Peter Schiff Finally Softens on Bitcoin: Valuable Lessons from a Hardcore Critic

Jakarta, Pintu News – Peter Schiff, known as a vocal Bitcoin critic, seems to be softening towards the largest cryptocurrency. In a recent tweet, Schiff admitted that he has learned from his previous experience with Bitcoin (BTC).

The Shocking Confession of Peter Schiff

In a surprising statement, Peter Schiff, who has been known as a gold advocate and Bitcoin (BTC) critic, revealed his new outlook on the cryptocurrency. “Never say never, especially when it comes to the price of Bitcoin.

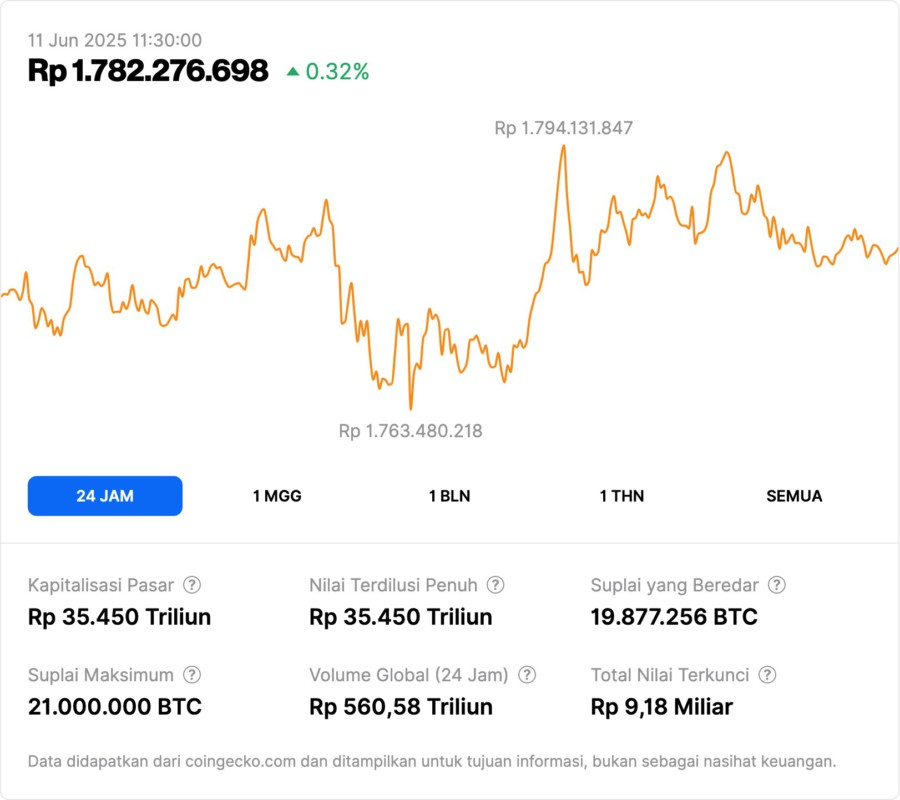

I’ve learned that lesson,” Schiff said via his X account. This statement came after he expressed amazement at Bitcoin’s (BTC) price surge that managed to break $110,000. Schiff’s comments come after Bitcoin (BTC) recorded a price above $110,000 on Monday, a milestone that has not happened in the past two weeks. The rise sparked a broader rally in digital assets, with Bitcoin (BTC) trading around $109,257, up 1.81% in the last 24 hours.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Analysis of Bitcoin Price Increase

Bitcoin (BTC) has shown a significant recovery with a rise of almost 5% in the past seven days, after bottoming out at $100,377 on June 5. At its current price, Bitcoin (BTC) is 2.38% below its record high reached in May of $111,814.

This rise demonstrates Bitcoin’s (BTC) resilience in the face of various market challenges and speculation. According to data from Glassnode, the liquidation of Bitcoin (BTC) short positions occurred when the price jumped from $105,000 to $107,000 within four hours on June 9. The total liquidation increased from $105,000 to $359,000. This may be due to the sudden wave of liquidation of short positions.

Market Dynamics and Schiff Reaction

Yesterday’s liquidation of Bitcoin (BTC) short futures reached $5.74 million, with a daily moving average of $768,252.14. Meanwhile, the long-side premium for Bitcoin (BTC) has increased significantly over the past 12 hours, reaching $270,480. Despite derivatives showing potential overheating, funding rate increases have been modest, with perpetual futures funding rates showing a small increase.

This rise suggests that the market may be experiencing a temporary imbalance, but it also shows a growing interest in Bitcoin (BTC) as an investment asset. Schiff, with his latest admission, may begin to see this dynamic as evidence of Bitcoin’s (BTC) resilience that he did not expect.

Closing: Schiff’s Change of View

Peter Schiff’s change in attitude towards Bitcoin (BTC) marks a watershed moment in the discussion surrounding cryptocurrencies. While it remains to be seen whether this will turn into a full-fledged endorsement, this admission shows that even the toughest critic can change his views given sufficient evidence. It also confirms that in the world of investing, especially crypto, flexibility and readiness to adjust views based on the latest data is key.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Peter Schiff Softens on Bitcoin: ‘I’ve Learned My Lesson’. Accessed on June 11, 2025

- Featured Image: Bitcoin News