Whale Cardano Buys 120 Million Tokens: Will This Spark a Rally?

Jakarta, Pintu News – Cardano’s massive whale buying has fueled market optimism, liquidation of short positions, and boosted retail investor confidence.

Whale Accumulation Strategy: What Underlies It?

In the past 48 hours, Cardano whales have accumulated more than 120 million tokens, marking one of the most aggressive buying phases of the quarter. Although Cardano’s price has remained stable between $0.61 and $0.72, this activity shows the silent confidence of large holders.

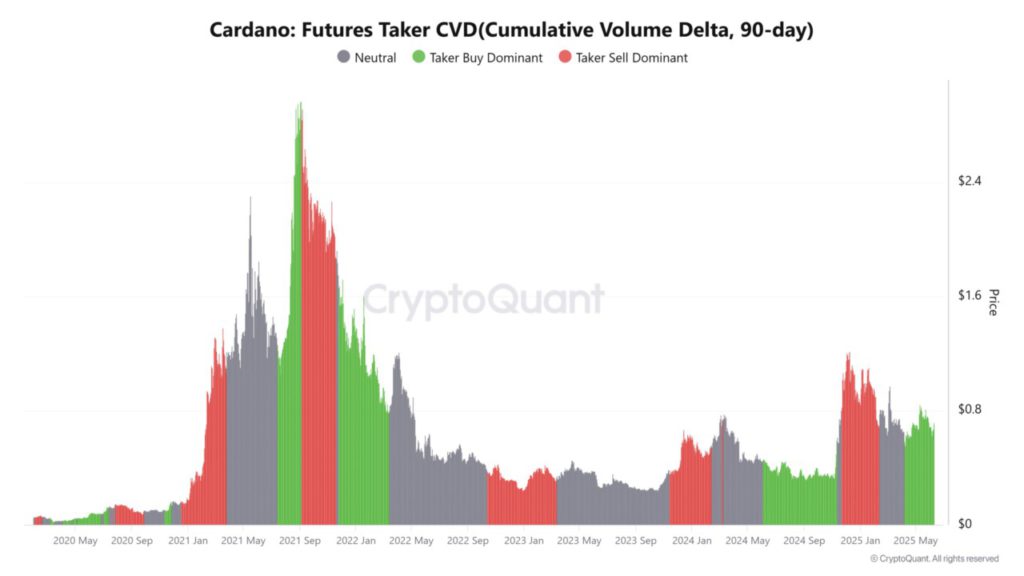

This increase in whale activity suggests that institutions or investors with high net worth may be preparing medium-term strategies. The dominance of Buy Takers in the Futures market has emerged strongly, confirming that aggressive market buying is leading the trend.

The 90-day CVD remains positive and continues to rise, reflecting continued bullish pressure in the derivatives market. This trend aligns perfectly with the timing of the latest whale accumulation, suggesting that these large players are not only buying but also driving prices through the spot and futures markets.

Read More: Algorand Transaction Surge: A Sign of ALGO Price Rise in June 2025?

Are the Bears Pinched?

Liquidation data showed a sharp spike in the liquidation of short positions, totaling $251.21K, compared to only $8.94K for long positions. This sudden imbalance suggests that many traders betting against Cardano were taken by surprise by the upward movement triggered by the whale influx. As the price began to rise, the triggering of stop-losses on short positions likely led to a chain liquidation, which amplified the price action.

This rise not only improved sentiment but also materially affected the market structure by forcing bearish traders to offload their positions. The OI Weighted Funding Rate for Cardano has turned positive, registering at +0.0109% at the time of writing, reflecting a significant shift in sentiment.

Can Cardano Break Out of its Wedge Pattern?

Currently, Cardano’s price is near $0.7242, pressing the upper boundary of a long-term descending wedge pattern. Although there were some previous rejections near this trend line, a combination of accumulation, liquidation, and momentum has pushed ADA into the zone of a possible breakout.

The MACD is showing signs of early recovery, and if the price can maintain this momentum, the $0.8446 resistance may be reached soon. However, the wedge pattern remains in effect until a confirmed breakout occurs, so traders should still be cautious. Sustained momentum and a push beyond key resistances are required to confirm trend continuation.

Conclusion

The accumulation of 120 million tokens by Cardano whales is not an isolated event. It is in line with the dominance of Taker purchases, positive funding levels, and increased retail confidence. The surge in the liquidation of short positions confirms that this accumulation phase has affected the price structure.

However, Cardano must maintain momentum and push past key resistances to confirm trend continuation. If accumulation continues and momentum builds, this coordinated activity could lay the foundation for a stronger, sustained rally.

Also Read: Crypto Market Optimism: Can Optimism (OP) Break $0.72?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Cardano whales go all in with $120M ADA scooped up, will this spark a rally?. Accessed on June 12, 2025

- Featured Image: Bitcoinsensus