XRP Hits $2.39 – Is This the Breakout We’ve Been Waiting For? Here’s What You Need to Know!

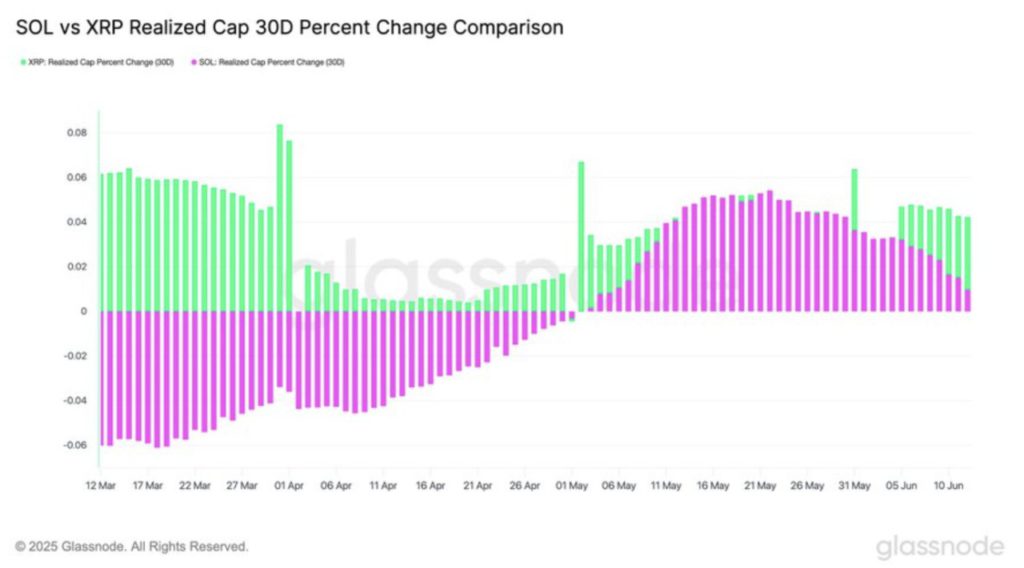

Jakarta, Pintu News – As reported by AMB Crypto (15/6), in the last 30 days, Ripple’s Realized Cap surged by 4.2%, far surpassing Solana’s slim 1% increase.

This increase in Realized Cap indicates a more aggressive capital shift to XRP, which is indicative of increased investor confidence and short-term conviction in the asset.

As the Realized Cap reflects the value of the coin based on the price at which it was last moved, this increase suggests a new long position from investors with bullish sentiments.

As such, the momentum of this inflow could be the first sign of a stronger price movement, as long as market conditions remain favorable and buying pressure continues to persist above the key support zone.

Are Traders Still Going Long?

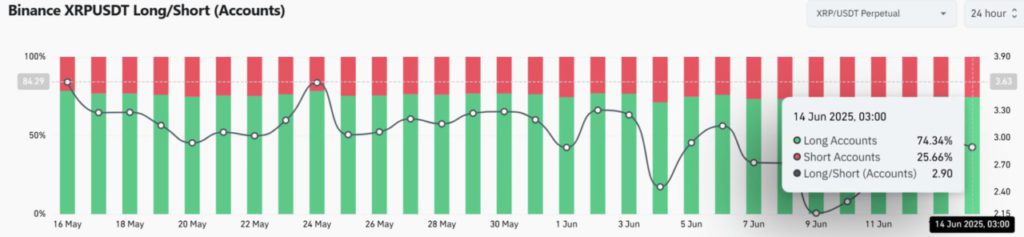

On Binance, as of June 14, 74.34% of XRP traders still held long positions, while 25.66% chose to go short. This results in a Long/Short ratio of 2.90.

Read also: Solana ETFs Could Be Next! Invesco and Galaxy Gear Up as Approval Odds Hit 90%

However, the gradual decline in the dominance of long positions from mid-May to early June indicates the emergence of uncertainty in the market.

Although the ratio is recovering, traders should still be cautious, as over-leveraged long positions amid volatile market conditions can trigger sharp price corrections.

Is Short Squeeze Pressure Starting to Build Behind the Scenes?

Meanwhile, XRP’s Liquidation Map provided early warning signals. Short traders incurred losses of $375.8K on June 14-seven times more than the liquidation of long positions.

The largest losses from short positions occurred on Binance and OKX, indicating that traders who bet against XRP faced a sudden price reversal.

If this condition persists, the short squeeze pressure could be an additional trigger for upward price movement in the next few trading sessions.

Can XRP Maintain its Fibonacci Support?

On June 14, XRP was trading around $2.15, slightly above the 1,618 Fibonacci extension level of $1.87, which serves as strong support.

The RSI indicator is at 43.40, indicating that the asset is neither overbought nor oversold, and is in a consolidation phase.

Therefore, a decisive move through the resistance around $2.39 or a drop below $2.00 is likely to determine the next direction.

Until then, sideways movements will probably dominate, as bulls and bears battle around key levels.

Read also: 3 Altcoins that Soared This Week: How Far Will These Tokens Fly?

XRP Futures volume fell by 36% to $3.99 billion, signaling a cooling in leveraged trading activity. However, Open Interest edged up by 0.55%, indicating that some traders are still holding onto their positions.

More strikingly, Options volume surged 180%, while Open Interest for Options plummeted 56%, indicating a surge in short-term speculative activity rather than long-term conviction.

This directional difference between activity in Futures and Options suggests that while some traders anticipate volatility, most are not willing to allocate large capital at this time.

Is XRP’s Foundation Strong Enough to Experience a Breakout?

The increase in XRP’s Realized Cap, the dominance of strong long positions, and the wave of short liquidation suggest that there is a bullish current that is strengthening beneath the surface.

However, the weak RSI, low futures volume, and speculative behavior in the options market suggest that traders are not yet fully convinced or committed to the breakout potential.

As long as XRP is able to maintain support above $2.00 and $1.87, the asset is likely to continue consolidating before making a more decisive move.

If the price manages to break the important resistance at $2.39 cleanly and convincingly, it could be a signal that XRP is ready to enter a new bullish phase.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. XRP at $2.39? The altcoin’s most bullish signal comes with a warning. Accessed on Jun 16, 2021