Bitcoin Predicted to Rise to $150,000 – Or Correction to $92,000?

Jakarta, Pintu News – After hitting a new all-time high of Rp1.8 billion ($111,814) on May 22, 2025, Bitcoin is losing momentum. Within a week, the crypto king corrected more than Rp147 million ($9,000) and is currently trading at around Rp1.68 billion ($103,000).

This correction has sparked a heated debate among crypto market participants: is this just a healthy consolidation phase or the beginning of a deeper decline?

Check out the full analysis here!

Bitcoin’s Technical Signals Are Getting Dangerous

According to Crypto Potato, BTC’s price movements in the last 24 hours have been quite wild, with fluctuations between Rp1.68 billion ($103,300) to Rp1.71 billion ($105,000). While it’s still up 9.1% in 30 days and 52.1% in a year, the rate of increase seems to be slowing down.

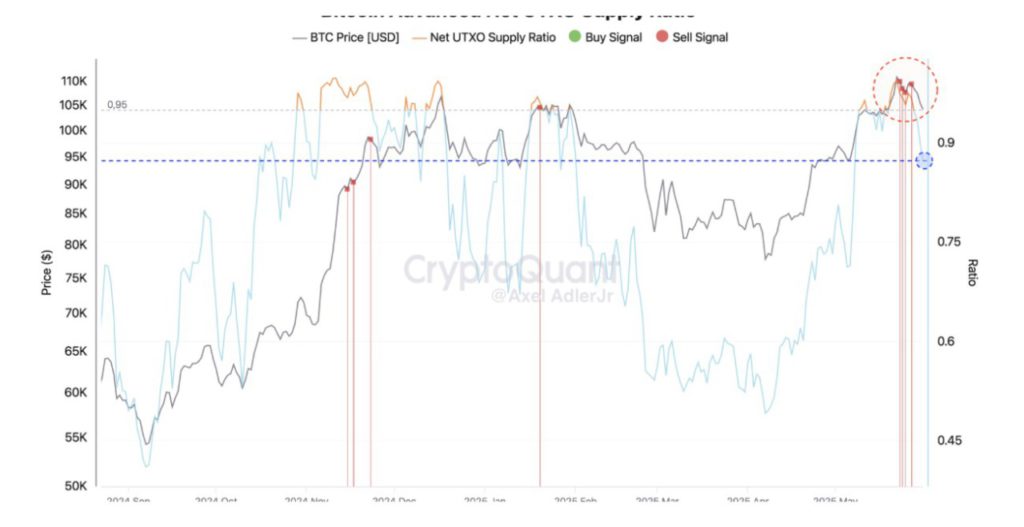

Analyst from CryptoQuant, Axel Adler Jr. warns that BTC has just triggered four consecutive sell signals based on the Net UTXO Supply Ratio indicator. According to him, this reflects an overheated market and is starting to enter the profit-taking phase by investors.

He also revealed two scenarios that might occur in the near future. First, Bitcoin could move flat in the range of Rp1.55 billion-Rp1.71 billion ($95,000-$105,000) for the next few weeks.

The second scenario is an intermediate correction that brings the price down to IDR1.5 billion ($92,000) in order to “reduce the current overbought pressure”. This is certainly a concern for short-term traders and institutional investors.

Also read: These 3 Crypto are Predicted to Make You Suddenly Rich in 2025!

Optimistic Prediction: BTC Could Hit Rp2.4 Billion This Year?

Despite the cold market, some analysts and market participants remain optimistic about the future of BTC. According to a report from the BetIdeas platform, there is an 80% chance of Bitcoin breaking Rp1.96 billion ($120,000) in 2025 and a 40% chance of reaching Rp2.45 billion ($150,000). BetIdeas spokesperson Steve McQuillan stated that Bitcoin’s bullish trend throughout May shows that the potential for a big surge is still wide open.

Not only that, they also noted that traders have placed a 22% chance for BTC to reach Rp3.27 billion ($200,000) before the end of 2025. According to them, volatility has always been a part of crypto, but the long-term trend is upward.

This sentiment reinforces the view that the current correction could be an accumulation opportunity, not a signal of panic. Some investors even consider this a “calm before the next bullish storm” phase.

Also read: Top 4 Most Sold NFTs in the Last 30 Days, CryptoPunks Dominate?

Key Zones and Analysts’ Technical Approach

Popular analyst Daan Crypto Trades mentioned that the zone between Rp1.58 billion and Rp1.61 billion ($97,000-$99,000) is an important point to watch. This zone reflects a strong support area based on the Fibonacci retracement indicator and the 200-day moving average.

If the price manages to stay in this zone, it is likely that Bitcoin will rebound in the near future. But if it breaks, BTC could experience a continued decline before bouncing back.

Meanwhile, veteran analyst Michaël van de Poppe sees the current situation as natural, calling this correction a form of “healthy consolidation”, part of the natural up-and-down pattern of the cryptocurrency market.

In his view, Bitcoin’s long-term trend is still very strong, and the current movement is better considered a transitional phase. This approach emphasizes the importance of looking at price movements on a macro level, rather than just short-term sentiment.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CryptoPotato. Bitcoin to $150K or Back to $92K? Traders Divided as Market Cools Off. Accessed June 2, 2025.

- Featured Image: Generated by AI