Investment Surge in Ethereum ETFs: A New Crypto Market Breakthrough!

Jakarta, Pintu News – The Ethereum Exchange-Traded Funds (ETF) market in the United States experienced a significant increase with a record 15 consecutive days of fund inflows, reaching a total of $837.5 million since May 16. This increase occurred along with the Pectra update on Ethereum , which increased EIP-7702 transactions to nearly 1,000 per day and improved wallet features without changing the address.

Ethereum ETFs: Fund Flows Reach Record High

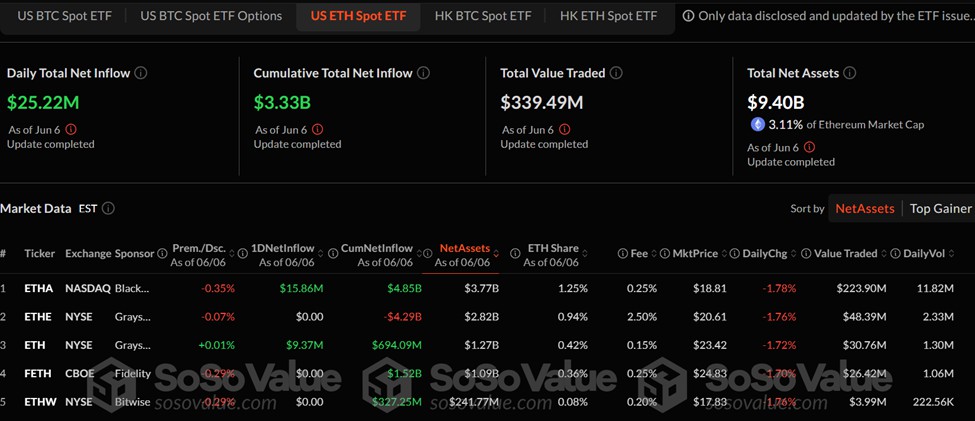

Since its launch in May 2024, the Ethereum ETF has recorded fund inflows amounting to 25% of total inflows. This is the longest period of inflows ever recorded since late 2024. According to data from SoSoValue, the cumulative inflow value of the Ethereum ETF now stands at $3.33 billion. BlackRock’s ETHA ETF led the market with nearly $600 million in contributions during this period.

Although ETHA recorded the highest inflows, Grayscale with its two products, ETHE and ETH, still holds the largest asset base with a total of $4.09 billion. Meanwhile, Fidelity’s product follows with $1.09 billion, and the rest of the ETFs are still under $250 million. This rise comes on the heels of Ethereum’s (ETH) price surge of 38% in the past 30 days, driven by increased institutional interest and optimism towards Ethereum’s (ETH) long-term fundamentals.

Also Read: Ripple (XRP) Shakes Dollar’s Dominance in Global Markets, Will XRP Price Rise in the Near Future?

Comparison with Bitcoin ETFs

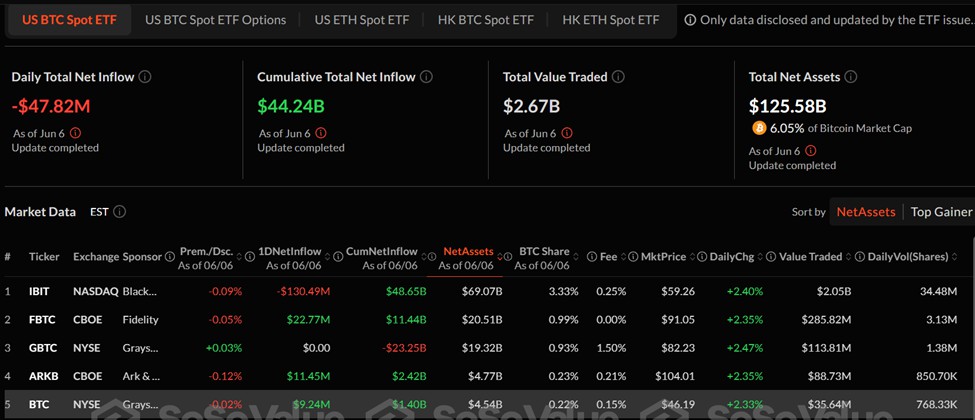

While the Ethereum ETF showed an impressive performance, the Bitcoin ETF saw a decline. Bitcoin ETF inflows were cut off on May 29, with a fund outflow of $346.8 million in a single day. Since then, Bitcoin ETF fund flows have been volatile, with a total decline of more than $1 billion, from $45.34 billion on May 28 to $44.24 billion.

BlackRock’s IBIT ETF remains the category leader with $69 billion in assets under management. Fidelity’s FBTC and Grayscale’s GBTC ETFs follow with $20.51 billion and $19.32 billion, respectively. Markets also experienced turbulence after the exchange of words between President Donald Trump and Elon Musk that triggered massive selling in crypto and equity markets.

Innovation and Staking in ETFs

As investor interest in Ethereum ETFs grows, some analysts argue that future inflows will depend on the introduction of staking functionality. James Seyffart, ETF analyst from Bloomberg, recently highlighted the regulatory solutions used to launch ETFs that allow staking.

REX Shares has applied for an Ethereum and Solana (SOL) staking ETF, and the product may become available in the US in the next few weeks. Increased demand is also reflected in broader Ethereum adoption metrics.

According to Santiment, the number of Ethereum holders has now surpassed 148 million, showing long-term confidence in the asset. In comparison, Bitcoin has 55.39 million holders, while other popular assets such as Dogecoin , Ripple , and Cardano report between 4 and 8 million holders.

Conclusion

With the performance of Ethereum ETFs now peaking, the crypto market’s spotlight is on whether this momentum can last. Possibly, staking-enabled offerings might drive the next wave of institutional adoption, opening a new chapter in the evolution of the crypto market.

Also Read: Big Companies Investing in Bitcoin, a Sign of Long-Term Adoption?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum ETFs Inflow Streak, Pectra Upgrade. Accessed on June 9, 2025

- Featured Image: Generated by AI