Ethereum (ETH) Stands at $2.8K: Reasons Why Investors Shouldn’t Panic

Jakarta, Pintu News – Ethereum has recently experienced a price drop to $2.8K, but recent analysis suggests that this is not the time to panic. Despite signs of selling from large wallets, other factors suggest that the market is still dominated by buyers, signaling a potential price recovery.

Causes of Ethereum (ETH) Price Decline

The recent drop in Ethereum (ETH) price was triggered by several factors. One of them was a large deposit by one of the Ethereum (ETH) whale wallets to the Kraken exchange, indicating a potential massive sell-off. However, this does not necessarily signify that the market is bearish.

Analysis from AMBCrypto shows that the sales volume did not increase significantly, which means that many investors are still holding their assets. In addition, the low trading volume during the price recovery from $1.7K to $2.8K indicates that not many investors are taking profits. This shows confidence in the long-term value of Ethereum (ETH), despite short-term price fluctuations.

Also Read: Whale’s Big Sale of SAND, Will Prices Plummet as Early as June 2025?

Technical Analysis and Market Sentiment

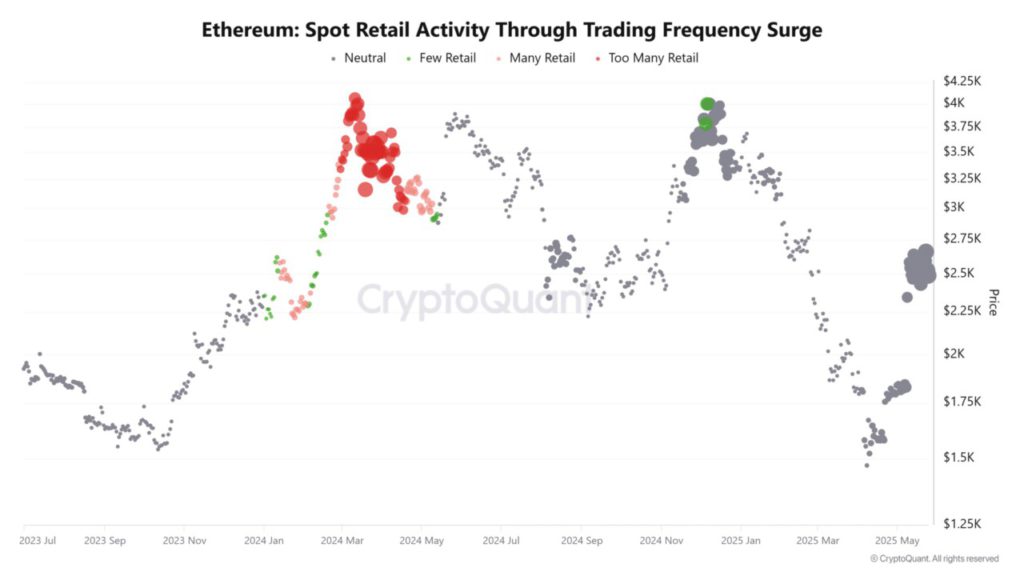

According to Burrak Kesmeci, analyst at CryptoQuant Insights, increased trading activity often accompanies local price peaks. However, in the recent case of Ethereum (ETH), increased trading activity was not seen, which suggests that the market has not yet entered the euphoric phase.

This could be an indicator that Ethereum (ETH) is still in the early phase of a bullish trend. In May, the spot taker CVD metric, which measures the cumulative difference between buy and sell volumes in the market, showed buyer dominance. This confirms that despite declining trading volumes, buyers still control the market, which could minimize the impact of a deep price drop.

Ethereum (ETH) Long-term Outlook

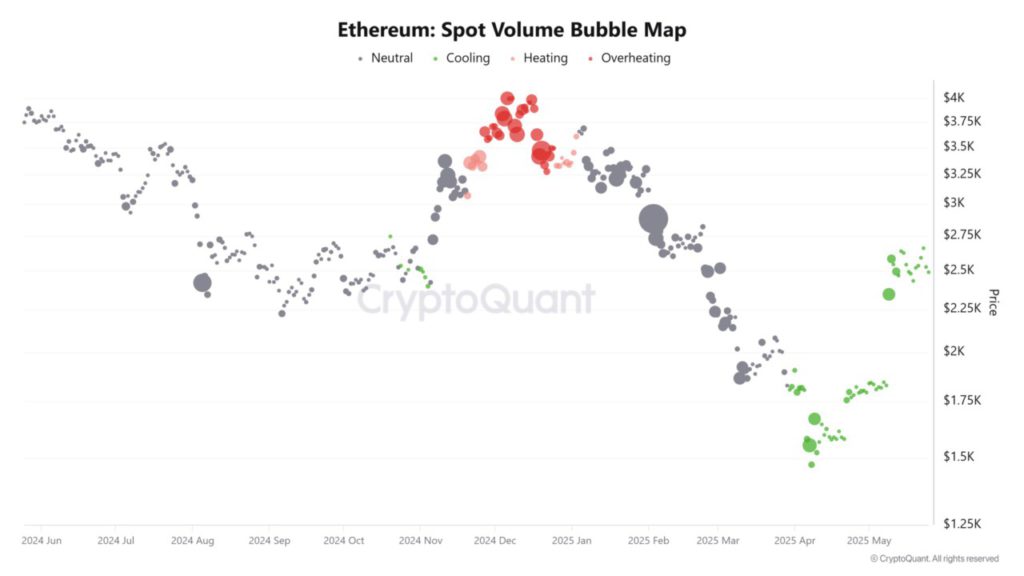

Despite short-term concerns, long-term indicators still show a positive outlook for Ethereum (ETH). Spot volume analysis shows that there was no meaningful spike in trading volume, which often precedes large price drops. This suggests that the market may not be overheated, and the current price drop is more of a normal correction than the start of a bear market.

In addition, the dominant presence of buyers over the past few months suggests that there is strong support at the current price. Investors and traders are advised to monitor these indicators and not rush into making selling decisions that may be premature.

Conclusion

Although Ethereum (ETH) is experiencing some selling pressure, in-depth analysis shows that this is not the time to panic. With strong buyer dominance and lack of market euphoric activity, Ethereum (ETH) still has the potential for further recovery and growth. Investors are advised to remain calm and conduct further research before making any investment decisions.

Also Read: BNB Nearing $700 Again – Time to Buy or Wait?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum’s $2.8k pullback: Here’s why you shouldn’t panic just yet. Accessed on May 28, 2025

- Featured Image: Bitcoinist