Chinese Yuan Breaks US Dollar Dominance in Global Transactions

Jakarta, Pintu News – The increased use of Chinese Yuan in cross-border transactions marks a serious step in the de-dollarization agenda. China’s central bank, the People’s Bank of China, has instructed banks to increase the proportion of transactions using Yuan from 25% to 40%. The move is part of China’s efforts to reduce dependence on the US dollar and strengthen the local currency’s position in global trade.

Policy Changes and Their Impact on the Bank

The Central Bank of China has set a minimum threshold of 40% for trade transactions using Chinese Yuan. This new policy, known as Macro Prudential Assessment, aims to strengthen the use of Yuan in cross-border trade. Banks that fail to meet these criteria will score lower in regulatory reviews.

A low score in the regulatory review may negatively impact the bank’s future business expansion. China is closing all loopholes that might hinder the strengthening of the Yuan. The initiative comes in response to tariffs imposed by the Trump administration, which disrupted the normal flow of import-export business and reduced the attractiveness of the US dollar.

Also Read: MicroStrategy Up 2,930%! Michael Saylor’s Crazy Strategy in Crypto Turns out to be Fruitful

International Reactions and Their Impact on Other Currencies

Trump’s announcement of tariffs and the 90-day temporary suspension have caused significant damage. Now, not only China, but also other countries such as the European Union and Japan, are trying to reduce their dependence on the US dollar.

They see this as an opportunity to promote their local currencies. The Chinese Yuan, Euro, and Japanese Yen are increasingly gaining momentum in global trade as alternatives to the US dollar. This move not only reflects a shift in economic power, but also shows countries’ desire to have more control over their own economies amid global uncertainty.

China’s Strategy to Dominate the Global Financial Sector

China has ambitions to internationalize the yuan and reduce the dominance of the US dollar in the global financial sector. The move is part of a broader strategy to increase China’s influence on the world stage. By strengthening the yuan, China hopes to draw more international transactions into its economic orbit.

The increased use of Yuan in cross-border trade is also an attempt by China to secure a more strategic position in the global economy. It shows China’s adaptation and response to changing global dynamics, as well as efforts to reduce dependence on the Western-dominated financial system.

Conclusion

With the increasing use of Yuan in global transactions, the future of international finance may see a significant shift in power dynamics. This move by China not only changes the global financial map, but also challenges the status quo that has long been dominated by the US dollar. Going forward, other currencies may also follow the Yuan’s lead, creating a more diversified and multilateral global financial landscape.

Also Read: Bitcoin in danger of weakening again? Bollinger Bands indicator gives this sign!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. De-dollarization: 40% of Foreign Transactions Now in the Chinese Yuan. Accessed on June 2, 2025

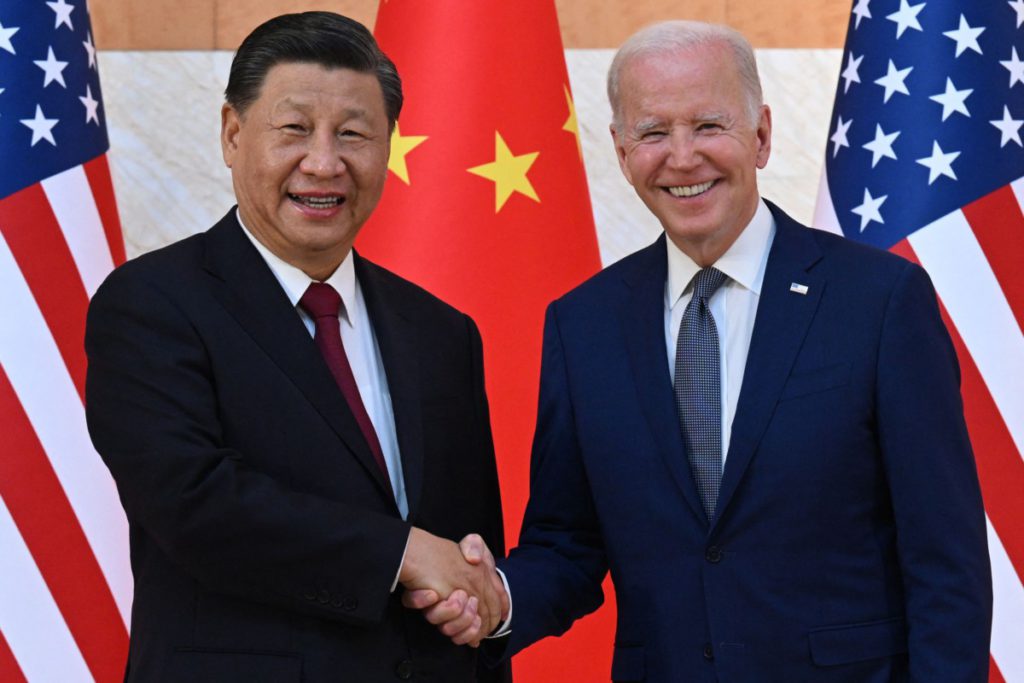

- Featured Image: Asiatimes.com