PEPE Coin Rally Goes Wild: Whales are Buying Big and Derivatives are Booming!

Jakarta, Pintu News – Crypto whales are starting to accumulate PEPE as technical indicators point to a potential trend reversal. Will Pepe coin reach a price of $0.000015?

The frog-themed meme coin Pepe recorded its fifth consecutive day of positive movement, with an intraday recovery of more than 7%. Will this short-term trend reversal push Pepe’s price back to the $0.000015 level?

PEPE Coin Price Analysis

According to Crypto Basic (10/6), Pepe is showing signs of a bullish trend reversal from the 23.6% Fibonacci retracement level at the $0.000010 psychological support area. After experiencing a 16% drop over two days last week, this meme coin has recovered by forming five consecutive bullish candles.

Read also: Whale SHIB Transactions Plunge 84%, Yet Shiba Inu Price Holds Steady!

Currently, the recovery rally is targeting the 38.2% Fibonacci level at $0.00001352.

With an intraday gain of over 7%, the ever-increasing bullish momentum signals a potential crossover between the 100-day EMA and 200-day EMA-indicators that are often considered as buying opportunities by price action traders.

Also, the MACD line and the Signal line are approaching bullish crossover points, as the bearish histogram diminishes. This indicates a potential trend reversal with renewed upside momentum.

Overall, technical indicators show a positive outlook for this frog-themed meme coin.

If the price manages to break above the 38.2% Fibonacci level, then it is likely that Pepe will retest the 50% level at $0.00001592. However, in case of a decline, an important support level is at the 50-day EMA at $0.00001147.

Large Investors Optimistic about PEPE Coin

Despite increased market volatility in the past month, crypto whales have shown optimism towards the PEPE meme coin.

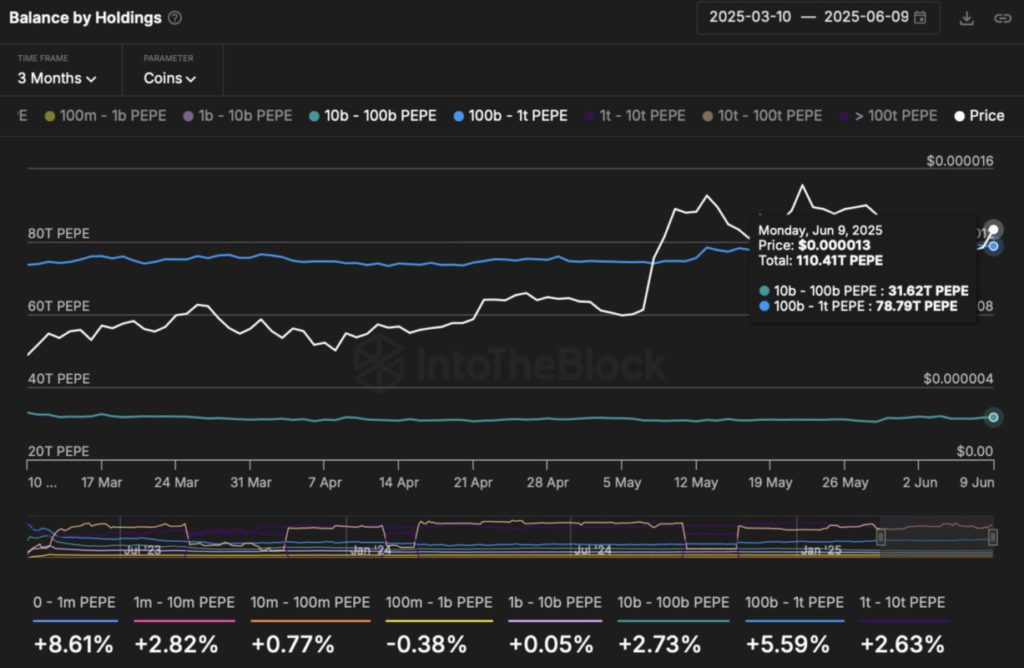

Based on data from IntoTheBlock’s Balanced Buy Holding indicator, holdings by large investors with portfolios between 10 billion and 1 trillion PEPEs increased from 106.54 trillion to 110.41 trillion tokens.

Interestingly, holdings by investors with between 100 billion and 1 trillion PEPEs also increased, from 73.64 trillion to 78.79 trillion tokens.

In the past 30 days, portfolios holding between 10 billion to 100 billion PEPE rose by 2.73%, while portfolios with 100 billion to 1 trillion PEPE grew by 5.59%.

Interestingly, large whales holding between 1 trillion and 10 trillion PEPE also increased their holdings by 2.63% over the same period. This reflects the growing confidence of large investors in this Ethereum -based meme coin.

Read also: 3 Cryptocurrencies That Surged by Hundreds of Percent on June 11, 2025

Derivatives Traders See Potential Upside for PEPE Coin

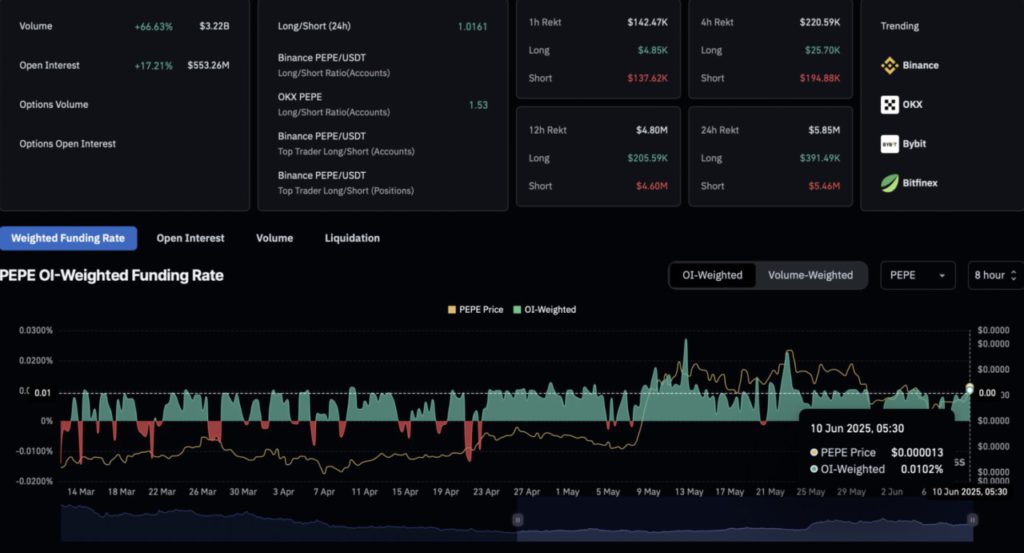

Adding to the evidence of growing confidence in Pepe, derivatives data from Coinglass shows that open interest increased by 18%, reaching $556.49 million. This surge reflects Pepe’s higher derivatives trading activity.

In addition, the funding rate rising to 0.0104% reinforced the bullish sentiment. This suggests that the bulls are willing to pay a premium to the bears to maintain price alignment between the spot and swap markets.

On June 10, 2025, the long-to-short ratio rose above 1, indicating that there are now more long positions than short positions.

During the same period, there was a $5.54 million liquidation of shorts-signaling a massive purge of bearish traders and reinforcing bullish dominance in the PEPE derivatives market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. PEPE Rally Gains Steam as Whales Accumulate and Derivatives Surge. Accessed on June 11, 2025