Market Participants Begin to Doubt, Will the Fed Cut Interest Rates on June 18?

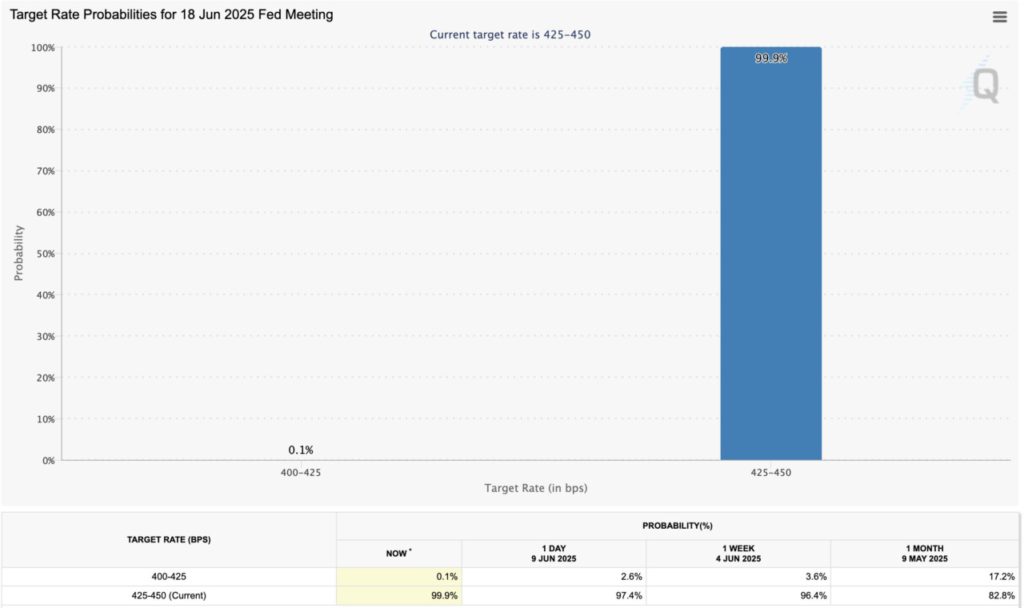

Jakarta, Pintu News – At the upcoming June FOMC meeting, market expectations for the Federal Reserve’s (Fed) interest rate policy are likely to remain stable. The latest data shows that the chance of a rate cut is very low, only 0.1%.

Although there is pressure for a rate cut, incoming economic data, such as labor and inflation, suggest that the current policy may still be the best.

Check out the full analysis here!

Market Expectations on Fed Interest Rates

Ahead of the FOMC meeting on June 18, data from CME FedWatch showed that the chance of a rate cut to the 400-425 basis points range was only 0.1%. This signals that the market expects the Fed to keep rates between 425 and 450 basis points.

Previously, at the May meeting, the chance of a rate cut was still at 9%. Recently released US jobs data showed strong labor demand, which reduces the likelihood that the Fed will cut rates in the near future.

Also read: Chainlink Facilitates Cross-Border Fund Transfers Between Hong Kong and Australia!

In addition, the inflation rate which is still above the Fed’s target also reinforces this view. Investors are now looking forward to the next US Consumer Price Index (CPI) data to better understand the Fed’s policy direction.

Pressure for Interest Rate Cut

Although the chances of a rate cut are very low, the calls for the Fed to cut rates continue to reverberate. This comes after the European Central Bank (ECB) cut its interest rate by 25 basis points.

Several opinion leaders, including US President Donald Trump, have urged the Fed to cut interest rates by 100 basis points, which he calls rocket fuel for economic growth. President Trump has also strongly criticized Fed Chairman Jerome Powell, calling him a disaster.

Also read: Ahead of Donald Trump’s Birthday, Can $TRUMP Price Jump 100%?

In fact, Trump has hinted that there will be an announcement regarding the new Fed Chair in the near future. Data from Polymarket suggests that Kevin Warsh, a former member of the Federal Reserve Board of Governors, is most likely to be Powell’s replacement.

Crypto Market Reaction to Fed Policy

Despite the low chance of an interest rate cut, cryptocurrency prices continue to rise. Bitcoin and Ethereum led the gains, with global market capitalization adding over $100 billion in the past day.

This suggests that the crypto market may have found another reason for optimism, despite the Fed’s interest rate policy. This rise may also be influenced by expectations that tight monetary policy by the Fed may limit inflation, which is traditionally considered positive for assets such as cryptocurrencies.

Investors in the crypto market seem to see this as an opportunity to increase their positions amid global economic uncertainty.

Conclusion

With the upcoming FOMC meeting, the market seems to have adjusted its expectations of the Fed’s interest rate policy. Although there is a strong push for a rate cut, strong economic data and inflation concerns make the chances of that very slim. Crypto markets, on the other hand, are showing impressive resilience, signaling a different dynamic from traditional financial markets.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Traders Bet Against Fed Rate Cut at June FOMC Meeting. Accessed on June 11, 2025

- Featured Image: Generated by AI