2 Key Support Levels for Bitcoin (BTC) Price This Week!

Jakarta, Pintu News – Bitcoin recently ended a two-week downward trend, which briefly dropped its price to $100,200 before bouncing back.

Despite the recovery, Bitcoin (BTC) still faces selling pressure from long-term holders, which could make it vulnerable to further price corrections.

The crypto market remains volatile, adding to the uncertainty over the next direction of Bitcoin (BTC) price movement. Check out the full analysis here!

Bitcoin Sales Spark Concerns

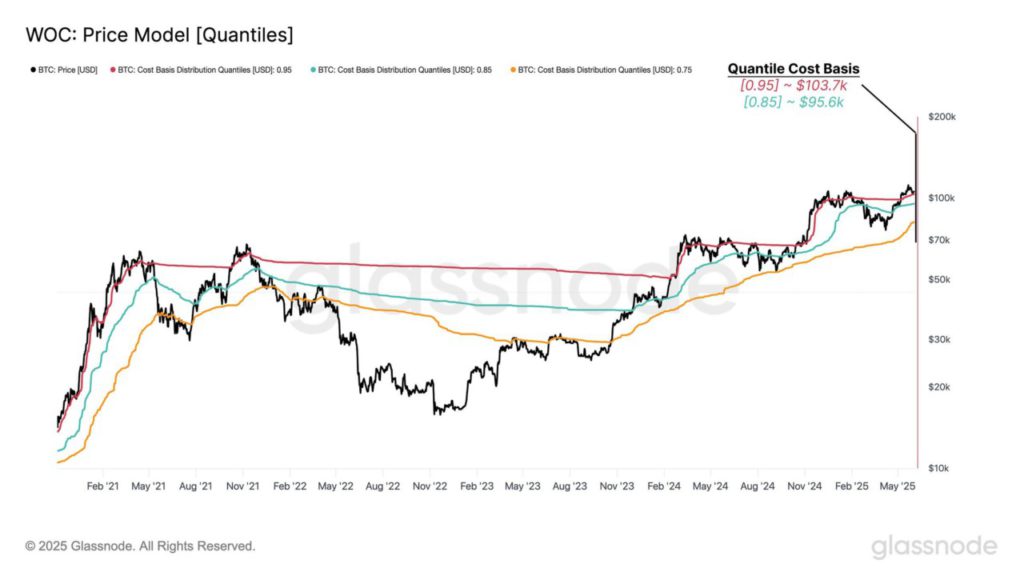

Quoted from BeInCrypto, Bitcoin (BTC) cost basis analysis shows some key support levels that could be very important in the near term. The Spendable Supply Distribution (SSD) at the 0.95 quantile shows that 95% of the circulating Bitcoin (BTC) supply was purchased below $103,700.

This shows that only 5% of Bitcoin (BTC) was gained above this level, making $103,700 a strong support zone. Additionally, another critical support level lies at $95,600, where SSD 0.85 converges.

This level signifies that 85% of Bitcoin (BTC) in circulation has a lower acquisition price, making it another potential bulwark for Bitcoin (BTC) price. If Bitcoin (BTC) faces further selling pressure, this level could serve as a strong barrier against a deeper drop.

Also read: Eric Balchunas Predicts Memecoin ETF to Emerge in 2026, Here’s What He Says!

Macro Outlook and Historical Trends

Despite selling pressure from long-term holders, Bitcoin (BTC)’s macro momentum suggests a positive outlook in the long term. Historical monthly return data for Bitcoin (BTC) shows that June is typically a positive month for this asset, with a median gain of 2.58%.

This suggests that although Bitcoin (BTC) may face a short-term correction due to selling, the broader market trend could favor a price recovery. Historical trends suggest that any correction Bitcoin (BTC) faces due to selling by long-term holders is likely to be temporary.

With the potential for Bitcoin (BTC) price growth in the long term, the market could soon shift to bullish sentiment, especially if broader market conditions improve.

Read also: Gold Jewelry Price Today June 9, 2025, Up or Down? Check the list!

BTC Price Support and Resistance Levels

Bitcoin (BTC) price recently gained 4.7% over the past three days, trading at $106,263. However, the cryptocurrency is still just below the $106,265 resistance level. Given the current market sentiment and key support levels, factors suggest that Bitcoin (BTC) may experience a decline in the short term.

If Bitcoin (BTC) fails to hold the $106,265 level and faces further selling pressure, the price could fall through the $105,000 support and move towards $103,700.

This level, as identified in the cost basis analysis, could provide significant support. In a more bearish scenario, Bitcoin (BTC) could even slide to the next support at $102,734.

Conclusion

Considering the current market dynamics and in-depth technical analysis, investors and market watchers should take note of these support and resistance levels to make informed decisions on investing or transacting with Bitcoin (BTC). Being prepared for possible price fluctuations will be key in capitalizing on the opportunities available in the crypto market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price Correction: Support Levels to Watch. Accessed on June 9, 2025

- Featured Image: Generated by AI