Is Solana’s $10 Billion Liquidity Drought a Sign of Crisis? Here’s the Outlook in June 2025!

Jakarta, Pintu News – The crypto market experienced a lot of turmoil in May, but Solana suffered more than any other major cryptocurrency with a drop of around 10%. Nonetheless, with the market starting to stabilize, Solana (SOL) has bounced back by 5% currently. Strategic investors seem to be re-positioning, eyeing the next big resistance zone as a potential area for a breakout.

Navigating Dwindling Liquidity

Liquidity is an important component for Solana (SOL). It not only drives user activity, but also serves as ready-to-use capital. Most Layer 1 platforms reduce supply in the traditional way by burning tokens, sending them to inactive addresses to combat inflation.

However, the $10 billion reduction in the last six months by Solana (SOL) is not a traditional method. It’s more of a value drain from the system. Pump.fun, for example, has attracted more than $700 million of Solana (SOL) into its memecoin launch. While these kinds of tokens can attract liquidity quickly, that value often disappears just as quickly, and doesn’t return to core DeFi.

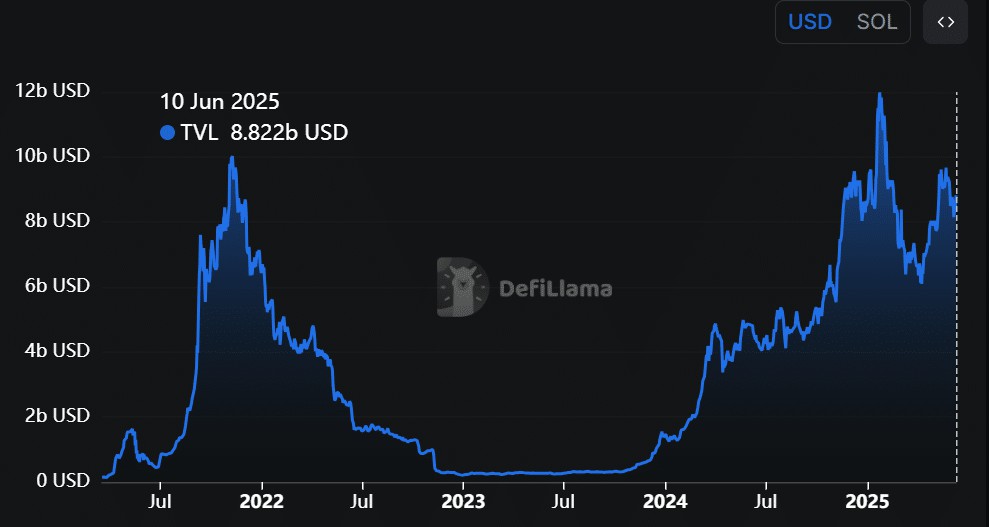

Meanwhile, most of this value loss comes from the Maximal Extractable Value (MEV) strategy. It is estimated that up to 30% of Solana’s (SOL) daily Total Value Locked (TVL) was drained in this way during the peak period. More worryingly, this “burned” amount of $10 billion exceeds Solana’s (SOL) current TVL of $8.822 billion. This suggests that the network is operating with a net liquidity shortage, where more value is leaving the ecosystem than is staying in it.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Short-term Increase, Long-term Questions

According to AMBCrypto, HODLers’ confidence in Solana (SOL) is on the decline. When combined with continued liquidity leaks, this signals an increasingly fragile market structure. Prices may still increase, but without strong support from long-term holders and enough capital to last, Solana (SOL) may be driven more by “hype” than real support.

This makes it extremely vulnerable if market sentiment changes. The past two weeks have seen signs of these concerns. Solana (SOL) has not only lost one key support, but has broken two, dropping back to $140 as market fears resurfaced. Indeed, a push towards the $164 resistance is still possible, especially with opportunistic capital coming in on the “dip”.

However, when viewed from a broader picture, the overall structure seems less reassuring. With more Solana (SOL) being pulled out than being reinvested or locked in DeFi, the network is essentially running a liquidity deficit. In the crypto world, we have seen what happens when the hype dies down and there is no real support underneath.

Conclusion

With the challenges faced by Solana (SOL), investors and market watchers should carefully consider this ongoing dynamic. Is this just a temporary phase, or a sign of deeper problems? Going forward, close monitoring of key indicators such as TVL, user activity, and overall ecosystem health will be crucial to assessing Solana’s (SOL) long-term prospects.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Is Solana’s $10B liquidity drain a sign of trouble for Sol?. Accessed on June 11, 2025

- Featured Image: Generated by AI