These 3 Crypto Are Exploding as the 2025 Bull Run Kicks Off – Don’t Miss Out!

Jakarta, Pintu News – The crypto market is showing signs of entering a bull run phase, with Bitcoin approaching the breakout point of its cup-and-handle pattern.

With the potential for Bitcoin (BTC) price to surge to at least $143,000, it’s a good time to consider investing in some promising altcoins.

This article will review three altcoins that are worth paying attention to ahead of the potential big surge, citing the Crypto News page.

Hyperliquid (HYPE)

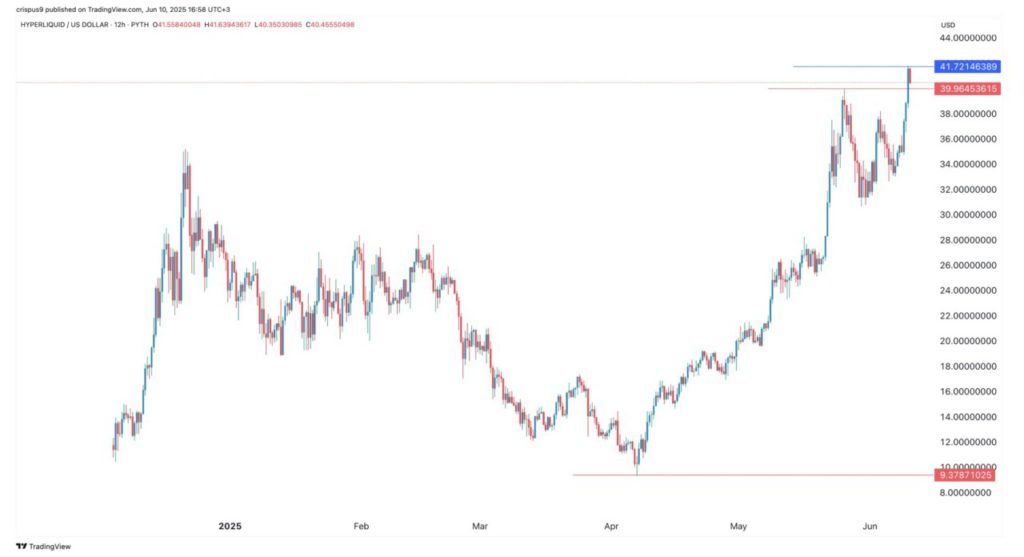

Hyperliquid has performed impressively with a 342% rise from its low point in April, and is now trading close to its all-time high.

Read also: Hyperliquid (HYPE) Skyrockets Past $40 as Whale Frenzy Sets New All-Time High!

The altcoin has dominated the perpetuity futures market, with trading volume reaching over $245 billion in the last 30 days. Revenue from decentralized exchanges has also increased significantly, from $43.3 million in April to $65.5 million in May.

The rise was driven by an increase in trading volume, revenue, and staking proceeds from Hyperliquid (HYPE). The token also managed to validate a double-top pattern at $39.96, signaling further upside potential.

Investors and crypto market watchers should consider Hyperliquid (HYPE) as one of the attractive investment options amid the growing bullish trend.

Uniswap (UNI)

Uniswap continues to expand its market share in the decentralized finance sector. In the past 30 days, the protocol has processed more than $92.8 billion, with fee revenue reaching $95 million in May, up from $60 million the previous month.

Uniswap’s Unichain network is also showing rapid growth, with DEX volumes reaching over $9.5 billion and total value locked (TVL) in DeFi approaching $1 billion.

The market capitalization of stablecoins on Unichain has also jumped to $320 million. Technically, the UNI token has managed to break the key resistance level at $7.5410, which was the peak on May 11 and 28 as well as the 23.6% Fibonacci retracement level.

If it can stay above this zone, UNI has the potential to reach the 50% retracement level of $11.97.

Ethereum (ETH)

Ethereum also showed a bullish signal with the formation of a bullish flag pattern, which consists of vertical lines and rectangles resembling a waving flag.

Read also: Ethereum Today: Crypto Analysts Hint ETH Is Gearing Up for a Spectacular Surge!

The upper limit of this flag is $2,743, and the lower limit is $1,386, which creates a move of $1,357. If added to the breakout level of $2,740, the price target is around $4,100.

Ethereum (ETH) has also formed a golden cross pattern, where the 50-day moving average crosses above the 200-day moving average. This is a classic bullish signal that supports the case for continued price gains.

Investors looking for assets with long-term growth potential should consider Ethereum (ETH) as part of their portfolio.

Overall, with strong indications of technical patterns and fundamental growth, Hyperliquid (HYPE), Uniswap (UNI), and Ethereum (ETH) are three altcoins that offer exciting opportunities in the developing bull run.

Monitoring these developments and strategically positioning investments can provide significant returns for investors in the crypto market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. The Crypto Bull Run is Here: Best Altcoins to Buy Now. Accessed on June 11, 2025