Pi Network Price Dips Today — Surge Ahead? Rising Buying Pressure Signals Major Breakout Incoming!

Jakarta, Pintu News – Pi Network’s native token, PI, has been struggling to experience price increases and its price movements have been stuck in a narrow range over the past few days.

However, market signals suggest that this stalemate is likely to end soon with the bullish side benefiting, as buying pressure increases.

Pi Network Price Drops 0.5% within 24 Hours

On June 5, 2025, the price of Pi Network (PI) was recorded at $0.6479, having risen slightly by 0.5% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,274), then 1 Pi Network is IDR 10,543.

Read also: Pi Network Users Unite Against Listing on Binance, Why?

In the past 24 hours, the price of PI moved in the range of $0.643 to $0.6564, indicating fairly stable market fluctuations but a downward trend.

With a market capitalization of $4,747,764,047, Pi Network shows its existence as one of the crypto assets that counts. Trading volume over the past 24 hours reached $67,726,843, indicating that transaction activity is still active despite the slight correction in price.

Pi Network Consolidation Coming to an End? Traders Brace for Big Moves

Reporting from BeInCrypto (4/6), based on the PI/USD daily chart, this altcoin has been moving in a very narrow price range between $0.629 and $0.656 since May 31.

This tight consolidation – with price movements of less than 5% – indicates low volatility and market uncertainty. Such situations often occur when buying interest begins to decline or when market participants are waiting for a specific trigger.

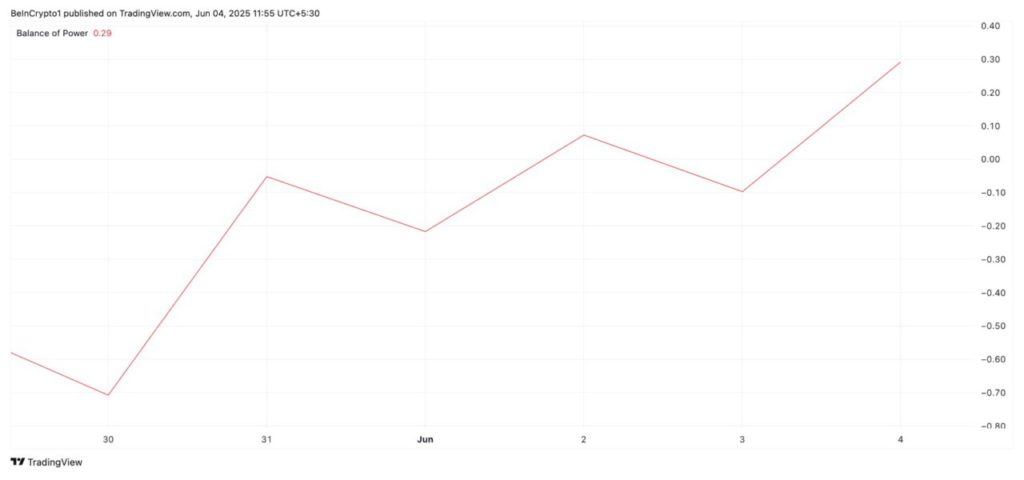

However, technical indicators point to a potential upside breakout above the $0.65 resistance level as PIs start to register a slow increase in new demand. The positive Balance of Power (BoP) indicator confirms this.

On June 4, 2025, the BoP stood at 0.29.

BoP itself measures the strength of buying pressure versus selling pressure in a given period. When the number is positive, it signals the dominance of buyers in the market. This reinforces the signal of accumulation in the PI market and signals the potential for price increases in the short to medium term.

Pi Network Selling Pressure Weakens

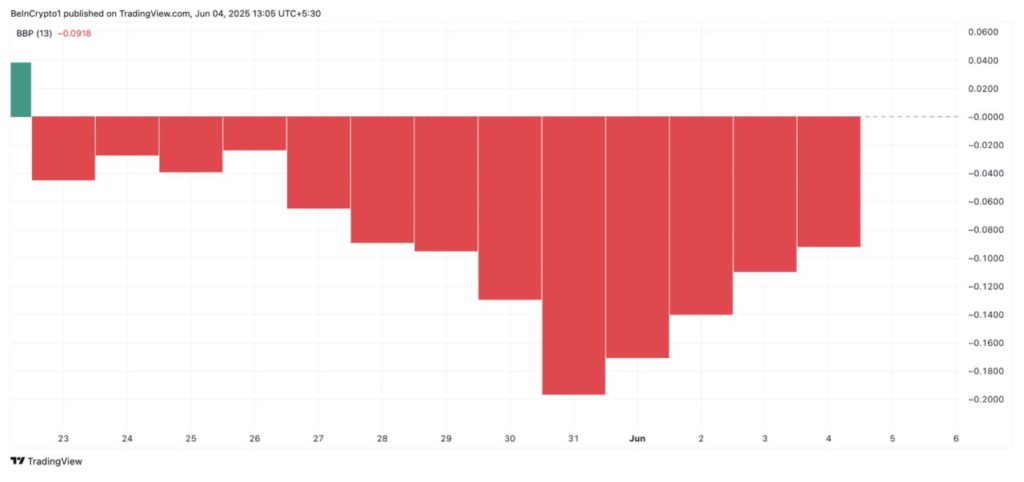

Also, the shrinking size of the red bars on the Elder-Ray Pi Index indicates that the selling pressure from the bearish side is gradually weakening in the spot market.

This indicator analyzes the difference between the price and the exponential moving average to assess the strength of bulls and bears in the market.

Read also: Ethereum Stalls at $2,600 — Are Crypto Whales Plotting a Massive ETH Breakout?

The shrinking of the red bars (bear power) signals a weakening of selling pressure, indicating that the bearish forces are starting to lose control-and a bullish shift is likely.

This series of signals indicates the beginning of a potential bullish breakout on the PI token.

PI Network Approaches the Deciding Point

As of June 4, PI was trading at $0.651, still below the $0.656 resistance mark.

If buying pressure increases and new demand starts to flood the market, PI has the potential to break this resistance limit and rise towards the $0.725 level.

If this price level manages to hold and turn into a strong support floor, PI could be pushed even higher towards $0.796 – its highest level last reached on May 26.

However, if the bearish side manages to strengthen their dominance in the market, they could trigger a pullback from the current narrow consolidation pattern, potentially pushing PI prices down to $0.629.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network Edges Closer to Upside Breakout Amid Rising Buying Pressure. Accessed on June 5, 2025