Bitcoin Holds Strong at $105K — Is a Major Reversal Just Around the Corner?

Jakarta, Pintu News – Bitcoin price started the new month with a rather flat movement. Since June 1, BTC has been trading in a narrow range, with a low of $103,861 and a high of $105,820.

Despite setting a new record high on May 22, the profit-taking that occurred was only mild. Instead, this latest price movement indicates that Bitcoin may be entering the final stages of its current correction phase.

In a market dominated by these major cryptocurrencies, there were very few factors that were able to break through important resistance levels.

While the price increase may not happen quickly, current conditions suggest that a major correction is unlikely in the near future. Here is the explanation.

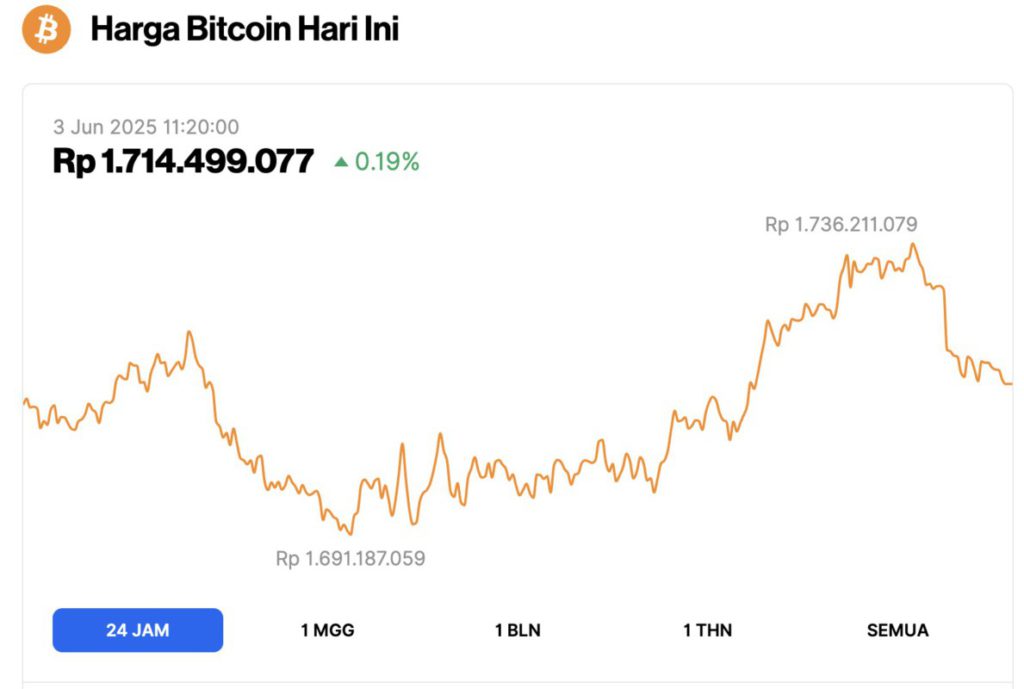

Bitcoin Price Up 0.19% in 24 Hours

On June 3, 2025, the price of Bitcoin was recorded at $105,409 or equivalent to IDR 1,714,499,077, a slight increase of 0.19% in the last 24 hours. During this period, BTC dipped to a low of IDR 1,691,187,059, and reached a high of IDR 1,736,2111,079.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.09 trillion, with trading volume in the last 24 hours rising 24% to $47.63 billion.

Read also: Ethereum Surges to $2,600 — Is a Massive Breakout to $3,000 Just Around the Corner?

Bitcoin Nearing a Potential Reversal Point

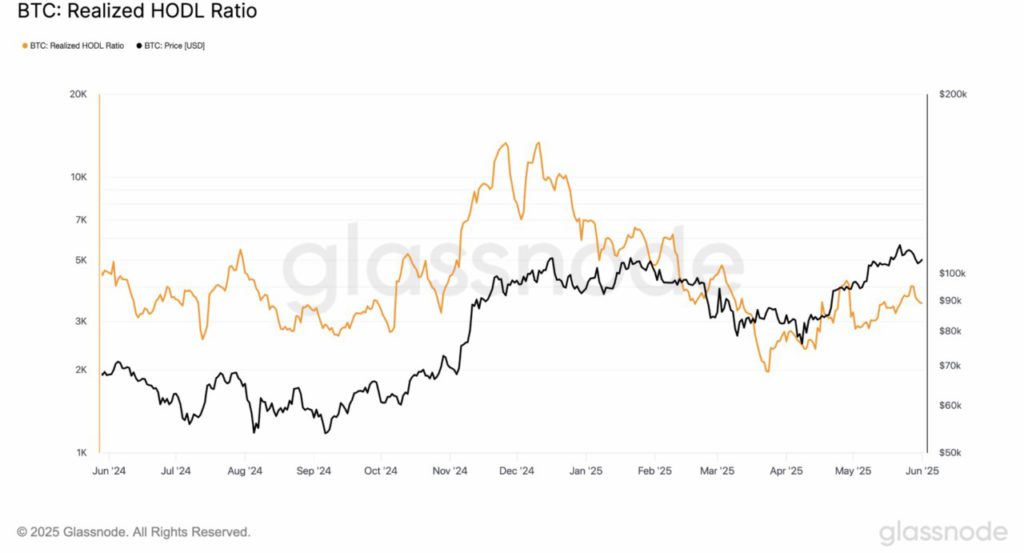

To support this statement, the CCN website (6/2/25) reviewed the Realized HODL Ratio metric or abbreviated as RHODL Ratio. This metric measures the relative wealth distribution between short-term and long-term Bitcoin holders.

Specifically, this metric compares the value of coins moved in the past week with the value of coins moved between one to two years ago.

An increase in the RHODL Ratio usually reflects increased activity from new market participants. In many cases, it indicates the formation of a local price peak.

Conversely, if this ratio decreases, it indicates the dominance of long-term holders, which usually corresponds to a price bottom or accumulation phase.

Based on data from Glassnode, Bitcoin’s RHODL Ratio recently dropped to 3,493.

This suggests that, despite Bitcoin’s recent record highs, the current price may not have reached its cyclical peak. As such, the ongoing consolidation phase may be coming to an end.

Strong Support, but No Clear Breakout Signs Yet

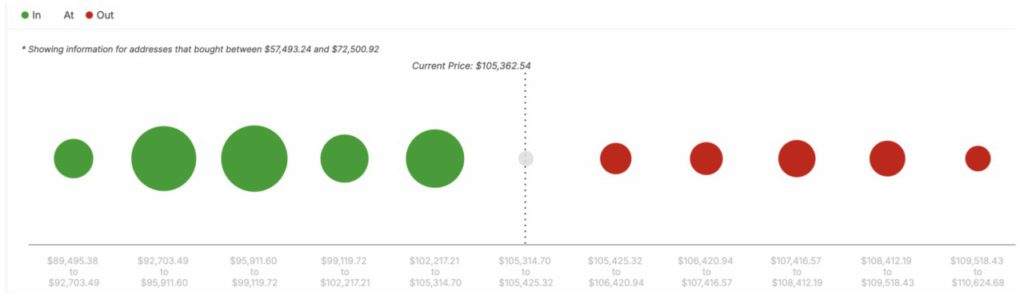

As part of this analysis, analysts from the CCN website also reviewed the In/Out of the Money Around Price (IOMAP) metric. This metric helps identify key support and resistance levels by looking at the volume of coins that are in an unrealized profit or loss position.

Read also: Altseason & Golden Cross Happen: These 4 Altcoins are Worth Buying Before They Explode!

In general, a high concentration of addresses that are in a profitable position below the current price indicates strong support. Conversely, a collection of losing holders above the current price indicates potential selling pressure or resistance.

Based on data from IntoTheBlock, Bitcoin currently has solid support in the range of $92,703 to $105,314 – an area where a large amount of BTC has been accumulated.

In contrast, the volume of coins purchased between $105,425 and $110,624 was relatively lower. This suggests that in the short term, Bitcoin is unlikely to face major selling pressure.

As such, if buying pressure increases, Bitcoin price could break the upper limit of $110,624 and potentially set a new record high.

However, analysts warn that this bullish scenario is highly dependent on successfully breaking important technical levels.

MN Capital CEO and renowned trader Michaël van de Poppe recently shared his views on the X platform, stating that BTC must break above the $106,000 level in order to move higher.

If this breakout fails, van de Poppe warns that Bitcoin price could decline and return to the $101,000 support zone, which may be the final correction area.

In line with van de Poppe, analyst from CryptoQuant Axel Adler Jr. also gave his views on Bitcoin’s prospects. According to him, the decline in BTC reserves on centralized exchanges is a bullish signal, as it indicates reduced selling pressure.

However, he warns that the current level of reserves is still high enough to hinder a sustained upward trend. This means that if a large portion of BTC is not removed from exchanges soon, the risk of short-term selling pressure will still remain.

BTC Price Prediction: Potential Short-Term Recovery

From a technical point of view, the daily chart shows that Bitcoin price is attempting to break the supply wall at $107,743. On two previous occasions before setting record highs, BTC was rejected at this level.

Read also: Top 5 AI Crypto Set to Soar 100x by Mid-2025 – Are You In?

This time, however, the green line on the Supertrend indicator is below the current price. As the IOMAP data shows, this signals strong support below the price.

In addition, the Money Flow Index (MFI) is showing an increase again, which indicates that market participants are starting to buy thedip. If this trend continues, BTC prices are likely to remain moving within a certain range for a while.

However, if the demand for Bitcoin increases significantly, the price could potentially break the resistance above it. If this breakout is confirmed, the next area to target for Bitcoin price is expected to be around $112,072.

On the other hand, if buyers fail to push the price of BTC past the $107,743 level, this scenario could be unrealized.

Under these conditions, Bitcoin price is likely to drop towards the $92,219 area, which is a correction level (pullback) at 0.236.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Bitcoin (BTC) Nears Final Leg of Pullback After Drop to $105K – Analyzing How. Accessed on June 3, 2025