Bitcoin (BTC) on the Threshold of Distribution? Check out the Signs!

Jakarta, Pintu News – Bitcoin is still showing bullish momentum, but some risk signals that have emerged recently suggest that there may be a shift to a distribution phase. With the price of Bitcoin (BTC) now above $109,000, the market appears energetic. However, improvements in some key indicators suggest that the profit potential for new entries is starting to diminish.

Bitcoin (BTC) Market Phase Change

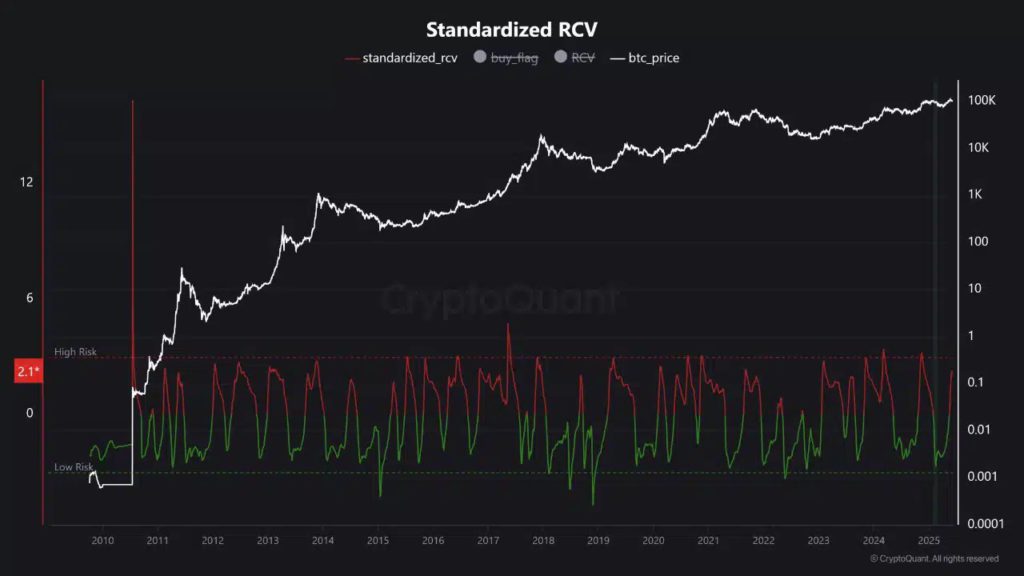

Since breaking out of the low-risk accumulation zone, Bitcoin’s (BTC) 60-day Realized Cap Variance has triggered a market reassessment. When the previous RCV level was negative and the price momentum increased, a buy signal was active. However, although the yellow flag of buying has disappeared, a sell trigger has yet to appear as the 30-day momentum is still strong. This signals a transition from an optimal accumulation phase to a more cautious market phase.

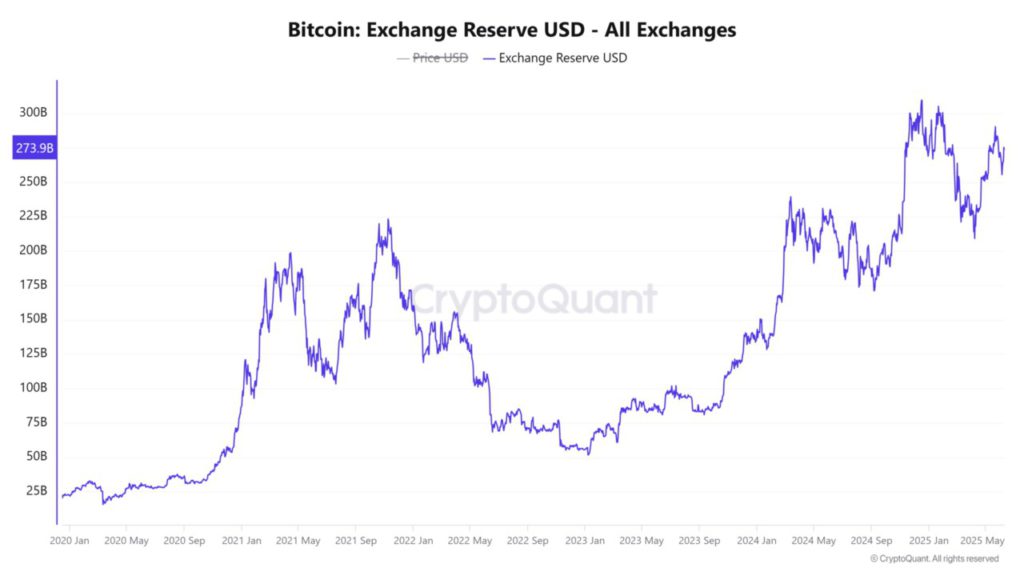

An increase in reserves on the exchange indicates more coins are available on the exchange, which often precedes increased volatility or a downward correction. This increase usually coincides with market participants preparing to offload their holdings at higher prices. Therefore, even if momentum is still intact, a spike in reserves could reflect a strategic shift among holders, especially as favorable accumulation conditions begin to fade.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Position of Miners and Crypto Whales

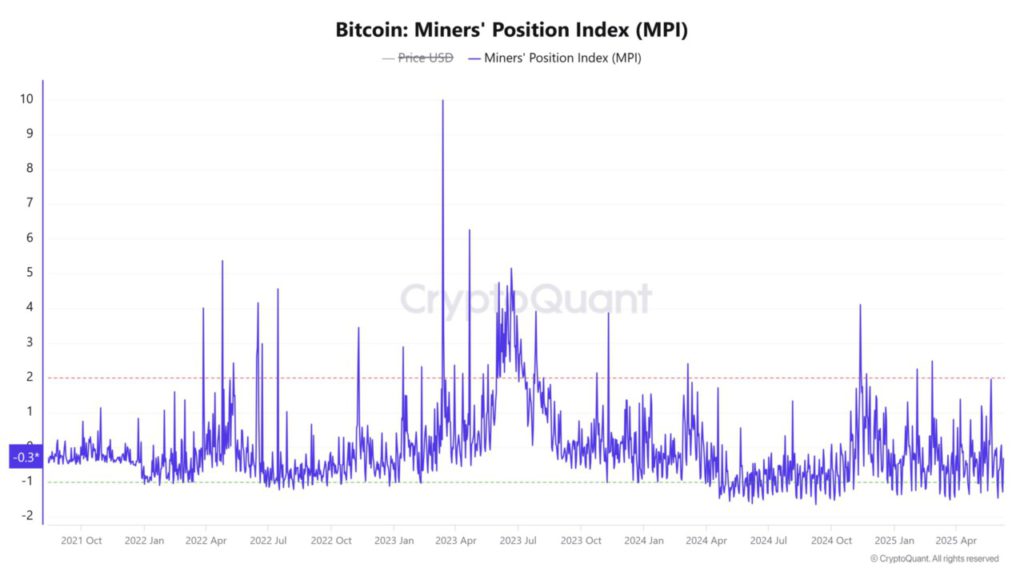

The Miners Position Index (MPI) has surged over 96%, indicating an increase in miner outflows, although values are still slightly negative. Meanwhile, the Exchange Whale Ratio shows consistent inflows of large holders to the exchange. Historically, this dynamic signals a decline in market confidence from key participants.

While not yet extreme, these coordinated moves may hint at a distribution phase taking shape. Monitoring wallet flows, especially from high-impact players, is critical as they often precede broader trend reversals in the Bitcoin (BTC) price structure.

Unrealized Gains and Potential Profit Taking

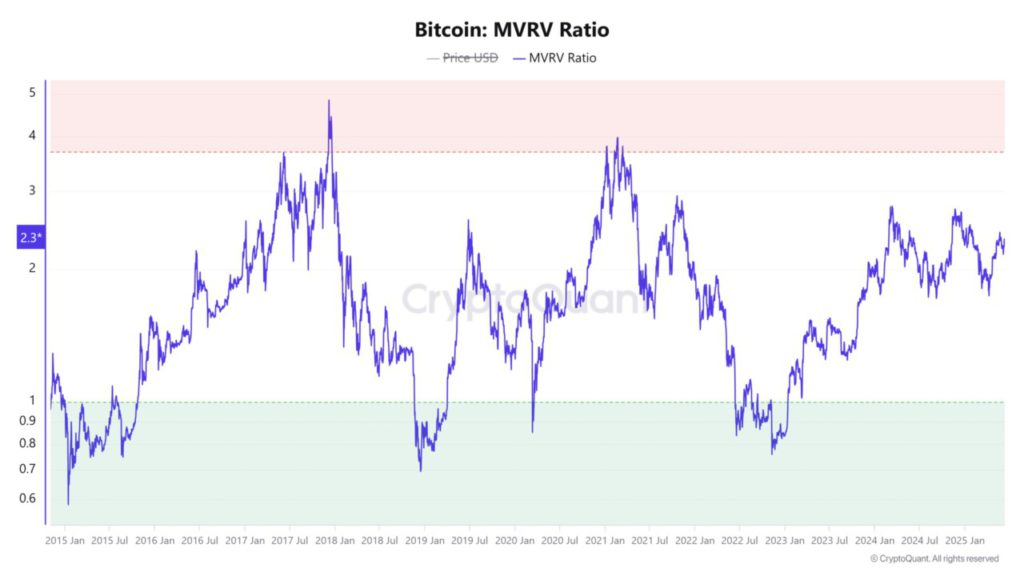

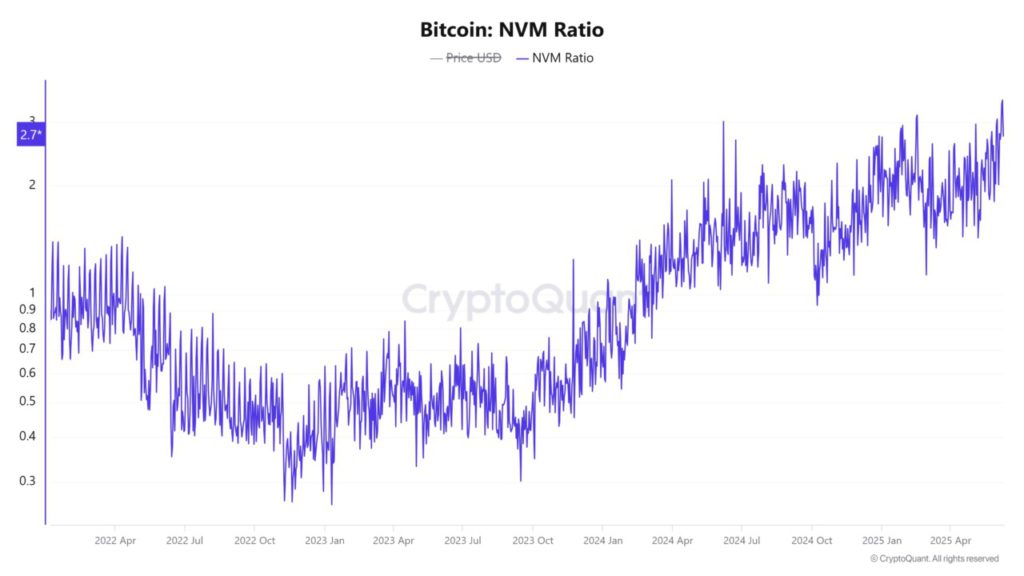

Bitcoin’s (BTC) MVRV ratio has jumped 3.88% to 2.32, indicating that the majority of holders are now sitting on significant gains. When this ratio rises above 2, it often signals that investors are increasingly tempted to secure profits.

Therefore, the higher this metric rises, the more vulnerable the market becomes to a pullback. While this doesn’t confirm an imminent correction, it does suggest that the upside may face resistance from internal selling pressure.

Conclusion

With the disappearance of buy signals, increasing stock exchange reserves, cautious miner behavior, and increasing MVRV, all point to a potential turning point. Although the market is not yet fully in distribution mode, the accumulation phase is over. Market participants should now focus on protecting profits, looking for confirmed sell triggers, and avoiding overexposure as Bitcoin’s (BTC) risk-reward profile continues to evolve.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin price volatility ahead: The signals you should watch at $109k. Accessed on June 11, 2025

- Featured Image: Generated by AI