Pi Network (PI) Token is Ready to Flood! What Happens If the Price Falls Below IDR6,500?

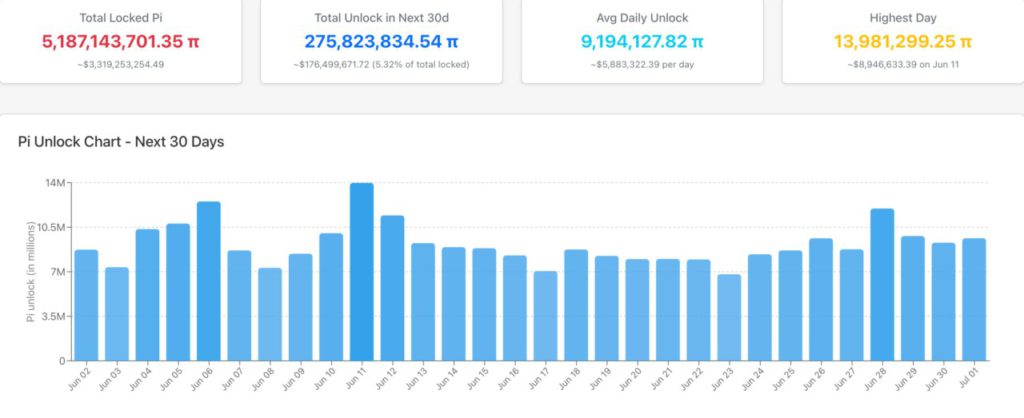

Jakarta, Pintu News – The planned massive token release by Pi Network (PI) in June has caught the attention of the global cryptocurrency community. With more than 276 million tokens to be released to the market, the potential selling pressure on PI is one of the most discussed issues.

Pi Network Prepares to Release 276 Million Tokens

Based on data from PiScan, Pi Network is scheduled to unlock 276 million PI tokens in June 2025. With a current market price of around $0.63 per token, the total value of the tokens to be released is more than $176 million or equivalent to Rp2.868 trillion.

Large token releases like this often increase selling pressure, especially when market conditions are sluggish. Low trading volumes and bearish investor sentiment make this unlock moment particularly vulnerable to further price declines.

Also Read: MicroStrategy Up 2,930%! Michael Saylor’s Crazy Strategy in Crypto Turns out to be Fruitful

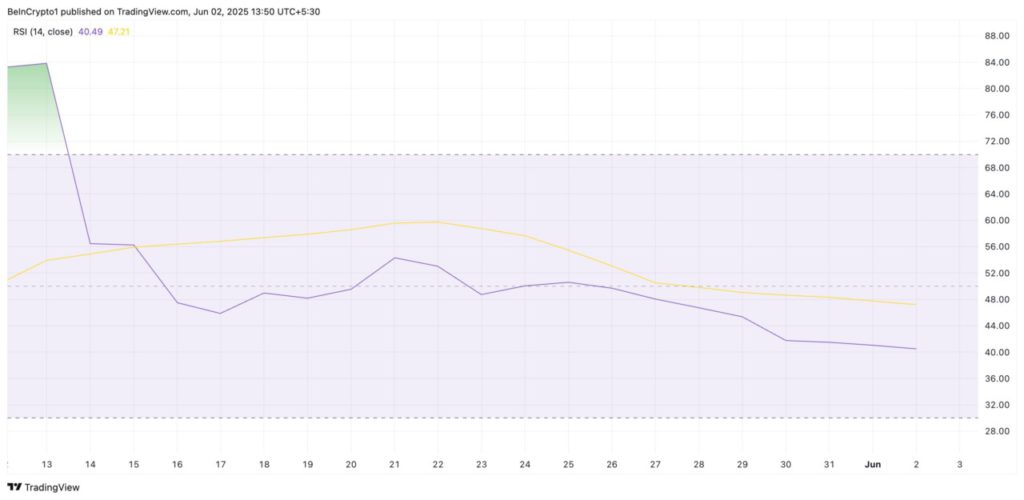

Technical Indicators Depict a Negative Trend

On the technical front, PI is showing signs of waning investor interest. PI’s Relative Strength Index (RSI) currently stands at 40.49, which is below the neutral line of 50. This signals that selling pressure is dominating the market, with more market participants choosing to sell than buy.

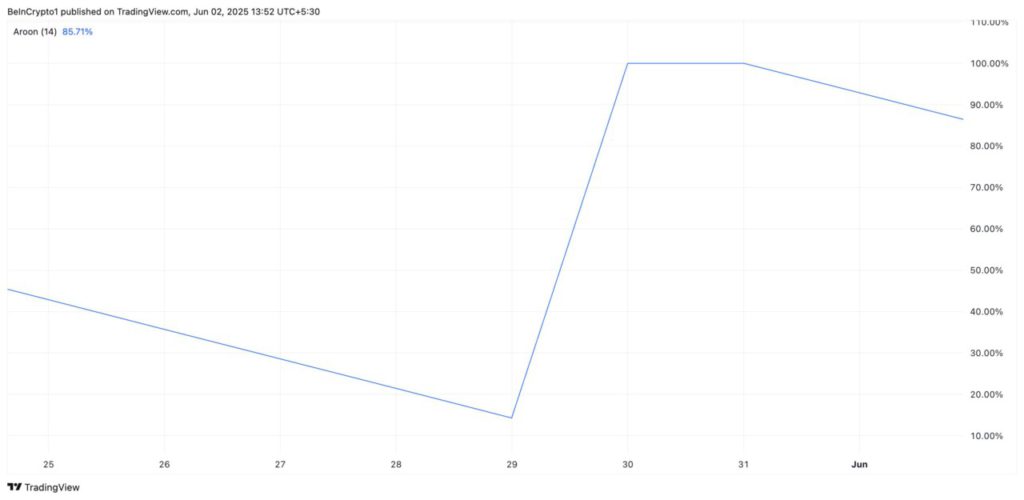

In addition, PI’s Aroon Down indicator is at 86%. This value is very high and indicates that PI prices are frequently registering new low points, emphasizing the dominance of the bearish trend. If this condition continues, the PI price is at risk of touching or even breaking the all-time low of $0.40 or around Rp6,520.

Between Correction and Recovery

With prices currently hovering around $0.63 (IDR10,269), the potential for a decline towards the $0.40 (IDR6,520) support point is increasingly open. If selling pressure remains high and there is no significant buying interest, then the possibility of breaking the support could become a reality.

However, the opposite scenario is also still possible. If there is a new surge in demand, for example from community sentiment or ecosystem development, PI could experience a price bounce and even head towards resistance at $0.86 or Rp14,018. This would undo the negative trend that has been dominating.

What are the Implications for Crypto Investors?

For cryptocurrency investors, this incident is a reminder of the importance of risk management and understanding the dynamics of token unlocks. Not all token releases lead to price drops, but in the context of a technically depressed Pi Network, the risk is higher.

As a mitigation measure, market participants are advised to monitor technical indicators such as RSI and Aroon regularly. Evaluation of community sentiment and information around project development is also very important, especially in market conditions that are heavily influenced by news and emotions.

Conclusion

With the release of 276 million PI tokens scheduled for June, the crypto market is closely watching whether this will be a turning point or a trigger for a deeper price crash. This situation confirms that an investment strategy in cryptocurrency should be based on in-depth analysis and preparedness for extreme volatility.

Also Read: Bitcoin in danger of weakening again? Bollinger Bands indicator gives this sign!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network’s Token Unlock Could Drive PI Below $0.40. Accessed June 3, 2025.

- Featured Image: CoinPedia