3 Hot Altcoins Crypto Whales Are Secretly Loading Up On for Massive Gains in June 2025!

Jakarta, Pintu News – In the last week of May, the crypto market experienced a slowdown in trading activity as market participants took profits after the previous rally.

Despite the brief lull, a number of altcoins caught the attention of large investors – known as “whales” – who began accumulating holdings in the hope of a price increase in June.

Dogecoin (DOGE)

As a prominent meme coin, Dogecoin is among the assets being accumulated by crypto whales for potential gains in June. This trend is evident from the surge in DOGE accumulation by whale wallets holding between 1 million and 10 million tokens.

Read also: Dogecoin Dips (June 2) as Major DOGE Deal Sends Shockwaves Through the Market!

Based on data from Santiment, the DOGE whale group added 30 million tokens to their wallet in the past week.

This kind of buying activity by whales is often a strong signal to retail traders. When large investors confidently add to their holdings, it can encourage participation from retail investors, ultimately triggering DOGE prices to rise as buying pressure in the market increases.

If the buying pressure continues, the token has the potential to continue its rally and go up to $0.206. However, if the accumulation from the whales stops and selling pressure increases, the price of DOGE could drop to $0.175.

Avalanche (AVAX)

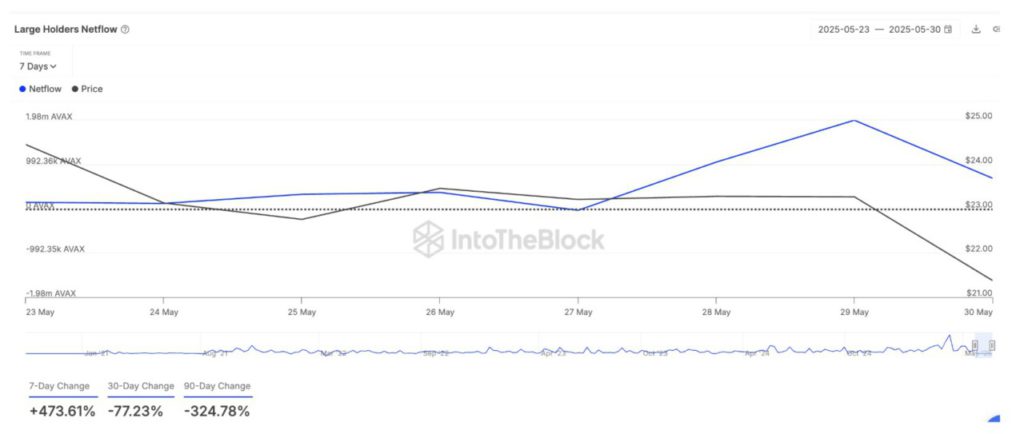

Avalanche’s Layer-1 (L1) coin is yet another asset that crypto whales are currently accumulating in pursuit of potential gains in June. This is reflected by the 474% surge in AVAX large holder netflows over the past seven days.

Large holders are address whales that own more than 0.1% of the total circulating supply of an asset. Their netflow shows the difference between the amount of coins they bought and the amount they sold in a given period.

When the netflow of large holders increases, it means that more tokens are going into the wallets of large investors than are going out. This trend indicates that AVAX whales are accumulating the asset, signaling confidence in its potential future value.

If the accumulation by whales continues, AVAX has a chance to recover and surge up to $24.28.

On the other hand, if the whales start taking profits and selling, the price of the altcoin could continue to drop to $14.66.

Read also: June 2025 Crypto Shock: 3 Altcoins Tipped to Outperform Bitcoin!

Quant (QNT)

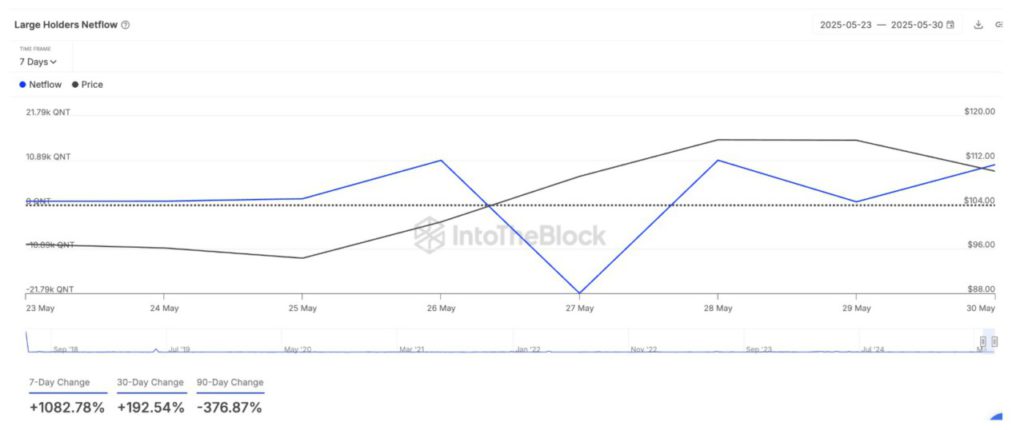

Quant managed to defy the general crypto market downtrend this week by recording a 7% gain.

This near 10% rally seems to be driven by revived investor interest following the launch of Overledger Fusion – a Layer 2.5 network designed to bridge institutions, enterprises, and the decentralized finance ecosystem.

The launch also prompted a surge in accumulation by whales, as seen by the 1083% increase in QNT large holder netflows over the past week.

This surge reflects growing confidence in QNT’s short-term performance and opens up opportunities for further rallies as exposure from large investors increases.

If this trend of buying by large traders continues, QNT prices could be pushed up to $115.20.

However, if the selloff resumes, QNT risks dropping below $101.87 and could even slump towards $93.52.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What Whales Are Buying For Potential Gains in June . Accessed on June 1, 2025