Ethereum Surges to $2,600 — Is a Massive Breakout to $3,000 Just Around the Corner?

Jakarta, Pintu News – Ethereum formed a bullish cup-and-handle pattern above the 200-day EMA – will ETH break above $3,000?

Ethereum is still moving in a consolidation phase within a price range, but remains above the 200-day EMA at $2,457. As this consolidation phase continues, the big question arises: Will Ethereum manage to break out of this pattern and start a longer rally?

If a breakout occurs, a price target above $3,000 becomes increasingly realistic.

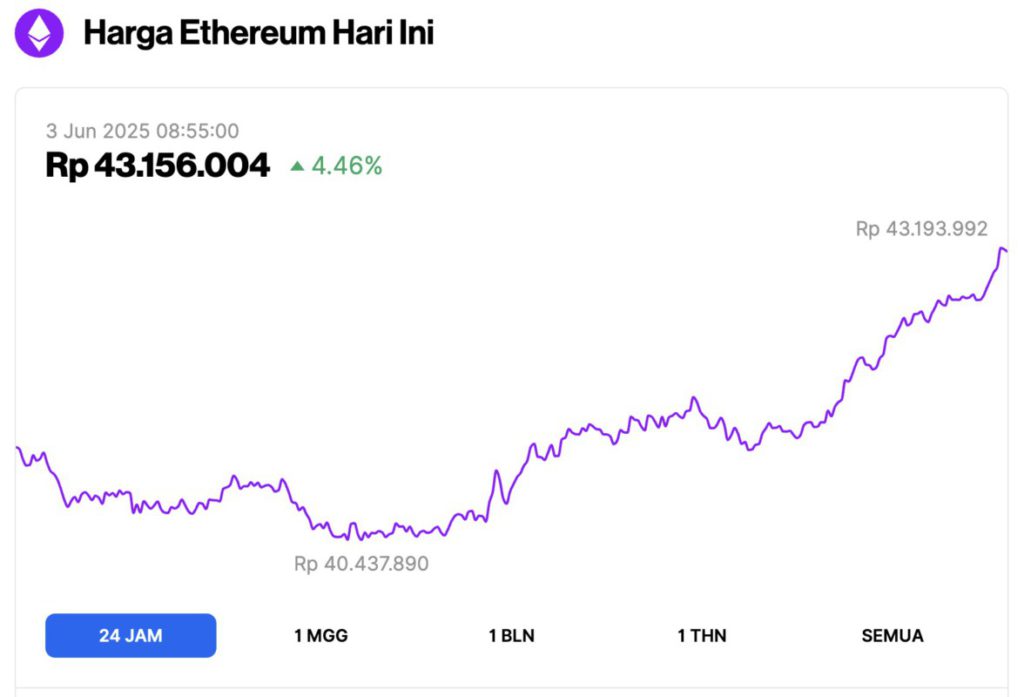

Ethereum Price Up 4.46% in 24 Hours

As of June 3, 2025, Ethereum was trading at approximately $2,646, or around IDR 43,156,004 — marking a 4.46% increase over the past 24 hours. During this time, ETH dipped to a low of IDR 40,437,890 and reached a high of IDR 43,193,992.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $319.02 billion, with daily trading volume rising 41% to $18.27 billion within the last 24 hours.

Read also: Top 3 Potential Altcoins of the Week

Forming a U Pattern, ETH Potentially Rise to $3,255?

On the daily chart (2/6/25), Ethereum shows a rounding bottom reversal pattern formed between February and May, with the neckline aligned with the 61.80% Fibonacci level at $2,712.

Reporting from Crypto Basic (2/6), Ethereum’s price movement is moving sideways slightly below the neckline, and is supported by the 200-day Exponential Moving Average (EMA) at $2,457.

This sideways movement and U-shaped reversal pattern completes the rounding bottom pattern on the daily chart.

Additionally, this pattern has produced a bullish crossover between the 50-day EMA and 100-day EMA lines, signaling a possible short-term trend reversal as well as increasing the chances of a breakout.

Currently, Ethereum is near the lower boundary of the pattern and also close to the 200-day EMA, while the Relative Strength Index (RSI) line continues to decline. This indicates weakening momentum and the appearance of a hidden bearish divergence, which could signal a potential price drop.

In this scenario, the immediate support level is at the 50% Fibonacci level at $2,386, and the next support is at the 38.20% level at $2,098.

However, if the overall market experiences a recovery, the possibility of a bullish breakout from this pattern is still open. If it does, the uptrend could lead to the 78.60% Fibonacci level of $3,255.

Read also: Predicted Pi Network Price at the End of 2025 – How Many Dollars?

Optimistically, if the breakout is confirmed, the price rally could continue until it hits the 100% Fibonacci level at $4,108.

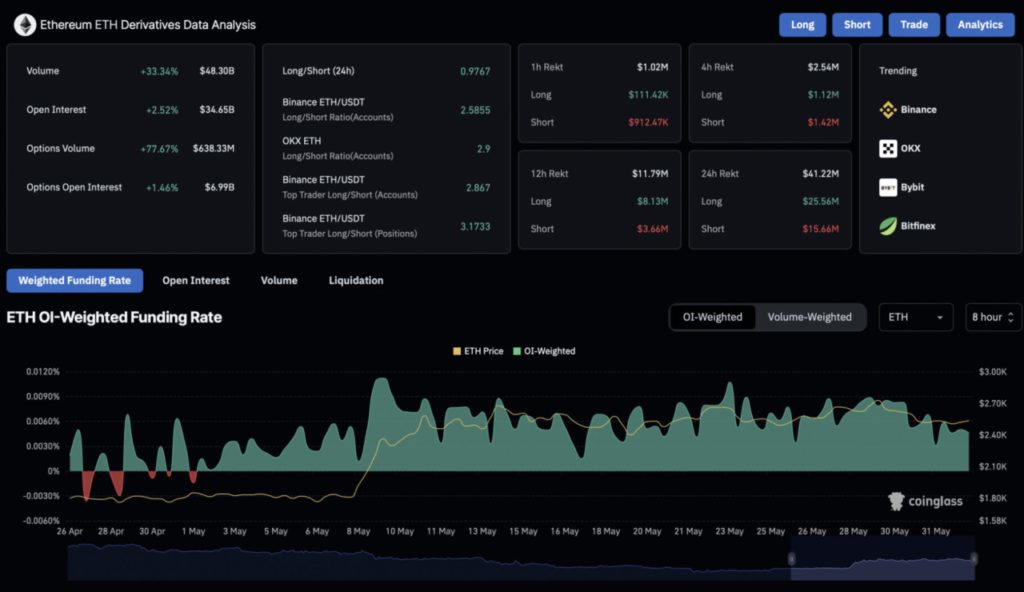

Derivatives Market Remains Optimistic

Despite the hidden bearish divergence on the RSI indicator signaling a potential price correction, the bullish chart pattern is fueling increased optimism in the derivatives market.

Ethereum’s open interest increased by 2.52% and reached $34.65 billion, with the funding rate increasing slightly at 0.0046%.

This indicates an increase in bullish activity in the market. However, the liquidation of long positions in the last 24 hours increased to $25 million, while the liquidation of short positions was lower at $15.66 million.

Currently, the long-to-short ratio in the last 24 hours stands at 0.9767, indicating a slight bearish tendency in the market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. Ethereum Forms Cup-and-Handle: Will ETH Rally Above $3,000? Accessed on June 3, 2025