SUI Surges 6% After Breaking Resistance, $4 Target is Getting Closer!

Jakarta, Pintu News – SUI recently recorded a significant gain of 6% after successfully breaking the resistance of a bullish flag pattern. This increase signifies strong buyer dominance in the market, with the next price target expected to reach $4. Although spot volume showed a decline, analysis from AMBCrypto of CryptoQuant data indicates an increase in aggressive buyer behavior that could push prices higher.

Buyer Dominance Increases

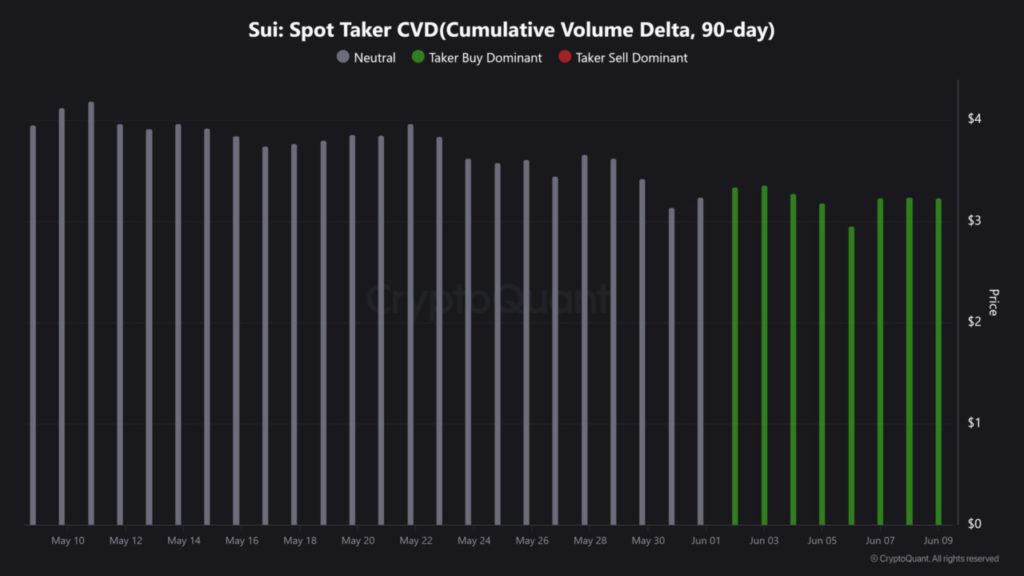

An analysis of CryptoQuant’s 90-day cumulative delta volume shows a sharp spike, signaling that demand in the spot market is outweighing selling pressure. Trends like this are often a precursor to significant price movements. In previous cases, similar trends have managed to push crypto asset prices to dramatically higher levels.

This strengthening suggests that the market still has bullish potential despite some warning signs. Investors and traders should pay attention to whether buyers can continue to absorb selling pressure or if momentum starts to wane. Market behavior in the coming sessions will largely determine the next direction of SUI prices.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Short-term Precautions

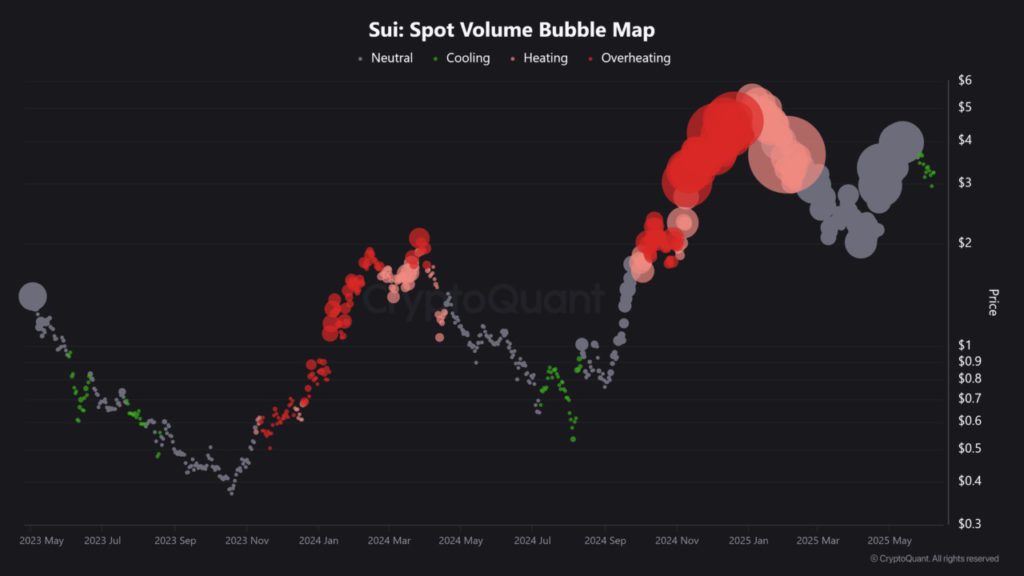

Despite strong indications of buyer dominance, the SUI spot volume bubble map shows a decline in market activity. This could be an indication that market activity is starting to slow down, which might dampen the confidence of market participants. This divergence between strong CVD and shrinking volumes suggests that a new catalyst may be needed to sustain price gains.

If this happens, there is a possibility that SUI will retest the breakout zone before resuming its advance. This is important to keep an eye on as it could determine whether the bullish trend will continue or be temporary. Stability at the breakout level and increased volume will be key to reaching the $4 price target sooner than expected.

Price Outlook and Predictions

With all eyes on SUI, the ability to sustain the breakout level will be crucial. If market volume can pick up again, the $4 price target may be reached sooner than expected. However, if spot interest continues to decline, a temporary consolidation may occur before the next wave of gains.

Investors and traders should monitor these market indicators to make informed decisions. Understanding the dynamics between trading volumes and buyer behavior will be key in navigating this volatile market. The opportunity to profit from SUI price fluctuations is still wide open for those who understand market trends.

Conclusion

Despite some warning signs, the outlook for SUI remains bullish with the potential to reach $4. An in-depth understanding of trading volumes and market dynamics will be important in taking advantage of this situation. Market participants should remain vigilant and be ready to adjust their strategies according to market developments.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. SUI surges 6% after key breakout, 4% on the cards. Accessed on June 11, 2025

- Featured Image: The Block