Mysterious investor puts $29.85 million into Bitcoin, speculation or strategy?

Jakarta, Pintu News – The cryptocurrency market was recently shocked by the emergence of a new wallet that made a massive transaction. In just two days, the wallet has withdrawn $29.85 million in USD Coin through Arbitrum and put it into the decentralized perpetual trading protocol, Hyperliquid. This investor used the capital to bet long on Bitcoin with very high leverage.

The Start of Big Investments

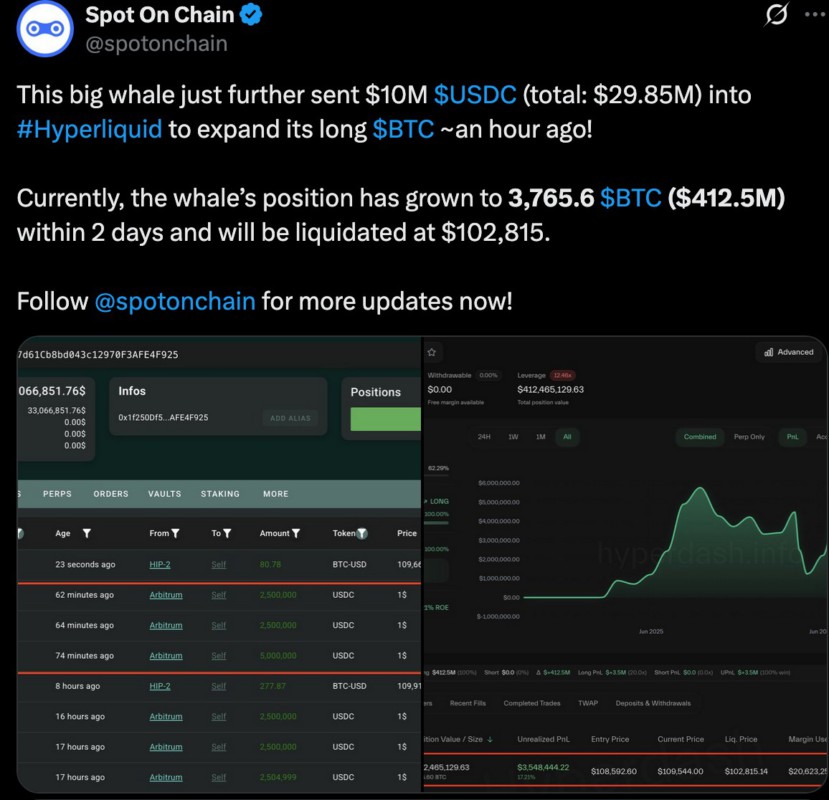

The spotlighted wallet was first analyzed by chain analytics platform, Spot On Chain, which recorded an initial deposit of $19.85 million in USDC. An additional $10 million investment increase was recorded on June 11, bringing the total investment to $29.85 million.

With this capital injection, the long Bitcoin (BTC) position held by this investor increased from 3,686.32 BTC to 3,765.6 BTC, valued at approximately $412.5 million. The initial investment and capital increase show a high level of confidence or speculation from this investor. By utilizing 20 times leverage, this investor could potentially earn huge profits if the price of Bitcoin (BTC) continues to increase.

Also Read: Will Bitcoin (BTC) Reach $150K? Qubetics 2025 Predictions and Innovations

Position and Risk Details

The average entry price achieved by this investor is $108,569.7 per Bitcoin (BTC). The position has a liquidation price of $102,815, which means that if the price of Bitcoin (BTC) falls below that value, the position will be liquidated automatically. Currently, with Bitcoin (BTC) trading slightly above $109,000, the position is still in favorable conditions.

The risks involved are minimal, but still present. Any unfavorable price movements can reduce profit margins or even potentially lead to large losses due to the use of high leverage. Therefore, real-time market monitoring and strategy adjustments are crucial.

Profit Fluctuations and Market Attention

With a purchase price of $108,569.7 and a current Bitcoin (BTC) price of around $109,703, the early stage shows an unrealized profit of over $3.5 million. However, with the funding payment incurred and small price movements, the unrealized profit has also fluctuated.

The activity of these wallets is attracting great attention from crypto traders and analysts, as it could indicate either institutional-equivalent trust or highly risky speculation. Hyperliquid, as a chain-based trading platform with transparent margin and liquidation data, is now in the spotlight due to this significant trading activity.

Conclusion

This massive investment activity not only highlights the boldness of such investors in taking risks, but also marks a pivotal moment for Hyperliquid as a decentralized trading platform. How this bet turns out will largely determine the perception and adoption of high-leverage trading in the cryptocurrency ecosystem.

Also Read: 4 Best Crypto Investments of 2025 According to Analysts: BlockDAG, DOGE, TRON, and HYPE

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Blockchain Reporter. Whale Bets $29.85M on a Massive 20x BTC Long via HyperLiqud in Just 2 Days. Accessed on June 12, 2025

- Featured Image: Generated by AI