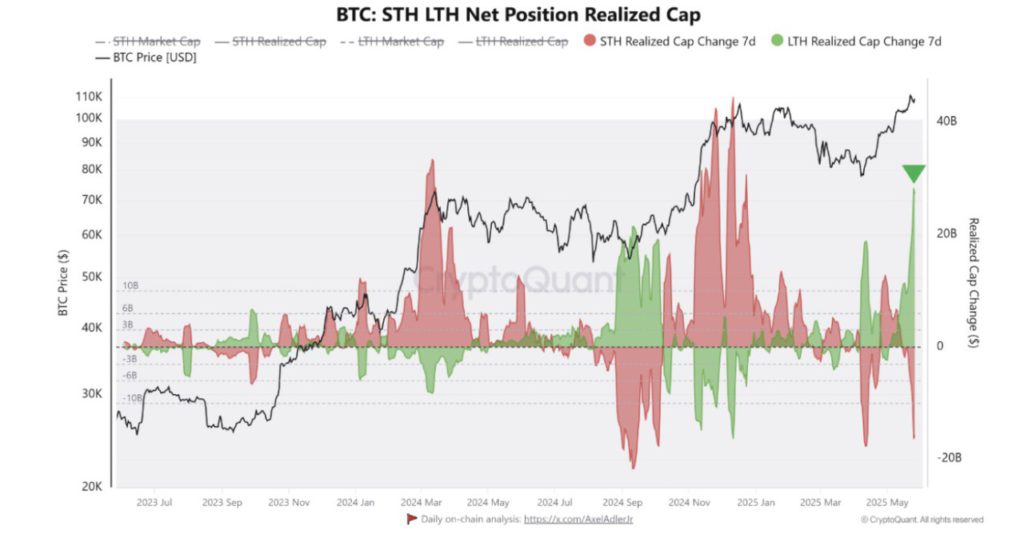

According to CryptoQuant, retail investors are still not heavily involved, with Bitcoin trading volumes currently lower than the average for the past year. This suggests that the market has not yet entered the “FOMO” (Fear of Missing Out) phase – a condition that usually occurs when prices are near their peak.

Additionally, an on-chain analyst from CryptoQuant noted that when the price of BTC briefly dropped below $111,000 and $109,000, short-term holders using high leverage experienced liquidation.

Read also: Asian food company DDC Enterprise buys 21 Bitcoin (BTC), its shares plummet!

On the other hand, long-term holders (LTHs) capitalized on the price drop to increase their holdings.

This pushed the realized capitalization of long-term holders to surpass $28 billion – a level last reached in April. This realized capitalization measures the value of each Bitcoin based on the last time it changed hands, rather than the current market price.

“Long-term investors are taking advantage of this period of forced selling to increase exposure and accumulate more Bitcoin for the long term. This strategy of accumulating while the market is under pressure reflects the strong conviction of long-term holders (LTH),” said an analyst from CryptoQuant.

Based on technical analysis and market data, Bitcoin has not yet peaked in the current cycle. Nevertheless, investors are still advised to be cautious of short-term fluctuations and macroeconomic factors that may affect the market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 5 Reasons Why Bitcoin Could Hit $200,000 This Cycle. Accessed on May 28, 2025