Will Toncoin (TON) Reach $4 in June 2025? Check out the Latest Analysis!

Jakarta, Pintu News – In the past week, Toncoin recorded a gain of 7.2%, despite experiencing sharp price fluctuations due to confusion surrounding Grok AI’s potential integration with Telegram.

Initial excitement followed an announcement by Pavel Durov of a one-year deal, but Elon Musk quickly denied any formal agreement, triggering a rapid price drop. Durov later explained that the deal was only “in principle,” adding to the uncertainty in the market.

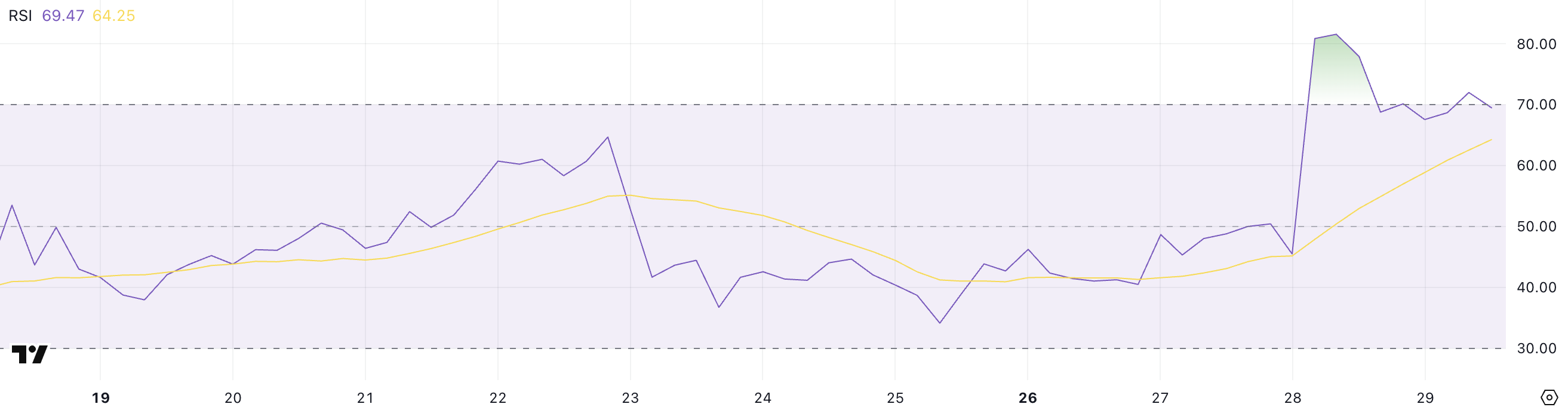

Toncoin RSI Indicator Indicates Possible Reversal

Toncoin (TON) volatility increased sharply after mixed signals about the Telegram-xAI partnership. Pavel Durov, the founder of Telegram, announced the integration of Grok AI for one year which made TON jump more than 20%. However, the rise did not last long.

Elon Musk denied any formal deal saying, “No deal has been signed,” which sent TON down within 30 minutes. Durov later clarified that the deal was only approved “in principle.” Toncoin’s Relative Strength Index (RSI) currently stands at 69.47, down from yesterday’s intraday peak of 81.55.

RSI is a momentum oscillator that ranges from 0 to 100 and helps identify overbought or oversold conditions-values above 70 usually indicate overbought conditions, while values below 30 indicate oversold conditions. The surge in TON from 45.47 to above 80 in a day indicates extreme buying pressure after the initial announcement.

Also Read: 3 Latest Airdrop Tokens to Follow in Early June 2025!

Toncoin Momentum Weakens Despite Bullish Setup

Toncoin is trading above the Ichimoku Cloud, indicating short-term bullish momentum. Price is between the blue Tenkan-sen (conversion line) and green Chikou Span (trailing span) lines, indicating short-term bullish momentum. Tenkan-sen is slightly above the red Kijun-sen (base line), which supports a continued upward bias.

However, the distance between the two is narrowing, suggesting that the trend is weakening and could reverse if buyers don’t step in soon. The clouds ahead (Kumo) are thin and bullish. Senkou Span A (green leading span) is above Senkou Span B (red leading span).

However, the flat nature of the future clouds and the low height relative to the most recent candles suggest that momentum could stall unless another catalyst appears. The Chikou Span is still above the price action from 26 periods ago, confirming the current bullish stance, but if it drops below it, a trend reversal warning will appear.

Toncoin Forms Golden Cross-Will Bulls Push Toward $4?

Recently, Toncoin formed a golden cross-a bullish technical pattern that occurs when the short-term moving average crosses above the long-term moving average-signaling the potential start of a sustained uptrend. These crossovers often attract momentum traders and are generally seen as confirmation of mounting upside pressure.

If this bullish setup holds, TON could continue to rise and eventually test resistance around the $3.59 level, a zone that could act as a breakout trigger if accompanied by strong volume. However, if the bullish momentum fades and the trend reverses, TON might retest support at $3.22. A break below this level could lead to a deeper correction, with the next key support located near $2.91.

Conclusion

Despite market uncertainty and price volatility, Toncoin (TON) is showing some promising technical signals. With the golden cross and position above the Ichimoku Cloud, the opportunity to continue the bullish trend is still wide open. However, investors should remain wary of potential reversals signaled by the RSI and Ichimoku indicators.

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. TONCOIN (TON) June Short Term Outlook. Accessed on May 30, 2025

- Featured Image: Bitcoinist