Why hasn’t SUI Price Surged Despite the $14.8 Billion DEX Record?

Jakarta, Pintu News – Despite SUI recording a record-breaking daily trading volume on the decentralized exchange (DEX) at $14.8 billion, the token’s price is still stuck below the critical resistance zone.

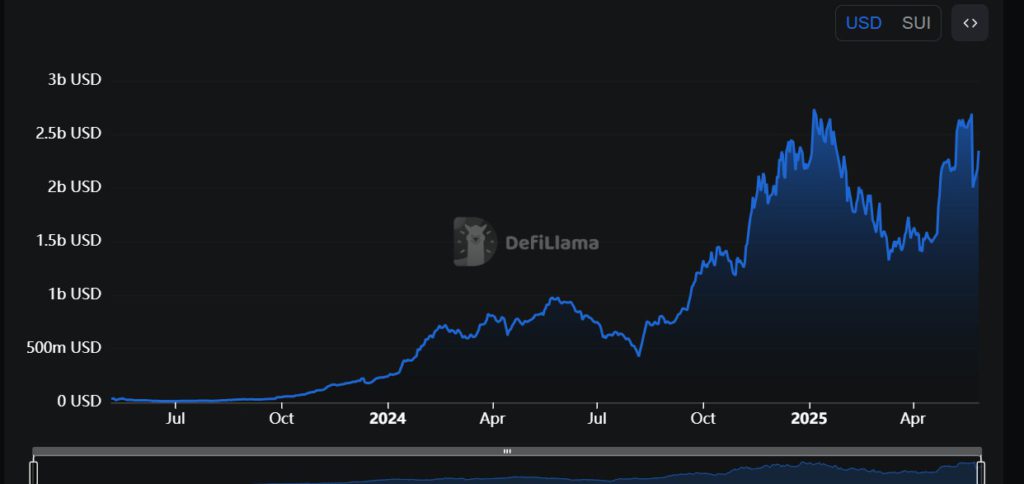

Activity in SUI’s decentralized finance sector has shown an increase, but this has not been enough to push the price past the existing resistance. The big question is, will the increase in on-chain activity and Total Value Locked (TVL) of $2.346 billion be a catalyst for further price increases?

Strong Price Resistance at $3.87

Currently, SUI is under immense pressure at the Fibonacci resistance zone between $3.87 and $4.13. Despite a price increase of 3.98% to $3.69, the token has still not been able to break the upper limit that has long been a barrier. This zone has proven to be a critical area that determines the future direction of SUI’s price trend.

At this point, many market participants are closely monitoring whether SUI can maintain its momentum or will experience a drop back to lower support levels. Failure to break this resistance zone could trigger a larger sell-off, given the large number of short positions accumulated around this price.

Also Read: 3 Latest Airdrop Tokens to Follow in Early June 2025!

TVL and Increased On-Chain Activity

SUI’s TVL of $2.346 billion shows significant growth, up 7.69% in the last 24 hours. This increase signifies that more crypto assets are locked in the DeFi SUI protocol, which could be a positive indicator for the growth of the ecosystem.

TVL growth is often considered one of the indicators of health and adoption in the DeFi ecosystem. However, while TVLs are showing strong growth, this has not been fully reflected in SUI prices. This may be due to broader market uncertainty or perhaps investors are waiting for more functional developments or integrations that could strengthen SUI use cases.

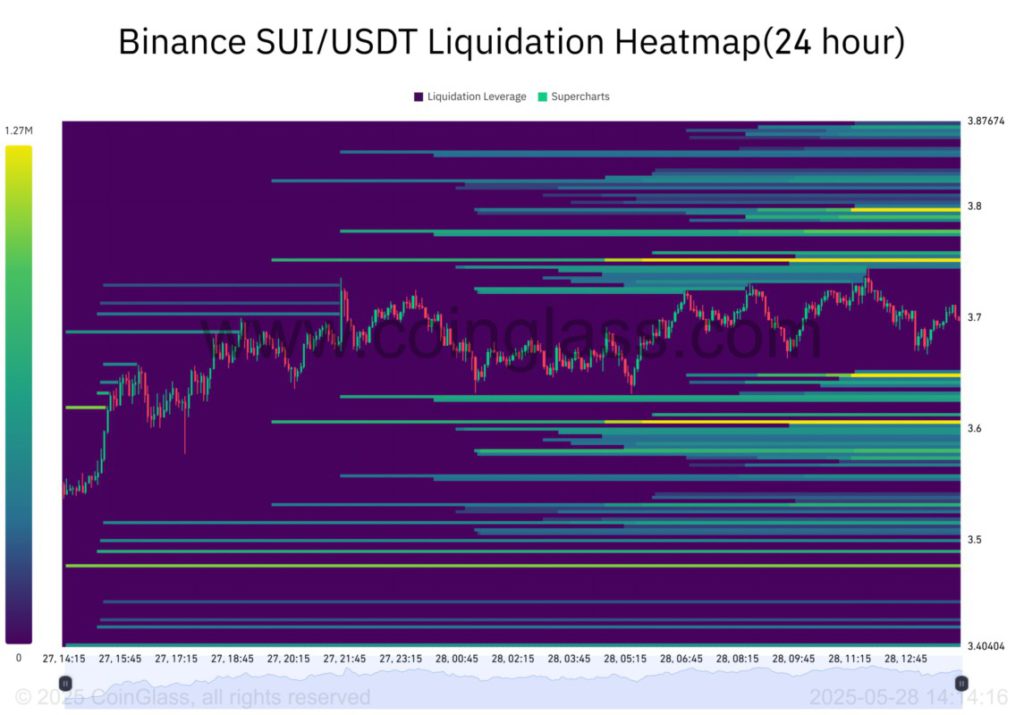

Liquidation Cluster and Breakout Potential

The Liquidation Heatmap data shows a dense liquidation risk zone between $3.6 and $3.87. This zone signifies where short positions are most vulnerable to liquidation, which could trigger rapid price movements if there is a sudden surge in buying. This situation adds complexity to the technical analysis and trading strategies that should be implemented.

If SUI can break the resistance at $3.87, there is potential for a rally higher, especially if supported by increased trading volume and positive sentiment in the market. However, keep in mind that this congested liquidation zone could also serve as a strong barrier, limiting the upside potential of the price in the short term.

Conclusion

Although SUI showed impressive growth in terms of trading volume and TVL, strong price resistance and dense liquidation clusters are challenges to overcome. Going forward, it is important for investors to monitor these indicators and broader market dynamics to make informed investment decisions.

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. SUI hits $14.8B DEX record yet price action is trailing, why?. Accessed on May 30, 2025

- Featured Image: Crypto Rank