Is Ethereum’s stablecoin dominance threatened by Tether and Circle’s moves?

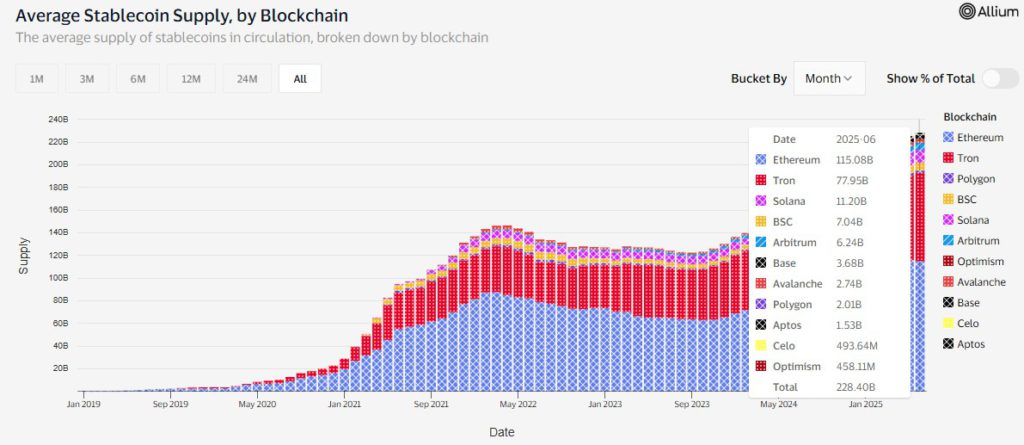

Jakarta, Pintu News – The stablecoin market has experienced significant growth, with the value increasing from $5 billion to over $240 billion in the last five years. Circle’s successful IPO suggests that the market is poised for further expansion. However, recent moves from Tether and Circle raise questions about Ethereum’s future in stablecoin dominance.

Introduction of Specialized Networks by Tether and Circle

Tether chose to use Plasma, a technology optimized for Tether issuance, while Circle Payment Network (CPN) is designed to reduce friction in global money transfers. This move was considered by Ryan Berckmans, a member of the Ethereum community, as the development of an ‘alternative L1 network’ that could potentially increase the risk of centralization and was deemed unnecessary.

Berckmans emphasized that this move could reduce Ethereum’s role in the stablecoin ecosystem. Plasma, which is backed by Tether, aims to become a Bitcoin sidechain that allows deeper integration with DeFi BTC and provides offramps for USDT. The network has already attracted major investor interest, with the XPL token sale raising $500 million in a matter of minutes.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Ethereum’s Position in the Stablecoin Market

Data from Visa shows that Ethereum still controls $115 billion of the total stablecoin market, followed by Tron with $80 billion. Nonetheless, the presence of new networks like Plasma and CPN could change the dynamics of stablecoin supply.

Berckmans suggested that Tether and Circle competitors, including traditional financial companies and banks, launch an Ethereum Layer 2 (L2) solution that integrates new stablecoins, real assets (RWAs), onchain products, and an integrated distribution strategy. According to Berckmans, maintaining stablecoin liquidity on Ethereum can increase DeFi opportunities and maximize investment returns. This demonstrates the importance of Ethereum in supporting innovation and growth in the decentralized finance sector.

Future Prospects and Influence of the IPO Circle

The significant growth of the stablecoin sector, with a 4,600% increase in the last five years, shows great potential. Circle’s IPO has opened up direct investment opportunities in the growth of stablecoins, with CRCL shares jumping 300% from a pre-IPO value of $31 to over $122 before stabilizing at $117.

This success demonstrates the strong market interest in stablecoins and digital payment infrastructure. If this trend continues, Plasma’s XPL token will be an important crypto asset to follow. As the stablecoin market continues to develop, more opportunities and challenges will arise, especially with regard to decentralization and integration with traditional financial systems.

Conclusion

With strategic moves from Tether and Circle, as well as continued growth in the stablecoin sector, Ethereum’s dominance may face challenges. However, with the right strategy and continuous innovation, Ethereum still has the potential to maintain its important role in the digital finance ecosystem.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum’s stablecoin lead at risk; Tether and Circle’s moves raise concerns. Accessed on June 11, 2025

- Featured Image: Crypto Economy