Bitcoin (BTC) hits a new record, will the uptrend continue in June 2025?

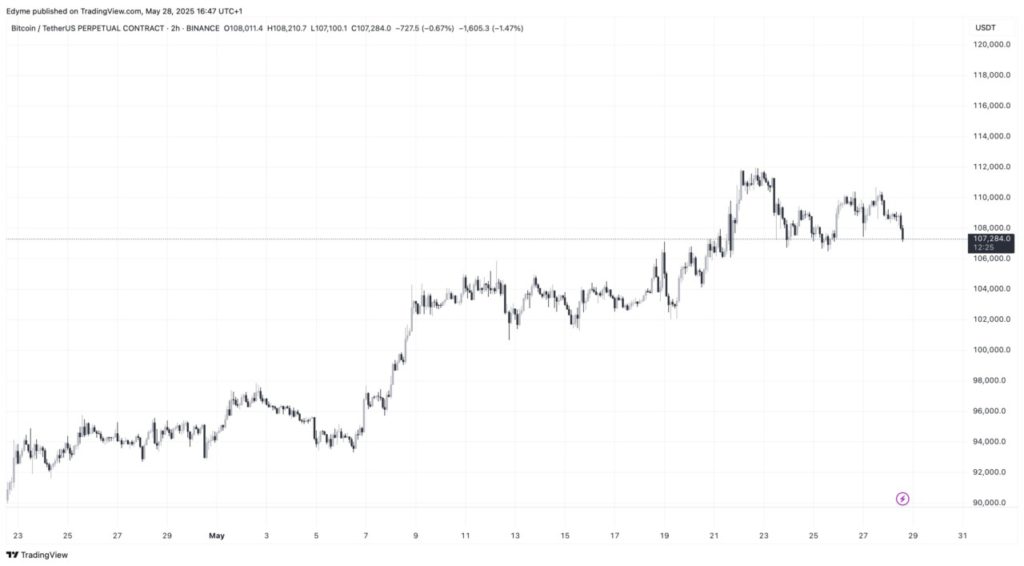

Jakarta, Pintu News – Bitcoin is now trading at $109,000, a decline of 0.6% in the last 24 hours. Despite the short-term decline, the broader market trend remains strong, with Bitcoin (BTC) recording a gain of around 15% over the last month. This performance comes after Bitcoin (BTC) reached a new record high above $111,000 a few days ago, continuing its strong momentum during the second quarter of 2025.

MVRV Ratio Shows Important Signals

Burak Kesmeci, a contributor on CryptoQuant’s QuickTake platform, recently discussed the Market Value to Realized Value (MVRV) ratio in his latest analysis. The MVRV ratio compares the market value of Bitcoin (BTC) to its realized value, effectively measuring holder profitability and offering insight into market sentiment as well as potential turning points.

Currently, the MVRV ratio stands at 2.36, well above the 365-day simple moving average (SMA365) level which stands at 2.14. However, the analyst pointed out that there is significant resistance approaching at 2.93, a critical level where the previous rally hit a roadblock. The upcoming test of this resistance could indicate whether Bitcoin (BTC) will continue its upward trajectory or undergo stabilization or correction.

Also Read: 3 Latest Airdrop Tokens to Follow in Early June 2025!

Retail Investors Are Still Cautious

Another factor shaping the state of the Bitcoin (BTC) market is the conspicuous lack of retail investor engagement. Although Bitcoin (BTC) hit a new record in the second quarter of 2025, retail investor participation, as measured by the volume of small-denomination transfers (under $10,000), has remained relatively quiet.

While Bitcoin’s (BTC) price trajectory remains strong, retail volumes have only seen a minimal increase, suggesting that the current rally is primarily driven by institutional or large-scale investors. Retail investor participation has historically been an important driver for sustained bull markets, amplifying price movements initially fueled by institutional investment.

Effect of Increase in Retail Investment

Kesmeci noted that major rallies in the past, such as those observed in 2020-2021, gained significant momentum when retail investors started to actively engage. Therefore, a critical aspect to monitor going forward is retail activity. Increased retail investment could potentially trigger further Bitcoin (BTC) appreciation, solidifying recent gains and setting the stage for a broader market rally. Monitoring this activity will be key to predicting the future direction of the Bitcoin (BTC) market.

Conclusion

With Bitcoin (BTC) continuing to set new records and the MVRV ratio showing potential resistance, the market may be on the verge of an important phase. In-depth analysis and understanding of retail investor dynamics will be crucial in determining the next direction of Bitcoin (BTC) price.

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Up 15% in a Month, Analyst Cautions on MVRV Resistance Level. Accessed on May 30, 2025

- Featured Image: Generated by AI