Dogecoin Surges Today— Is This the Takeoff? Analysts Reveal Why DOGE Might Be Ready to Soar!

Jakarta, Pintu News – The latest forecast for Dogecoin uses Fibonacci extensions to show possible bullish price targets ahead of the expected altcoin season.

As of June 10, DOGE had recorded an increase of 4.88%, bringing its price to $0.1911. However, on a weekly basis, the cryptocurrency is still down 1.58%.

Although short-term movements are still volatile, analysts still provide long-term projections using technical analysis tools.

One of the market commentators named “Matters” on the X platform recently shared a chart showing the potential future direction of the Dogecoin price.

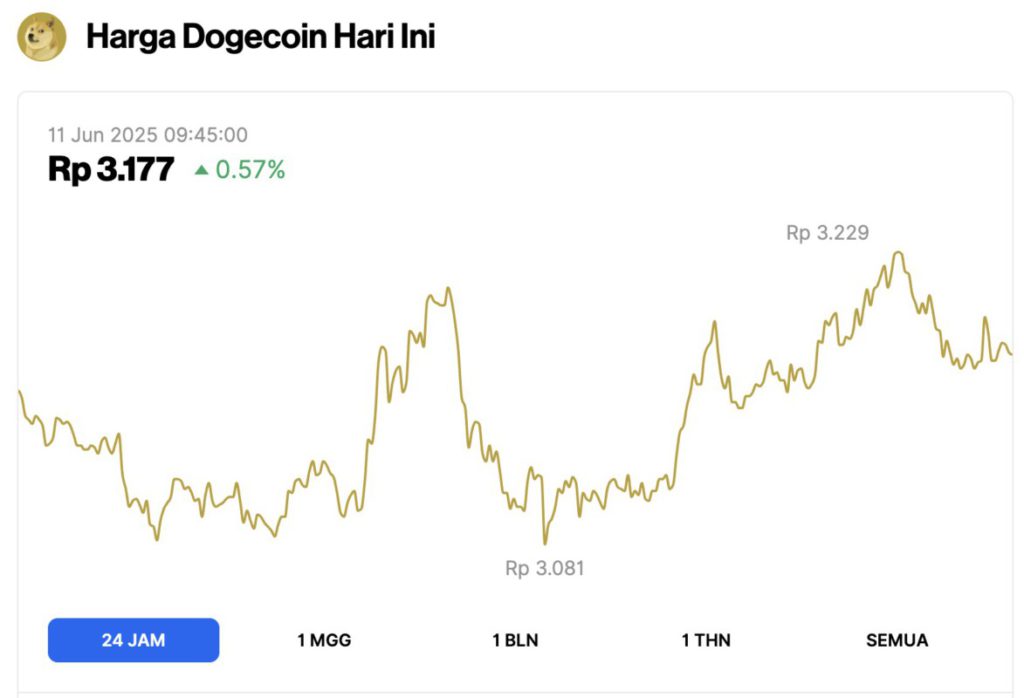

Dogecoin Price Rises 0.57% in 24 Hours

On June 11, 2025, Dogecoin saw a modest 0.57% increase over the past 24 hours, bringing its price to $0.1959, or approximately IDR 3,177. During the day, DOGE traded as low as IDR 3,081 and reached a high of IDR 3,229.

At the time of writing, Dogecoin’s market cap stands at around $29.27 billion, with trading volume rising 12% to $1.38 billion within 24 hours.

Read also: Ethereum Soars Past $2.700 Today (June 11): Experts Say a Major Breakout Could Be Imminent!

Minimum and Ambitious Price Targets for DOGE

The analyst used the Fibonacci extension tool to predict Dogecoin’s possible price movements. This weekly chart projects a price target based on historical data from the previous price peak at $0.73.

The chart shows that Dogecoin has the potential to follow an uptrend, characterized by a green trend line indicating an upward direction of movement.

This chart includes important levels of Fibonacci extensions that analysts believe are potential price targets for DOGE in the upcoming altcoin season. The first level is 1.618, which represents the price of $1.2750. According to the analyst, this level is the minimum upside target for DOGE.

In the event of a stronger bullish rally, DOGE prices could be pushed up to $1.5643, which corresponds to the Fibonacci 2 level.

Meanwhile, the 2.618 Fibonacci extension level suggests that Dogecoin could potentially reach a price of $2.0324, reflecting a more optimistic scenario for the cryptocurrency’s future.

Read also: Bitcoin Stalls at $109K Today — Is a New All-Time High Just Around the Corner?

Potential Short-Term Support Zone

Back on June 8, analyst Matters also used Fibonacci retracement levels on short-term charts to identify possible support zones for Dogecoin.

These levels are important for determining where the price might experience a reversal or find support after a significant move.

Major retracement levels show potential support areas at some price points. A price correction could take DOGE down to the 0.786 retracement level of $0.1711.

Meanwhile, the 0.886 level at $0.1351 indicates a possible deeper correction, which could also be a support zone.

In addition, there is a yellow line at the $0.0899 level that signals the potential for a sharper price drop. This level is considered a potential low point for Dogecoin in the event of a prolonged correction, and could be a very important support area if the market comes under pressure.

On the other hand, the chart also highlights that the $0.4390 level could be a significant resistance area.

Golden Cross on Dogecoin

In a separate analysis, a trader named Tardigrade noted that Dogecoin’s 4-hour chart shows a golden cross pattern, which is when the 20-period simple moving average (SMA) crosses above the 50-period SMA.

Read also: 5 New and Hidden Crypto Ready to Explode in 2025!

This pattern previously preceded a significant price spike in the May 6 to 9 period. According to Tardigrade, a similar bullish candle formation has now reappeared, which could signal the start of the next big upside move for DOGE.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. Dogecoin Outlook for the Upcoming Altcoin Season: Minimum and Ambitious Price Targets Revealed. Accessed on June 11, 2025