Bittensor (TAO) Leads AI Crypto Asset Rally, Price Ready to Hit IDR8 Million?

Jakarta, Pintu News – Bittensor (TAO), one of the tokens in the artificial intelligence and big data sector in the cryptocurrency world, has recorded a price surge of 11.42% in the last 24 hours.

At the time of writing, TAO is trading at around US$431.57 or approximately IDR7,014,312 (with a conversion of US$1 = IDR16,256), surpassing many other projects in the same category. This rise coincides with the recovery of the broader crypto market. Technical analysts think that this surge could be the beginning of further potential price gains, even up to the US$500 psychological level.

TAO Breaks the Consolidation Zone, Uptrend Signal?

Bittensor managed to break the top of its descending channel, passing the technical resistance level at US$429.30. The positive momentum was reinforced by the Moving Average Convergence Divergence (MACD) indicator, which showed a histogram value of 5.7-a strong signal of a potential bullish trend. The MACD line is now above the signal line, which is often considered a signal of market reversal to the positive side.

In addition, the Chaikin Money Flow (CMF) indicator is at 0.30, indicating that capital flows continue to enter the TAO ecosystem. This reinforces the assumption that investor buying interest is on the rise. If this buying pressure continues, TAO is expected to test the next important resistance level at US$500. However, if it fails to stay above US$400, the potential for a correction is again lurking in the market.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Leveraged positions are an indicator of volatility risk

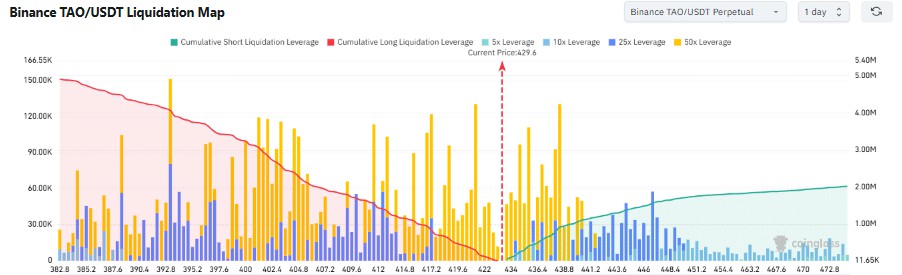

The latest liquidation map from CoinGlass reveals a dominance of highly leveraged long positions in the US$417 to US$430 area. Most of these positions use 50x leverage, indicating an expectation of price increases from speculative traders. On the other hand, the area above US$440 is dominated by low-leveraged short positions of 5x to 10x.

This creates the possibility of two-way price pressure: if TAO drops to US$417, then many long positions will be liquidated, which could trigger further declines. Conversely, if the price breaks US$435, short sellers could be forced to close their positions, which could prompt additional price spikes due to sudden buying pressure. This situation reflects how highly sensitive TAO prices are to sudden movements in the short term.

TAO Leads AI Sector Rally, How About Other Projects?

In the AI and big data-based crypto sector, TAO led the rally with the highest gain in the last 24 hours. Internet Computer also recorded significant growth of 10.21%, trading at US$6.19. Meanwhile, Near Protocol rose by 6.7%, and Render Token (RNDR) gained 4.19% to US$4.01.

Other tokens such as Artificial Superintelligence Alliance and Filecoin also experienced price recoveries of 1.74% and 4.67% respectively. This data shows that interest in AI technology-based crypto assets is still quite strong amid the general crypto market recovery. However, TAO remains in the spotlight due to its most aggressive moves and technical indicators that support further upside potential.

Conclusion

With a combination of strengthening technical signals, increased buying volume, and dominance in the AI crypto sector, Bittensor (TAO) is now strategically positioned towards the US$500 price level. However, traders should keep an eye out for a potential correction if selling pressure or leveraged long liquidation occurs. This rally also marks the importance of monitoring the AI sector in the rapidly evolving cryptocurrency world.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Bittensor [TAO] leads AI sector with 11% daily gains – Is $500 next? Accessed June 11, 2025.

- Featured Image: Crypto News