Ethereum Tanks 4% Today — Is a Shocking Rebound to $3,000 Coming Next?

Jakarta, Pintu News – Ethereum performed better than Bitcoin , with a daily gain of 6.6% while BTC fell 2% on May 29, 2025.

There was a bullish crossover between the major EMA indicators, coupled with the accumulation of 190,000 ETH by whale investors, suggesting that $3,000 could be the next target.

Then, how is Ethereum’s current price movement?

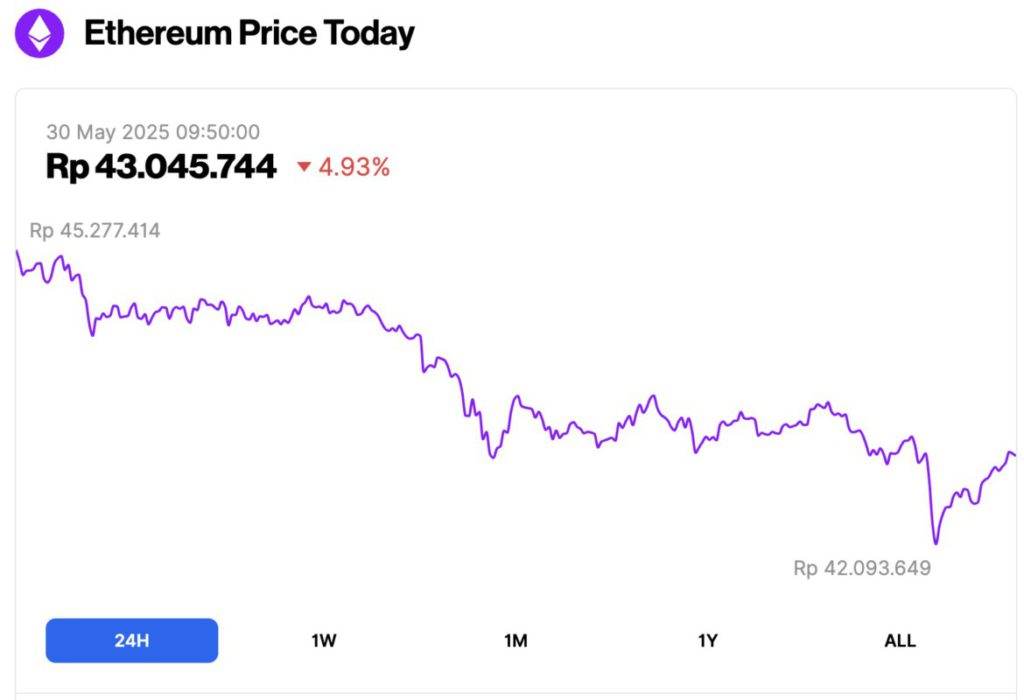

Ethereum Price Drops 4.93% in 24 Hours

As of May 30, 2025, Ethereum (ETH) was trading at approximately $2,630, or around IDR 43,045,744, marking a 4.93% drop over the past 24 hours. Within this time frame, ETH reached a high of IDR 45,277,414 and dipped to a low of IDR 42,093,649.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $317.35 billion, with daily trading volume rising 6% to $24.13 billion in the last 24 hours.

Read also: Bitcoin Crashes to $106K — But Smart Investors Are Buying the Dip Like Crazy! (May 30)

EMA Crossover Signal Indicates Ethereum’s Potential Rise to $3,000

Ethereum’s daily chart shows a bullish crossover between the 20-day and 200-day Exponential Moving Average (EMA). This is the first time this crossover has occurred since November 2024.

These technical developments indicate that the recent uptrend is getting stronger and opens up opportunities for ETH to test the $3,000 level again. In addition, the 50-day EMA has also converged with the 100-day EMA, forming a strong floor of support.

In November 2024, a similar crossover pushed Ethereum’s price up from $3,100 to $4,000 in just under four weeks – a jump of 28%. If this pattern repeats, ETH could potentially reach $3,400 by June 2025.

The RSI (Relative Strength Index) indicator also supports this bullish projection, as its value rose to 71 signaling strong buying pressure. With increased buying pressure, ETH is expected to reach the 123.6% Fibonacci level of $3,060 before continuing its rise to $3,400.

However, if this bullish scenario does not materialize, the 78.6% Fibonacci level at $2,440 will be an important support area. This drop could happen if the buyers start getting exhausted, although the RSI line is still pointing upwards.

In addition to positive technical factors, the rotation of capital from Solana to Ethereum also strengthened this sentiment.

Ethereum now ranks first in terms of netflow and stablecoin supply, signaling that investors are starting to turn their attention to ETH with optimism that the price will break above $3,000.

Read also: Top 3 Potential Crypto RWAs Worth Keeping an Eye on June 2025!

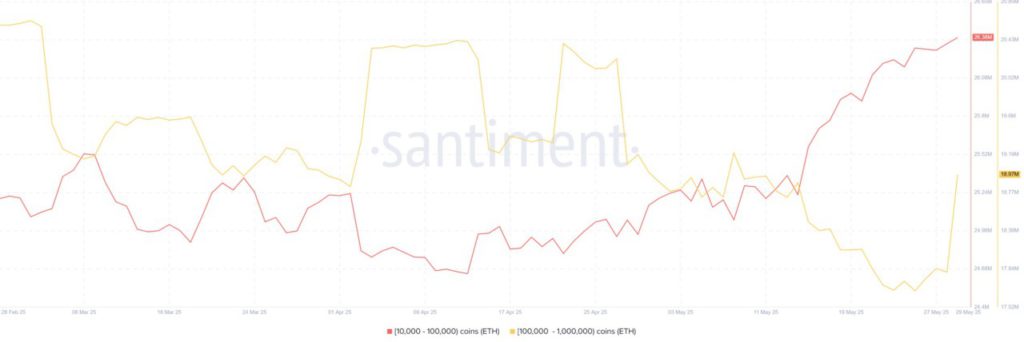

Whale Raises 190,000 Tokens as Ethereum Momentum Strengthens

Ethereum whales seem to be the main driver of the increased buying pressure, as reflected by the rise in the RSI indicator.

According to data from Santiment, between May 24 and 29, Ethereum wallets holding between 10,000 and 100,000 ETH increased their holdings by more than 190,000 tokens. At the current Ethereum price, this amount is worth around $513 million.

Another group that has also been aggressively accumulating are holders with balances between 100,000 and 1 million ETH. As of May 29, 2026, these wallets recorded 18.97 million ETH, up from 17.7 million ETH on May 25. This means they bought around 1.27 million tokens in just four days.

Whales are known for their strategy of buying at low prices and selling at high prices. The fact that this group is actively accumulating ETH shows their belief that the current price rally will continue.

Along with the strengthening momentum of the Ethereum price after the bullish crossover, ETH is predicted to break the $3,000 level soon.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Eyes $3,000 as Whales Accumulate 190,000 ETH. Accessed on May 30, 2025