Ethereum (ETH) is poised to outperform Bitcoin (BTC) in the third quarter, here’s the data!

Jakarta, Pintu News – The cryptocurrency market is always full of interesting dynamics. One question that has come up frequently in recent times is whether Ethereum can outperform Bitcoin in terms of growth and adoption in the third quarter of this year. Recent data and analysis suggests that Ethereum (ETH) has significant potential to do just that.

Ethereum (ETH) at the Heart of the Stablecoin Ecosystem

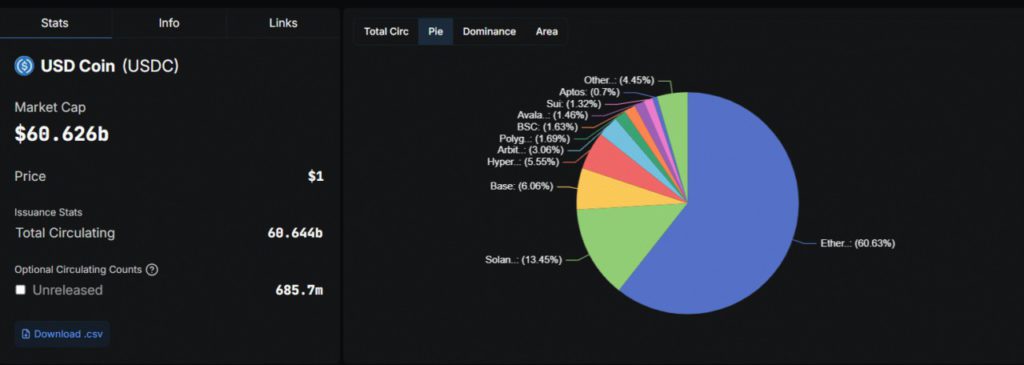

Ethereum (ETH) dominates USDC’s presence on the blockchain, with over $36.7 billion or more than 50% of the stablecoin’s circulating supply residing on the Ethereum (ETH) mainnet. This concentration not only confirms Ethereum (ETH)’s role as the technical backbone, but also as a liquidity hub and advanced smart contract infrastructure.

With Circle’s IPO putting the spotlight on stablecoins, institutional investors are starting to take notice of the infrastructure behind them. Ethereum’s (ETH) existence as a strategic asset is further reinforced with every tokenized dollar that flows through its network. In addition to the mainnet, Circle has also distributed $10 billion USDC on Layer 2 Ethereum (ETH) such as Arbitrum, Base, and Polygon. This expansion reduces congestion, increases scalability, and reinforces Ethereum’s (ETH) central role in the stablecoin infrastructure.

Also Read: From Dogecoin Millionaire to Pepe Millionaire: The Latest Meme Coin Investment Strategy!

ETFs Show Steady Institutional Interest

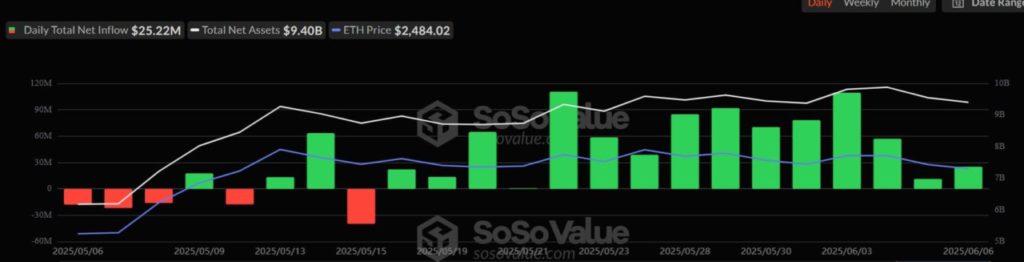

ETF flow data shows a more complex picture. According to SoSoValue, the spot Ethereum (ETH) ETF has seen net inflows for eight of the last ten trading days, totaling $25.2 million as of June 6. Although the price of Ethereum (ETH) fell below $2,500, the total assets held reached $9.4 billion.

Daily flows may have fallen from their peak in early June, but this trend still indicates steady confidence from institutions. These inflows, though modest, reflect the value of Ethereum (ETH) as a mature investment vehicle in regulation.

Money Rotation to Ethereum (ETH)

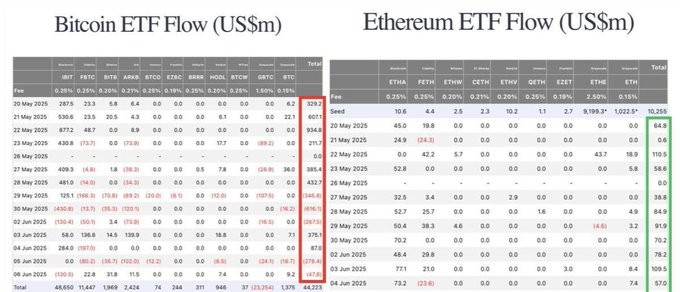

While the Bitcoin (BTC) ETF lost more than $1.4 billion since May 22, the Ethereum (ETH) product quietly absorbed $579 million, showing sustained green inflows almost daily. This Ethereum (ETH) ETF momentum is in line with strong on-chain signals, leading 24-hour net flows on the bridge and recording the largest stablecoin supply growth, according to Artemis.

Despite Layer 2 expansion, these flows reinforce confidence in the strength of Ethereum’s (ETH) base layer. With the third quarter approaching, the main question that arises is whether Ethereum (ETH) can outperform Bitcoin (BTC) in flow, performance, or both.

Conclusion: Ethereum’s (ETH) Potential in the Third Quarter

With a variety of supporting data and analysis, Ethereum (ETH) shows strong potential to outperform Bitcoin (BTC) in the third quarter. Engagement in the stablecoin ecosystem, steady institutional interest, and the continuous flow of money into Ethereum (ETH) are indicators that cannot be ignored. Investors and market watchers will continue to monitor these developments with great enthusiasm.

Also Read: Shocking Prediction: Bitcoin (BTC) Has the Potential to Reach $250,000 in 2026!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Can Ethereum outpace Bitcoin in Q3? These datasets say yes. Accessed on June 10, 2025

- Featured Image: Decrypt