Is SAND Price at Risk After Hashed Sent 36.9 Million to Binance?

Jakarta, Pintu News – The cryptocurrency market is abuzz again with news of a massive transfer by Hashed that has deposited more than 36.9 million Sandbox worth $12.13 million to Binance in the last 15 days.

The last transaction of 18.45 million SAND for $5.79 million took place just an hour before this news was written. This kind of activity often leads to speculation about possible heavy selling in the market, which could affect the price stability of SAND.

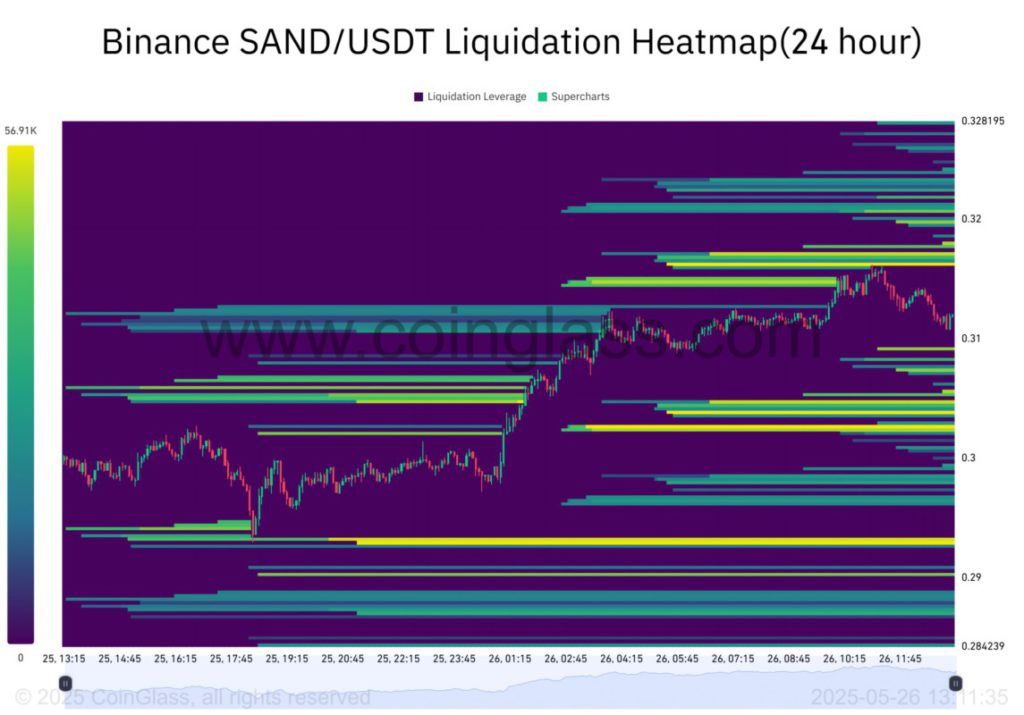

SAND Technical Analysis: Critical Support Zone

Sandbox (SAND) has bounced several times from the $0.29 to $0.30 demand zone, which is a key support area on the price chart. Despite the multiple bounces from this zone, SAND continues to register lower peaks, indicating a decrease in bullish momentum.

Recently, the price approached this zone again and was only able to bounce to the $0.312 level, showing buyers’ hesitation and increasing vulnerability. If this support level is broken, it could be that sellers will take over and push SAND prices to a new low this month. The current price structure seems fragile, especially with the increased deposits by whales.

Also Read: Whale’s Big Sale of SAND, Will Prices Plummet as Early as June 2025?

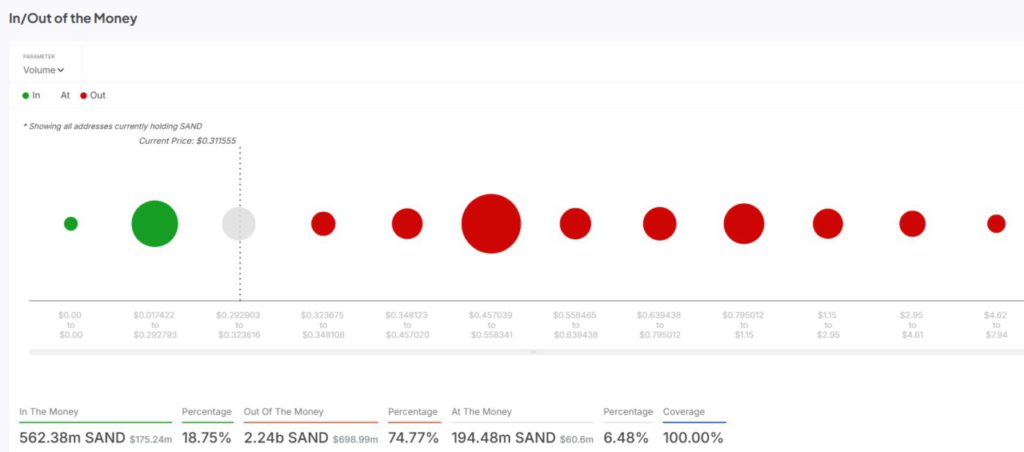

Resistance from Loss-making SAND Holders

Data from IntoTheBlock shows that approximately 74.77% of SAND holders are in a loss position, with the purchase price above the current market price of $0.311. This means that around 2.24 billion SAND have unrealized losses. Only 18.75% of addresses appear profitable at this point.

These conditions create a large potential selling pressure above the current price, as holders may try to exit their positions close to breakeven. Any price increase risks being rejected due to profit-taking by trapped participants. This supply overhang may limit bullish momentum, unless new demand appears on the charts.

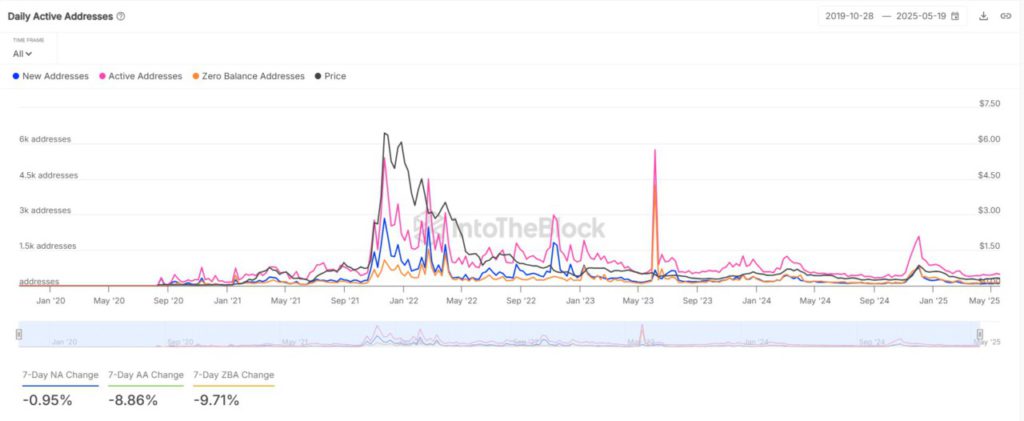

Decline in User Activity: A Warning Sign for Price Recovery?

Daily active address metrics showed a decline, with active users dropping by 8.86% and new addresses decreasing by 0.95% in the last week. This decline in participation could signal reduced network demand and weak market interest in SAND. Historically, increased user activity has supported price growth. However, current data suggests a slowdown in speculation and utility, making the bullish recovery less sustainable.

Conclusion

With consistent inflows from whales, declining network activity, and most holders suffering losses, the pressure on SAND is currently considerable. Although the $0.29-$0.30 support zone is still holding for now, the bearish signals suggest that a decline is more likely than an increase.

Also Read: BNB Nearing $700 Again – Time to Buy or Wait?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Hashed sends $36.9M SAND to Binance, is the altcoin’s price at risk?. Accessed on May 28, 2025

- Featured Image: Sandbox